How to Build Business Credit

A good business credit score can increase a company's value and protect personal credit. But how can I build my business credit fast? Read on for the answer.

|

As a small business owner, the lines between your personal and business life can become blurred. Creating a separate business credit profile will protect your personal assets and give your business more lending power.

What is Business Credit and Why Do I Need It

Business credit is similar to personal credit, but it's based on your business's financial history. It's tied to your Employer Identification Number (EIN) instead of your SSN. It's a completely separate file from your personal credit report.

Having business credit allows your business to borrow money, which is important for growth. Lenders will look at your business credit to get an idea of how reliable you are in paying back loans and decide if they want to work with you.

Business credit is essential for things like:

- Qualifying for small business loans

- Determining how much credit limit you can get

- Determining business insurance premiums

- Eligibility to open vendor accounts

8 Responsible Ways to Build Business Credit

|

| © CreditDonkey |

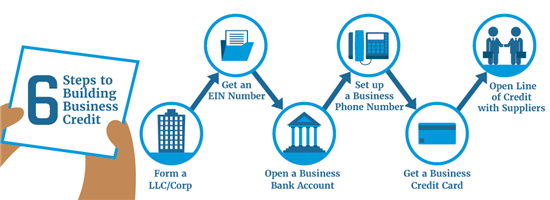

Building business credit is not as straightforward as building personal credit. But don't worry, it's not too complicated. There are just some extra steps.

We'll go over everything you need to know.

1. Establish Your Business Formally

Before you can build business credit, you need to establish your business as its own entity separate from yourself.

This means you need to register your business as one of the following:

- Limited Liability Company (LLC): An LLC limits personal financial liability from the owners while allowing them to record profits and losses on their personal taxes.

- Limited Liability Partnership: This is when two or more partners go into business together. Unlike a normal partnership, you are protected from personal liability.

- Corporation: Corporations are completely independent legal entities that eliminate liability from owners. Because of their tax requirements, however, owners can end up being taxed twice on earnings.

Some businesses are required to get business insurance. If you have employees, for example, you'll need to provide unemployment, disability, and worker's compensation insurance. Some states also require additional ones. But required or not, it's best to get one. It can protect your business from lawsuits, damages, and loss of income.

2. Get an Employer Identification Number (EIN)

An EIN is like a Social Security number for your business. Use it to apply for a business checking account and to file business taxes.

To obtain an EIN, you can get one for free on the IRS website. This number is usually issued right away.

3. Open a Business Bank Account

A dedicated business banking account is essential to keep a clear divide between your personal and business life. It makes your business more legit and will keep your finances organized. Open the bank account with your business name and EIN.

A checking account in itself won't build business credit. But your banking history is often something lenders look at when you apply for credit.

And plus, it helps you establish a relationship with your bank, which can help when you apply for business loans and credit down the road.

Here are the best business checking accounts for all types of small businesses.

4. Apply for a DUNS Number

Dun & Bradstreet is the main business credit reporting agency. It's what most lenders and suppliers use when evaluating your credit. Registering your business with them is one of the first steps to establishing a business credit file.

You can register for a DUNS number for free here. If you have had a business credit card or loan before, then you'll already have a file.

5. Get a Dedicated Business Phone Number

Obviously, you need a number for customers, clients, vendors, etc. to call. But that's not the only reason to get a dedicated phone number just for your business.

A business phone number makes your business credible. If you just use your personal mobile number, your business may not seem legit to a lender.

You don't need to buy a new smartphone just to get a business number. You can use a Voice Over IP service (like Grasshopper and RingCentral) to get a business number and forward calls to your current phone.

Creating social media pages for your business is another way to connect with your clients. People can reach out to you through them. As small business owners, it also makes your business look professional. LinkedIn, Facebook, and Instagram are popular ones you can use.

6. Establish Trade Credit With Vendors

A lot of vendors and suppliers offer trade credit. This means they first provide the product/service and you don't have to pay until later. This is essentially like a small loan.

If the vendor reports your payments to the credit bureaus, it will help to build business credit. Ideally, it's best to confirm if they report before engaging in business.

However, vendors aren't required to report, so some may not. If yours do not, your business won't have any record of payment information. If you already have a good relationship with your vendor, you can ask them to report.

Keep in mind that paying early results in a better rating on your business credit report. It's a useful little bonus that can boost your business.

If you've been doing business with the vendor for at least 6 months, you can ask for a higher net-30 credit line. That way, you can keep your credit utilization rate to a minimum.

Your credit utilization rate or credit utilization ratio shows how much credit you have used. It's typically expressed in percent. For example, let's say you have a $30,000 credit limit and your current balance is $10,000. Your credit utilization rate is 33%.

This ratio affects your credit score. It's best to keep it below 30%.

7. Open a Business Credit Card

Just like banking accounts, you should use a separate credit card just for business. Use your EIN when applying for a business credit card.

A business credit card can give you a higher limit, so you have more purchasing power for your business. Another big pro is that a lot of business cards offer business-related rewards and/or an intro 0% APR period.

Make sure the business credit card actually will report to the business credit bureaus. And some issuers (such as Capital One and Discover) report to both commercial and personal credit agencies. So having high balances on your business card will also impact your personal credit.

8. Get a Business Loan

A lot of growing small businesses need a loan or line or credit at one point or another in order to keep on growing. As you make payments on the loan, they'll be reported to credit bureaus.

You may have to sign a personal guarantee. This is a legal contract saying that you will be personally responsible to repay the loan if your business defaults on the loan. If you have late or non-payments, it could hurt your personal credit as well.

The fastest way to build good business credit is to start right away. After you've formally established your business, consider opening a business credit card or other line of credit.

Be sure to pay off your bills on time (or even early) to establish good vendor relationships. And monitor your business credit report regularly for mistakes that may unfairly lower your score.

Benefits of Business Credit

- Lower interest rates

A good business credit score will help you gain better interest rates on loans, credit cards, and other lines of credit. - Eliminate prepay requirements

Many suppliers require prepayment if they don't feel comfortable with your business' credit history. This can tie up precious cash flow. Having a better credit report can reduce and eliminate the need for prepayment obligations. - Better trade terms

Suppliers can be flexible with their trade terms for the right buyers. A better credit report can give your business leverage when negotiating payment due dates, discounts, and return policies with its suppliers. - Lower business insurance premiums

Insurance companies can look at your credit report to determine your policy rates. A better credit score can get you a lower premium. - Protect personal credit

Using personal credit for business expenses is very risky. It increases your credit utilization ratio and makes your personal credit look bad. Your personal credit will be damaged if you miss business payments or your business fails.Plus, it would make getting loans difficult (both for personal and business) since the two are mixed and lenders can't get a clear picture. So it's best to establish separate business credit as soon as possible.

- Easier Expenses Tracking

With a business credit card, you can separate your business purchases from your personal expenses. That means you can monitor your business spending more easily. Some business credit cards even provide a breakdown of categories.You can view if your purchase was for a meal, office supplies, etc. Should there be anything suspicious, you can also dispute improper charges.

- Less Time for Tax Report

Filing your taxes is less of a hassle since you can deduct business-related purchases more easily. It can also make work more convenient for a certified public accountant (CPA) if you hire one.

What Are Personal Guarantees?

When you first start your business, you won't have any business credit. In this case, lenders will usually require a personal guarantee.

Personal guarantees essentially require you to act as a co-signer for your business. The same way your children may need you to co-sign on their first car loan, your business needs your support when growing its credit history.

As the name suggests, personal guarantees make you personally responsible for the payment of the credit agreement should the business not be able to pay. In other words, signing a personal guarantee can put your personal assets at risk.

But they are also an important first step to get your business up and running until it can acquire new lines of credit independently.

How the Business Credit Bureaus Work

Much like personal credit bureaus, there are business credit bureaus that collect information about your business activities to provide business credit score and ratings.

Here are the 3 major business credit bureaus:

Dun and Bradstreet

D&B is the largest business credit agency. It maintains over 300 million company records worldwide. They analyze information provided by businesses and lenders, including payment activity and publicly reported earnings.

They generate several different credit scores that lenders may look at, including:[1]

- Paydex score: Ranges from 1-100 and evaluates your payment history. This tells lenders and vendors how risky you will be:

- 80-100: always pay on time or early (low risk)

- 50-79: have late payments up to 30 days (moderate risk)

- 0-49: have late payments past 30 days (high risk)

- 80-100: always pay on time or early (low risk)

- Failure Score: Indicates how likely the company is to fail within the next year.

- Delinquency Predictor Score (DPS): Indicates risk of delinquency. Ranges from 1-5, with 1 being low risk and 5 being very high risk.

- Supplier Evaluation Risk Rating: Indicates the risk that a supplier will become inactive or shut down in the next 12 months. Ranges from 1 to 9, with 9 being the highest risk.

- D&B Rating: Overall evaluation of a company's current and future health, and if it will stay in business.

To get started, you can register your business for a D-U-N-S number. Doing so will allow your lenders to report payment information on your business' credit profile.

Experian

Experian is a reporting agency for personal credit and also has a small and mid-sized business sector. Their database houses over 99% of all U.S.-based companies.

Experian's business credit score uses a scale of 1 to 100. The higher the score, the lower your risk to lenders.[2]

- 76 - 100: Low Risk

- 51 - 75: Low to Medium Risk

- 26 - 50: Medium Risk

- 11 - 25: High to Medium Risk

- 0 - 10: High Risk

Experian comes up with your score by looking at:

- Payment habits

- Outstanding balances

- Number of trade experiences

- Credit utilization

- Trends over time

- Company background info, public records, and legal filings

Equifax

Equifax also reports on business credit, including payment history, bankruptcies, public records, and business demographics.

