Chase Sapphire Reserve Priority Pass: What You Need to Know

Ad Disclosure: This article contains references to products from our partners. We receive compensation if you apply through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Priority Pass membership is one of Chase Sapphire Reserve® (See Rates & Fees) best benefits. Here is everything you need to know to sign up, activate and use it.

|

| Courtesy of Anna © 2018 |

![]() Chase Sapphire Reserve (See Rates & Fees) is one of the hottest travel reward cards. It has a huge $550 annual fee, but it also has many benefits that help justify the fee.

Chase Sapphire Reserve (See Rates & Fees) is one of the hottest travel reward cards. It has a huge $550 annual fee, but it also has many benefits that help justify the fee.

Personally, I think one of the best benefits is the Priority Pass Select membership. As someone who travels frequently, I love being able to wait for my flights in a comfy lounge (with free snacks!) instead of at the busy gate.

If you travel several times a year, be sure to check out the latest Chase Sapphire Reserve promotion.

Read on to learn about this benefit about how to use it.

What Is Priority Pass Select?

|

Priority Pass is the largest independent airport lounge network in the world. It partners with more than 1,000 lounges in over 500 cities around the world.

Besides lounges, certain airports also have restaurants that offer special benefits to Priority Pass holders. You receive a deduction from your bill when you eat at a participating restaurant.

Chase Sapphire Reserve gives you complimentary Priority Pass Select membership (free activation required). You get access into all of the Priority Pass lounges, no matter what airline you're flying. Plus, you can also bring in 2 guests with you at no extra charge (additional guests are $27 each). Note: Individual lounges may have their own rules.

- If your local airport has a Priority Pass lounge, apply right now for the Chase Sapphire Reserve.

- If not, check out which other credit cards can get you lounge access.

Amenities will vary by lounge, but generally, they include:

- Complimentary drinks and snacks, including alcoholic beverages

- Comfortable seating while you wait for your flight

- Free Wi-Fi

- Clean and private restrooms (a HUGE plus for me!)

- A quiet space to conduct business; many lounges offer computer terminals and conference rooms for your use

Seeing how a regular lounge pass costs around $50, this membership is a great perk. You get to wait for your flight in a comfortable setting. The complimentary snacks and beverages mean you don't have to buy expensive airport food (and I like to take some snacks with me for the flight too... shhhh).

Activating Your Priority Pass Select Benefit

This is important: you have to remember to activate your membership.

You cannot get lounge access with your Chase Sapphire Reserve card. You need to activate your membership and get a separate Priority Pass card.

Here's how to do it:

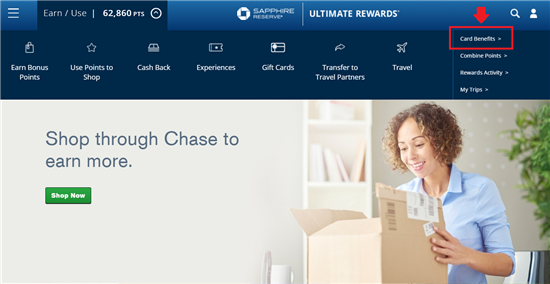

Step 1: Log into your Ultimate Rewards dashboard. At the top menu, click on "Card Benefits" at the top right.

|

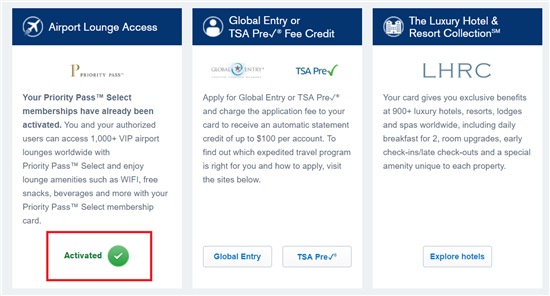

Step 2: You'll see all your card benefits. Just click "Activate now" in the Airport Lounge Access box on the left side. (I've already activated mine, so it says "Activated.")

|

And you're done. You will get your Priority Pass card in the mail in around 2 weeks. If you have authorized users on your account, their Priority Pass cards will automatically be sent as well.

