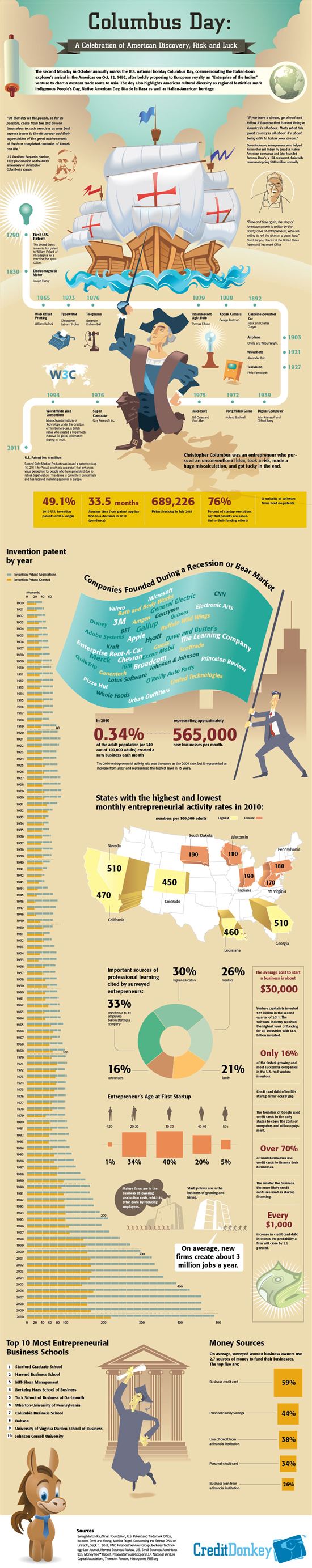

Columbus Day: Celebration of American Discovery, Risk and Luck

When Christopher Columbus sought funding for his visionary trip more than 500 years ago, he received the side-eye from European royalty. But thanks to his determination and perseverant spirit, he was finally able to secure the funds he needed to embark on his adventure to chart a western trade route to Asia.

|

| Infographics: Columbus Day Discovery © CreditDonkey |

As we all know, his efforts didn’t go as planned, but as a result, the Americas were discovered, leading the way to future colonization. Columbus displayed an entrepreneurial spirit that has been continued to be embraced by Americans, leading the way to innovation, jobs and economic success. Just as was true of Columbus’s famous voyage, American discovery requires a mix of risk and luck for payoff to be seen.

The Risk

American entrepreneurs must face both reputational and financial risk when pursuing their dreams. As stated by David Kappos, director of the United States Patent and Trademark Office, “Time and time again, the story of American growth is written by the daring drive of entrepreneurs, who are willing to roll the dice on a great idea.”

With startups costing about $30,000 on average to get off the ground, the financial risk involved in a new venture can be quite large. Business owners cover the costs through credit cards and loans, financial commitments that can cause quite a bit of stress if the payoff of the new venture doesn’t happen as quickly as the entrepreneur has hoped (and with the average patent taking 33.5 months from application to decision, it’s quite possible that the income will be delayed).

The Luck

When businesses see success, the payoffs can be quite big, bringing income to the owner and investors and new jobs to the community. In fact, on average, new firms are able to create 3 million jobs in the U.S. every year.

Of course, a successful company often has more to do with hard work and smart moves instead of luck. Many professionals call upon their knowledge to ensure success, with their most important sources of professional learning including:

• Previous work experience (cited by 33 percent of entrepreneurs surveyed)

• Higher education (cited by 30 percent)

• Mentors (cited by 26 percent)

• Family (cited by 21 percent)

• Cofounders (cited by 16 percent)

How to Minimize Your Risk when Seeking Luck

Having to borrow money to see your dreams into fruition can be nerve wrecking; especially when it’s your first entrepreneurial effort. But there are steps you can take to help minimize your risk without decreasing your chances at luck:

• Do your research – take the time to put together a detailed business plan; while a business plan alone can’t ensure success, it will help ensure you have looked at the venture from all angles, researched the market and your competitors, and help show banks and investors that you have a well thought out plan. This will help you secure the funding you need to get your idea running.

• Seek investors – spreading out your funding sources will help relieve some of your monthly financial pressures. Relying on credit cards and bank loans alone will leave you with some hefty interest payments. And dipping into savings can be risky. When seeking investors, you can talk to friends, family, past colleagues and venture capitalists.

• Review loan and credit card terms – before you sign on the dotted line, make sure you know all of the details of the credit card and business loans. Not all loans and cards are made the same, so take the time to research your various options so that you can find the ones that best fit your needs.

• Make payments a priority – one of the most important factors in determining your personal and business credit scores is your payment history, so be diligent in making your credit card and loan payments on time each and every month. This will also save you quite a bit in fees and interest.

(Additional Writing by Meghan)

Annette O'Connor is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Annette O'Connor at annette@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.