Chase Sapphire Reserve Lounge Access

Ad Disclosure: This article contains references to products from our partners. We receive compensation if you apply through links in our content. You help support CreditDonkey by using our links.

Airport lounge access is one of the best benefit of Chase Sapphire Reserve®. Learn how to maximize this perk including what lounges you can enter, how to use it, and the guest policy.

|

![]() Chase Sapphire Reserve is one of the best value travel reward cards. It has a huge $550 annual fee, but it also has many benefits that help justify the fee.

Chase Sapphire Reserve is one of the best value travel reward cards. It has a huge $550 annual fee, but it also has many benefits that help justify the fee.

Personally, my favorite benefit is the unlimited lounge access. Being a frequent traveler, I love being able to wait for my flights in a comfy lounge. Since I'm usually a budget traveler, this gives me a little taste of luxury when I fly.

Read on to learn everything you need to know about Chase Sapphire Reserve's lounge policy.

Note: There have been some recent changes to this benefit, so make sure you read this guide to know about them.

- What Kind of Lounge Access Do You Get?

- Guest Policy

- Lounge Access for Authorized Users

- How to Use Your Lounge Access Benefit

- Which Lounges Can You Visit?

- Priority Lounge Dining Benefits

- Priority Lounge Retail Discounts

- How to Renew the Membership

What Kind of Lounge Access Do You Get?

Chase Sapphire Reserve comes with a complimentary Priority Pass Select membership. This membership gives you unlimited access into the Priority Pass network of airport lounges. You can bring in 2 guests for free as well. Extra guests cost $27 each.

Priority Pass partners with more than 1,200 lounges in over 500 cities around the world. You can enter any Priority Pass lounge no matter which airline you're flying.

Not all airport lounges are available. For example, some networks, like Delta SkyClubs and AA Admirals Club, do not participate.

Unfortunately, most of these lounges are in international airports. There are only about 60 Priority Pass lounges across the entire U.S. So frequent international travelers may get the best use out of this benefit.

- If your local airport has a Priority Pass lounge, apply right now for the Chase Sapphire Reserve.

- If not, check out which other credit cards can get you lounge access.

What Lounges Offer

|

| Air China First Class Lounge in Beijing |

Amenities will vary by lounge, but generally, they include:

- Complimentary drinks and snacks, including alcoholic beverages

- Comfortable seating while you wait for your flight

- Free Wi-Fi

- Clean and private restrooms (a HUGE plus for me!)

- A quiet space to conduct business; many lounges offer computer terminals and conference rooms for your use

Not all lounges are created equal. In general, I've found that the overseas lounges are much nicer than domestic lounges. They're also less crowded too.

Guest Policy

Previously, the Chase Sapphire Reserve Priority Pass Select membership allowed you to bring unlimited guests with you into the lounges.

As of August 26, 2018, the rules have changed, and now you are limited to 2 guests. Additional guests will cost $27 each, charged to the card.

It's ultimately up to the individual lounges themselves to decide whether to allow in guests. For example, the lounge may deny access to guests if it's at capacity.

Lounge Access for Authorized Users

Authorized users get their own lounge access as well. They also get a complimentary Priority Pass Select membership. They can also bring in 2 guests of their own ($27 for each additional one).

I think this is actually one of the best reasons to add an authorized user. For Chase Sapphire Reserve, each authorized user costs $75/year. So to be able to get a lounge access membership at that price is amazing.

How to Use Your Lounge Access Benefit

This is important. You must remember to activate this benefit in order to receive your membership card.

You need to show your Priority Pass card and boarding pass to enter a lounge. You DO NOT get access by showing your Chase Sapphire Reserve card.

You can activate it online through your Chase account. It takes about a second. See our detailed article on how to activate your Priority Pass membership.

This will prompt Chase to send your Priority Pass membership card. You'll get your card in the mail in about 1-2 weeks.

When you receive it, you can create an account and set up a digital card on the Priority Pass app. You can use the digital card to gain entry into lounges as well (though some may not accept it, so it's still best to carry the physical card).

Which Lounges Are You Allowed to Visit

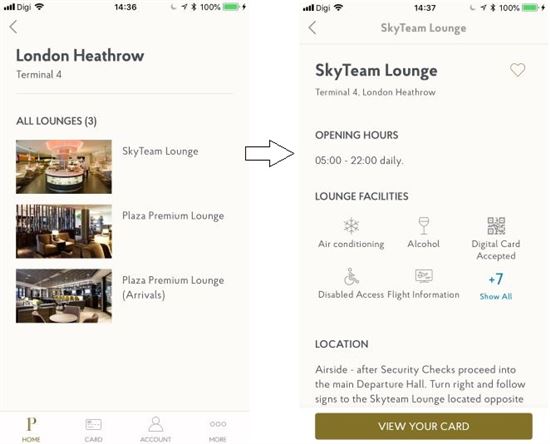

To find a Priority Pass lounge in your airport, you can search on their website or on the Priority Pass app. You'll find all the information about the lounge, such as:

- Location

- Lounge hours

- Amenities offered

- Time restrictions for Priority Pass members

- Lounge photos

For example, this is a search for lounges in London Heathrow (LHR).

|

Priority Pass Dining Discounts

Besides lounges, your Priority Pass membership also gives you discounts at participating airport restaurants. This is great if you'd rather have a nice meal before a flight.