Step 3: Download the Priority Pass app. It will tell you the location of the lounges. Just present your Priority Pass card and a boarding pass to gain entry.

How to Set Up a Digital Card

Priority Pass also gives you an option to set up a digital card. This is great because you don't have to carry around the physical card anymore.

Here's how to set up a digital card:

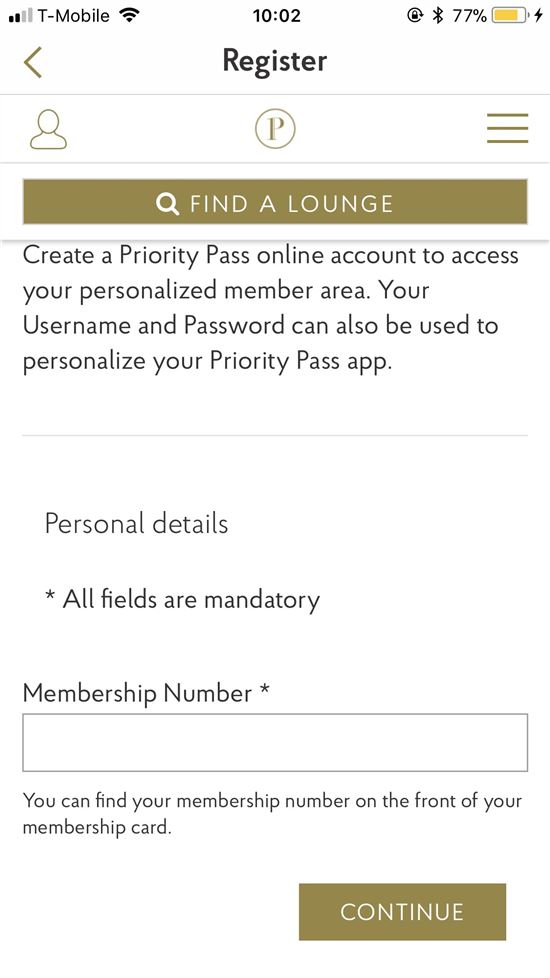

Step 1: When you get your Priority Pass, the letter will include your membership number and a website pin. You can use these to set up an online account.

Step 2: Go into the Priority Pass app and sign in with the account you've created.

|

And that's it. You'll see your new digital card in your menu options. Present the digital card at Priority Pass lounges for entry.

Frequently Asked Questions

- Can I bring in others with me into lounges?

Yes. Previously, the Chase Sapphire Reserve Priority Pass Select membership allowed you to bring unlimited guests with you into the lounges. As of August 26, 2018, the rules have changed and now you are limited to 2 guests. Additional guests will cost $27 each, charged to the card. Note that the lounge may deny access if it's at capacity. - How do I renew my Priority Pass Select membership?

You may have noticed that the Priority Pass cards have an expiration date. If you renew your Chase Sapphire Reserve card for another year, a new Priority Pass card will automatically be issued. - How do authorized users activate their Priority Pass memberships?

When you activate your membership, Chase will automatically mail out membership cards for you and your authorized users. If you add authorized users later, their Priority Pass cards will be automatically mailed as soon as you add the user. - What if I forget my Priority Pass membership card?

If you have set up a digital membership card, then you can use that to access the lounges. If not, then lounges (at their discretion) may let you in if you know your account number.If you have neither, then you can pay the lounge fee with your Reserve card, and give Chase a call and see if they can help. We've heard reports that Chase has reimbursed some cardholders on a limited basis (up to 2x a year).

Bottom Line

| |||||||||||||||

For rates and fees of the Chase Sapphire Reserve® card, please click here.

The Priority Pass Select membership is one of the Sapphire Reserve's best benefits. Just remember to activate your membership. Then you and your guests can enjoy waiting for your flights in style.

Next Step: View the issuer's official application, terms, and details

Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by Chase. This site may be compensated through the Advertiser's affiliate programs.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. This site may be compensated through the Advertiser's affiliate programs.

For rates and fees of the Chase Sapphire Reserve® card, please click here.

Read Next: