Stash Review

Can Stash help make you money? Find out if the investing app is legit and how it compares to apps like Acorns and Robinhood.

Overall Score | 3.8 | ||

Annual Fee | 3.5 | ||

Minimum Deposit | 5.0 | ||

Customer Service | 3.0 | ||

Pros and Cons

- Guidance for beginners

- Automatically save and invest through round-ups and recurring transfers

- Fees are high for small balances

- High ETF expense ratio

- Limited research

Bottom Line

Good investment app to guide beginners to invest in stocks

Micro-investing seems like it's here to stay.

It's not the same thing as a robo-advisor, though. Those companies manage your funds for you. Stash guides you but does not invest for you. That's up to you.

Stash makes it possible to invest by helping you choose investments and allocations. It spells things out in layman's terms to help you become an investor (assuming that's what you want).

It's not a hands-off approach to investing. Instead, it's a hand-holding approach. Nothing is too complicated in Stash and if it is, they have more help to push you along.

Keep reading to see if Stash is right for you.

How It Works and Who It's Best For

Stash is mainly for the beginner investor.

If you are a truly thematic investor who is passionate about investing in certain themes, it could be helpful too, but the fees might scare you away (see below).

Stash offers more than 3,800 stocks and ETFs to invest in, the majority of which hold stocks. But they won't overwhelm you with options. Instead, your choices are narrowed down based on your risk level.

With Stash Retire, you can save for retirement by opening a traditional or Roth IRA. (Stash doesn't offer IRAs for small businesses or entrepreneurs.)

How To Get Started

- You'll answer a series of questions to evaluate your goals, age, and risk tolerance.

- Once you decide to move forward, you link your bank account to Stash, deposit funds, and begin investing.

- Stash then offers approximately 3,000+ single stocks/companies to choose from. Stash helps you build and manage a diversified portfolio by giving personalized advice and financial education.

Sign Up and Get $5

- Sign up, add at least $5 to your account and get a $5 bonus.

- Invest with fractional shares

- Get portfolio recommendations

If you have experience in investing, however, you'll likely find the advice trivial and the fees too high compared to other investment companies.

What Are the Subscription Fees?

Stash offers two flat fee plans. Each is designed to fit a range of financial needs, from dipping your toes into the world of investing to maximizing your financial power with every tool.[1]

- Stash Growth($3/month) - It includes a personal brokerage account, a retirement account (Roth or Traditional IRA)

, and banking services

.

- Stash+($9/month) - It offers access to a personal brokerage account, a retirement account (Roth or Traditional IRA), two custodial accounts (UGMA/UTMC) for minors

(age will depend on account-holder's state), and banking services

, with 1% Stock-Back® Rewards

.

Stash also offers the Stash Stock-Back® Card and the Stock-Back® Rewards

program lets you earn pieces of stocks or funds back on qualifying purchases. You'll earn 0.125% Stock-Back rewards on every purchase and up to 2% on purchases with certain merchants each month

[2]

Sign Up and Get $5

- Sign up, add at least $5 to your account and get a $5 bonus.

- Invest with fractional shares

- Get portfolio recommendations

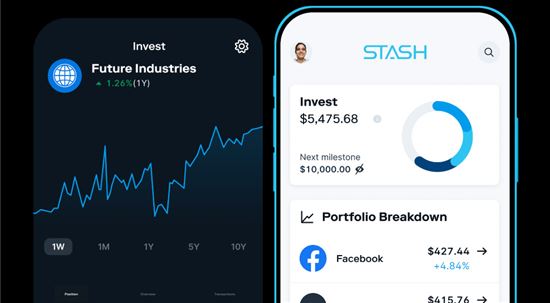

The App

|

| © CreditDonkey |

Stash is available on Android and iOS devices, as well as online. The app itself is pretty useful. You can get a snapshot of your account and its potential with the click of a few buttons.