Generally, for restaurants in U.S. airports, you will receive:

- $28 - $30 deduction off the bill for 1 person

- Another $28 - $30 deduction for 1 guest

This means you can get a max total of $56 - $60 off the bill, no matter how many people you have with you.

If your airport has a participating restaurant, it'll be listed on the website or app. For example, LAX offers a discount for P.F. Chang's. This is what you'll see:

|

This is a great feature for domestic travelers, because the lounge selection is not as wide in the U.S. Some airports don't have a Priority Pass lounge but have a restaurant instead.

- Boston Logan International (BOS) - Stephanie's (Terminal B), Jerry Remy's Sports Bar & Grill (Terminal C)

- Cleveland Hopkins International (CLE) - Bar Symon (Concourse C)

- Denver International (DEN) - Timberline Steaks & Grille (Concourse C)

- Fort Lauderdale International (FLL) - Kafe Kalik (Terminal 4)

- Greenville-Spartanburg International (GSP) - RJ Rockers Flight Room (Concourse B)

- George Bush Intercontinental (IAH) - Cadillac Mexican Kitchen & Tequila Bar (Terminal A), Landry's Seafood (Terminal C)

- Indianapolis International (IND) - The Fan Room (Concourse B)

- John F. Kennedy International (JFK) - Bobby Van's Steakhouse (Terminal 8)

- Lexington Blue Grass (LEX) - Kentucky Ale Taproom (next to Concourse B)

- Los Angeles International (LAX) - Rock & Brews (Terminal 1), PF Chang's (Tom Bradley)

- Miami International (MIA) - Air Margaritaville, Viena (Center Terminal Concourse E), Corona Beach House (North Terminal Concourse D)

- Portland International (PDX) - Capers Cafe Le Bar, House Spirits Distillery (Concourse C)

- San Francisco International (SFO) - Yankee Pier, San Francisco Giants Clubhouse (Terminal 3)

- Seattle-Tacoma International (SEA) - Floret by Cafe Flora (Concourse A)

- St. Louis Lambert International (STL) - The Pasta House (Terminal 1), The Pasta House & Schlafly Beer (Terminal 2)

- Syracuse Hancock International (SYR) - Johnny Rockets (N Concourse B)

- Tampa International (TPA) - The Café by Mise en Place (Airside F)

- Tuscon International (TUS) - Noble Hops (Landside 2nd floor)

- Washington DC Dulles International (IAD) - Chef Geoff's (Concourse C)

- Ronald Reagan Washington National (DCA) - Bracket Room (Terminal B), American Tap Room (Terminal C)

Priority Pass also has participating restaurants in many international airports. The offers could be a deduction off your bill or a percentage discount.

Priority Pass Retail Discounts

Priority Pass has also added retail offers with select partners. If your airport has any retail offers, you'll see it on the app. The actual website does not show retail offers.

Retail offers could be discounts at duty free shops or at select vendors (even including big names like Michael Kors and Emporio Armani).

For example, the Miami International Airport (MIA) has many retail offers:

|

What if I Forget My Priority Pass Card?

If you have set up a digital membership card, then you can use that to access the lounges. If not, then lounges (at their discretion) may let you in if you know your account number.

If you have neither, then you can pay the lounge fee with your Reserve card, and give Chase a call and see if they can help. We've heard reports that Chase has reimbursed some cardholders on a limited basis (up to 2x a year).

Renewing Your Lounge Access Membership

When you first receive your Priority Pass card, you'll see that it has an expiration date. If you renew your Chase Sapphire Reserve card for another year, a new Priority Pass card will automatically be issued.

Your digital card within the Priority Pass app will automatically be updated as well with the new expiration date. There is no additional work on your part.

Bottom Line

| |||||||||||||||

Unlimited lounge access is one of the Sapphire Reserve's best benefits. Just remember to activate your Priority Pass Select membership. Then you and your guests can enjoy waiting for your flights in style.

Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by Chase. This site may be compensated through the Advertiser's affiliate programs.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. This site may be compensated through the Advertiser's affiliate programs.

|

|

|