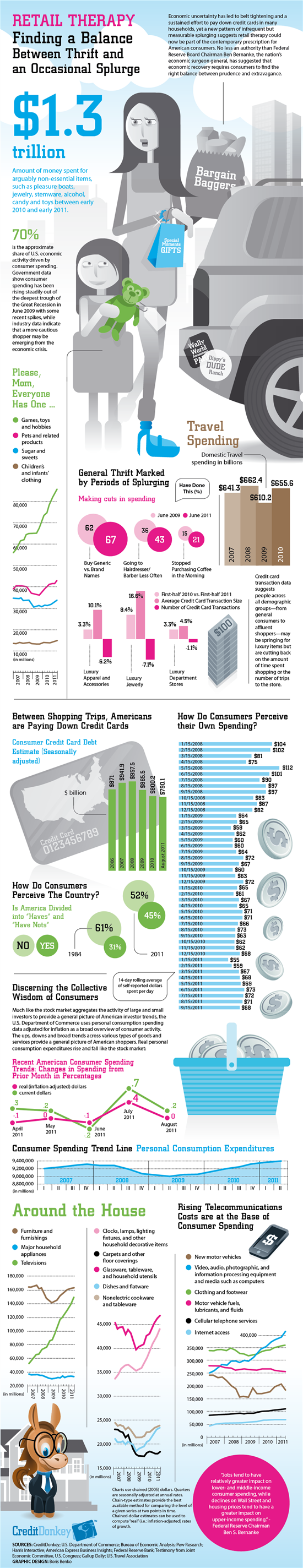

Infographic: Consumer Spending Statistics

American Consumer: Retail Therapy for Tough Economic Times

With $1.3 trillion spent on arguably non-essentials items, CreditDonkey study reveals how consumers find the balance between prudence and extravagance.

Government data show consumer spending has been rising steadily out of the deepest trough of the Great Recession in June 2009 while credit card and retail industry data indicate that a more cautious shopper is emerging from the economic crisis.

|

| Infographics: American Consumer © CreditDonkey |

Savings rates are up, revolving credit card debt is falling and some card brands report the average number of credit card transactions is down. Even so, American Express has found that the average dollar amount spent on each transaction is on the rise in merchandise categories that include items such as luxury jewelry and luxury department store apparel. The company reports that a “spend more, less frequently” trend is seen across all demographic groups, from average to affluent shoppers.

Analysts at First Data, an international credit card payment processor, recently released a report titled “Rebirth of Credit—Minus the Debt,” which describes a “new American consumer” who is a more “cash-conscious creature that emerged from the Great Recession.” According to the report, which is based on aggregated proprietary transaction data, February 2011 was the first month in which credit card use surpassed the use of debit cards after a two year shift toward cash-based bank cards.

"The picture that is coming into focus is an American shopper who is pinching pennies, buying generic brands and cutting back on trips to the salon but still rewarding herself or himself occasionally with a little retail therapy--balancing thrift with some extravagance," says Charles Tran, founder of the credit card comparison website, CreditDonkey.

A Look at Shopper Trends

Much like the stock market aggregates the activity of large and small investors to provide a general picture of the mood of American investors, the U.S. Department of Commerce uses personal consumption spending data adjusted for inflation as a broad overview of consumer activity. The ups, downs and trends across various types of goods and services provide a general picture of American shoppers.

- While automobile sales have long been a yardstick to measure the pace of American consumer spending, that measure may no longer be a good metric. Aggregate data show that spending for video, audio, photographic, and information processing equipment—such as computers and televisions—came out strongly from the June 2009 economic trough while new motor vehicle sales have followed a bumpy trend line that has not rebounded to pre-recession consumer levels. Some analysts believe this is because vehicles last longer and may never again be a good indicator of quarterly trends in consumer spending.

- Rising steadily with video, audio and computer equipment, consumer spending for telecommunications services—such as cell phone plans and Internet connections—now forms a sizeable base expenditure category that comes off the top of consumers’ available discretionary income that might otherwise be available to purchase retail goods and other personal services.

- Spending for carpets and floor coverings tanked with the recession in 2009 and has not fully climbed out of the hole into which it fell, while spending for clocks, lamps, glassware, tableware and decorative items for the home have now surpassed their pre-recession aggregate spending levels in inflation adjusted terms.

- Spending for major household appliances—other than televisions, which rose steadily as part of the fast growing video and computer spending category—remained all but constant over the economic downturn.

- Furniture spending took a beating as the economy slid downhill and is recovering weakly.

- Apparel and footwear spending sunk with the economy but has recovered lost ground and is sloping upward.

With the recession still weighing heavily on all family budgets, we recommend consumers compare [credit card deals] as banks continue to offer big incentives to try to get consumers to switch credit cards.

Annette O'Connor is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Annette O'Connor at annette@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.