It generates 3 business credit scores:[3]

- Business Payment Index: Evaluates your payment history in the past year. Ranges from 1-100. A score of 90-100 means that you always pay your bills on time. 80 means you had at least one late payment.

- Business Credit Risk Score: Indicates how likely it is for you to make late payments. It's graded on a scale of 101 - 992. The higher the score, the less risk. A score of 700 or higher is considered good.

- Business Failure Score: Indicates the likelihood of failure within the next 12 months. Ranges from 1000 - 1880, with higher scores suggesting less risk.

How to Maintain Good Business Credit

After you've established some business credit, it's important to maintain it. Here are some tips to maintain or improve your business credit:

- Pay bills on time. This is perhaps the most important thing you can do. Your payment history tells lenders how much debt-risk you carry.

- Lower your credit card utilization ratio. In other words, don't max out your business credit cards. If you need more credit, it may be better to open a small business loan instead.

- Make sure your suppliers report: Even if you have good relationships with your suppliers, it's no use if they don't report to the business bureaus. It's best to only work with suppliers that do report. If your supplier does not, you can manually submit trade references.

- Update your business information: If you have info that's out of date, that could affect you getting a loan or setting up trade credit. Keep your info updated with the DUNS manager tool.

- Dispute errors. See a negative remark that you believe to be inaccurate? You can dispute it with the business that made the report, or directly with the bureau. Your dispute will be investigated and removed from your credit report if you can prove your case.

If you really have missed payments with creditors, you can negotiate with them. You can offer to pay the account in full, and in exchange, they remove the negative remarks off your credit report.

Monitoring Business Credit

It's also equally important to regularly monitor your business credit to make sure it's accurate.

Unlike consumers, businesses are not legally entitled to a free credit report. Most business credit reports will cost you. Read on to learn about CreditSignal, one of the best free options.

CreditSignal (free)

CreditSignal is a free service provided by Dun and Bradstreet. It alerts you to changes to your D&B Paydex, Delinquency Predictor Score, Financial Stress Score, and Supplier Evaluation Risk rating.

One downside: CreditSignal only provides information from their platform. However, D&B is one of the largest business credit reporting agencies. So this is a great way to start monitoring your business credit.

Paid Options

Outside of CreditSignal, your best bet is to pay for a full credit report. Doing so will give you the best picture of your business' financial health.

D&B, Equifax, and Experian all offer paid subscription services that allow you to monitor your business credit report.

Starting a business with bad personal credit

You can build strong business credit even with poor personal credit. But you may need to get creative when applying for financing since lenders will likely review your personal finances until your company develops its own credit profile.

Start by formally establishing your business. Then look into financing options like:

- Trade credit

- Secured business credit cards

- Revenue-based financing

With discipline and responsible financial management, you should be able to develop strong credit for your business that won't be impacted by your personal credit situation.

Frequently Asked Questions

What types of business entities have business credit?

Types of business entities include sole proprietorships, partnerships, LLCs, and corporations. And you can establish business credit regardless of the type of entity your company is.

You can apply for business credit cards or use other types of credit such as vendor credit or retail credit.

How do I build business credit fast?

To build business credit fast, make sure you've set up the right business structure. Then, register with a credit agency such as Experian, and work with vendors who report your transactions.

Make sure to pay your bills on time and limit your credit use to 30% of your limit. This helps avoid negative impacts on your score.

Can a personal credit card help build business credit?

Business credit can affect personal credit but not the other way around. That means you can't use your personal credit to build your business credit.

Consumer credit bureaus will not report to business credit bureaus. But the latter will report to the former some activities such as defaults.

How long does it take to build business credit?

There's no specific length of time for you to build business credit.

But generally, 1-3 years is a good rule of thumb. You'll want to ensure your business has solid financial health within this period. And you'll want to make on-time payments to show that you can handle debt responsibly.

Do all of my accounts appear on my business credit reports?

Not all of your accounts might appear on your business credit reports. That's because businesses you work with aren't required to report your activities.

If a vendor, for example, doesn't report to a credit bureau, then your credit score won't be impacted even if you pay them in a timely manner.

How can I add an account that I already have to my business credit reports?

You can't add account transactions to your business credit reports. Only the businesses or vendors you work with can report on your behalf.

Keep in mind that they're not required to report to credit bureaus, so you may have to ask them to.

What the Experts Say

CreditDonkey asked industry experts to answer readers' most pressing questions about building credit safely.

Here's what they said:

Bottom Line

Building business credit doesn't have to be a daunting process. Establish the separation between your business and personal finances right away.

Take out small lines of credit using a personal guarantee so that your business can get approved for larger projects later. Then monitor your business credit profile and consistently update information as needed.

Follow these steps to give your business a healthy credit start.

References

- ^ Dun & Bradstreet Business Credit Scores & Ratings, Retrieved 1/9/2022

- ^ Experian Credit Ranking Score, Retrieved 1/9/2022

- ^ Equifax Business Credit Reports, Retrieved 1/9/2022

Write to Kim Shackleton at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.