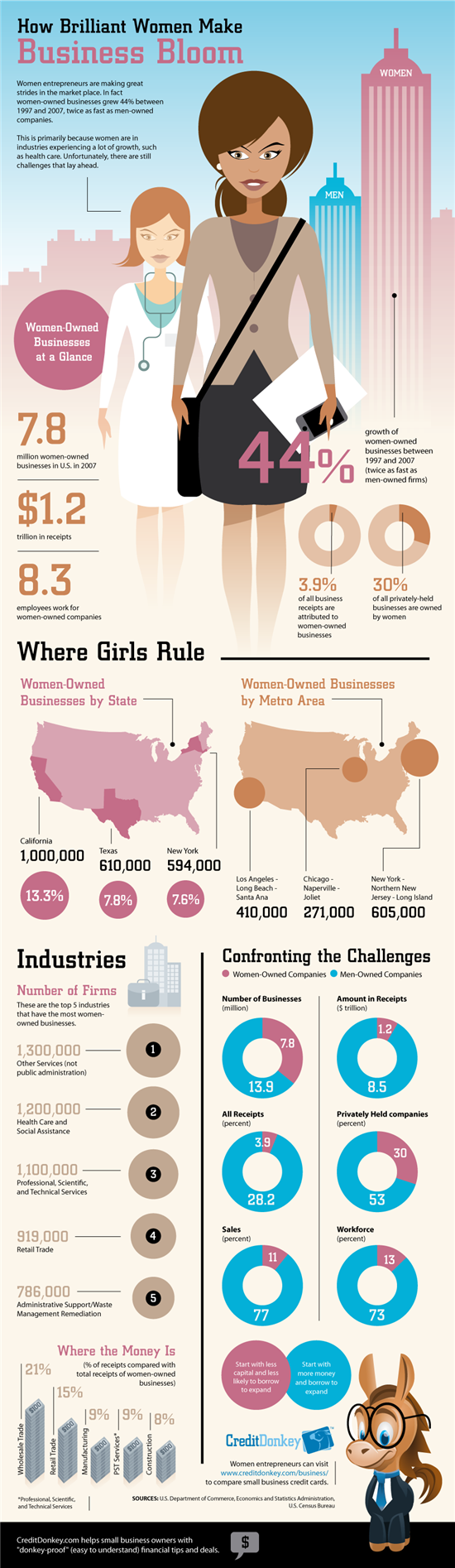

Some 7.8 million women-owned businesses generate $1.2 trillion in annual sales. And each of these companies employs an average of 8.3 workers. Even though fewer women than men own their own businesses, women-owned businesses have skyrocketed.

Whether they support their families with a mix of full-time work and domestic duties or forego a salary to stay at home and make the majority of purchasing decisions, women are a significant driver of the U.S. economic engine. In this CreditDonkey infographic, we focus on the impact of women who are entrepreneurs.

|

| Infographic: Women in Business © CreditDonkey |

Women-Owned Businesses: The Start of a New Club

Stats show that women-owned businesses are spread among a variety of industries, demonstrating that women are breaking through societal conceptions of past decades and making a name for themselves in industries that were once dominated by the "Good Old Boys Club," such as the professional, scientific, and technical services (PST services) industry. In fact, there are 1.1 million women-owned businesses reported to be part of the PST services industry alone.

Women Business Owners: How to Break Your Own Glass Ceiling

Women business owners have been smart to enter into industries that are experiencing tremendous growth, such as health care. However, despite their wise choices, women in positions of power are still facing all-too-familiar challenges that have dogged their gender for decades.

If you are thinking about starting your own business or are new to the role of top leader, here is a breakdown of the common societal and cultural pressures you may face, along with some tips on how to overcome these challenges.

| Challenge | Solution |

|---|---|

Stopping the tendency to do everything | When you're the owner, you just can't do it all. If you're running a retail shop, for example, you won't be able to be the cashier, janitor, accountant, and marketing manager and still expect to grow your business. When you can't afford to hire full-time help, take on what you can handle and look into ways to delegate the rest through contractors, interns, or unique resources like TaskRabbit. |

| Finding peers, for advice and networking |

Here are a just a few places to find other women in similar positions:

|

| Feeling like you're not being taken seriously |

It is 2013, but many women entrepreneurs still tell countless stories of not being taken as seriously as men. How to deter the doubters:

|

| Feeling bad about your off-kilter work/life balance | Women have a lot of societal pressure to juggle many hats, and to be a perfectionist in every realm of life. Hopefully, you've long ago realized no one can "have it all." There are going to be days when your work life steals more of your time. And other days when your family issues spill over into business. Shake off the guilt - you might not be there for your family or business 24/7, but you are showing your family and employees an example of a strong woman who is supporting her family and community. If it's hard for you to stop the guilt, tape a mantra to your bathroom mirror to repeat every morning to remind yourself that you are doing the best you can as a business owner and juggler of MANY hats. |

Business Ideas for Women: How to Start Your Own Business

It doesn't take much to start a home business; in fact, the SBA reports that 39% of business owners with no employees started their business with less than $5,000 in startup capital. If you're looking for information on how to obtain that startup capital, we have another infographic that you may find helpful: Where Home Businesses Go for Startup Dough.

Many small business owners use credit cards to get their businesses off the ground. Visit our comparison chart of credit cards for small businesses to see which one could fit your needs, as you'll need a new way to manage your cash flow. Then, learn more about how to apply for a business credit card.

Besides some business know-how, you'll need a niche. Consider your talents and your interests, and see if they're sellable. Tired of the full-time grind and wanting more flexibility, many women in recent years have uncovered talents they didn't know they had - such as creating companies like Stitchfix - and have become entrepreneurs. If you play your cards right, you could follow in their footsteps and find yourself leading a company someday.

(Research and Writing by Kelly; Graphic Design by Boris; Additional Writing by Meghan; Editing by Maria and Sarah)

Kelly Teh is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Kelly Teh at kelly@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|