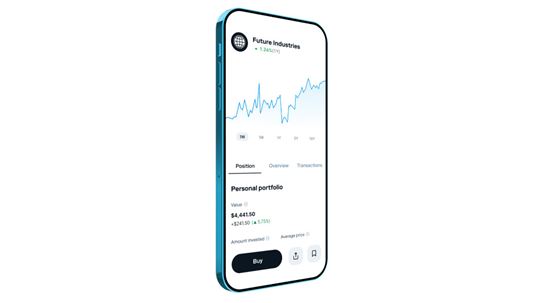

As it pertains to actual investments, you can learn what you need to know about a theme on one screen. In layman's terms, you'll learn about the investment, see a graph regarding its risk level, learn the expense ratios, and see the underlying holdings in each ETF. You can also learn about specific companies/stocks.

|

| COURTESY OF STASH |

Reasons We Like Stash

|

- Stash offers many educational opportunities to help beginners learn how to invest. Stash really caters to beginners, which not many investment companies do. Even those that say they are for beginners don't break the lingo down into layman's terms as well as Stash.

- There are no investment minimums. You don't need to maintain a minimum balance or invest a certain amount of money when using Stash. This makes it accessible to beginning investors who may not have a lot of money to get started.

- You can buy fractional shares.

If you can't afford a full share of the stock, Stash allows the purchase of fractional shares.

- You can open a custodial account. If you have children or grandchildren with an interest in investing or you want to start an account for them, you can open a custodial account. You must be 18 years or older to open your own account, so this gives younger investors a chance to get things going.

- You can invest in "themes." You won't have to choose from unrecognizable names of ETFs (or "tickers") when investing. Instead, you can invest in themes based on specific industries and your own interests. With each theme, you will see the individual ETF options spelled out in layman's terms.

- Stash names the ETFs based on their theme. Beginning investors often can't decipher the ticker tape language used. Stash changes the names to things like American Innovators or International Leaders. This gives you a better idea of what to expect within the theme. Clicking on the desired theme will give you examples of the holdings within that theme to help you even further.

- You can see your portfolio's historical performance right in the app. Stash continually encourages habitual investing or saving to increase your portfolio and future earnings.

![COURTESY OF STASH]()

COURTESY OF STASH - You can track your progress with Stash's Milestones. Stash sets certain milestones for you and then helps you recognize/celebrate them when they are met. You'll see the milestones when you first sign up and then be congratulated when you meet them. This is another way Stash helps to motivate you to keep investing.

- Stash can help you save and invest automatically through Auto-Stash. If you opt-in, the Set Schedule option allows you to set up automatic transfers into your investing account on a set schedule. Another option is Round-Ups which will round up spare change from your purchases to the nearest dollar every time you spend with debit card associated with your linked bank account. Once you have $5 accumulated, Stash will transfer the money to your personal investment account.

- You can withdraw funds. Stash doesn't charge you to withdraw your funds. You can do so at any time without penalty.[3]

Note: Funds are not immediately available. If your funds are invested in stocks or ETFs, you must sell the assets before withdrawing your funds. It takes 2 business days to execute an order, as this is an SEC regulation.[4] You must wait 5 business days after selling the assets before you can withdraw the funds.

Reasons You May Want to Look Elsewhere

- The fees are high for small investors. We discussed this above, but it's worth mentioning again. Small investors (investors with less than $5,000 invested) can pay a large portion of their investments in the fee. $36 a year doesn't sound like a lot, but when you only invest around $100, it takes away from your investment potential.

- The ETF expense ratio can be high. ETFs within Stash has an average expense ratio of 0.23%. However, that is only the average. Some of Stash's investments have an expense ratio of less than 0.15%, while some are closer to 0.95%.

- There isn't a lot of opportunity for research. If there's one thing that's important when investing, it's research. Even though Stash is for beginners, they have very little to offer in the way of research. They offer plenty of education, but it's basic terminology rather than true industry research.

Check out our comprehensive guide on best discount brokers for beginners.

Apex Clearing is a member of the Securities Investor Protection Corporation (SIPC). This means investments in your account are protected up to $500,000 total (including $250,000 for claims for cash).[5]

For uninvested funds, Stash accounts are enrolled in something called the Apex FDIC-insured Sweep Program. Deposits to the Sweep Program are covered by FDIC up to $250,000 limit per customer. Once the cash is deposited with the participating banks under the Sweep Program, the cash is no longer covered by SIPC.[6]

How it Compares

Stash vs Acorns: Acorns let's you invest "spare change" by rounding up your purchase to the nearest dollar. Once you reach $5, they will invest the funds for you.[7] It's a micro-investor and robo-advisor all in one, whereas Stash is a micro-investor, but not a robo-advisor.

| ||

| Learn More | Visit Site | |

Stash | Acorns | |

|---|---|---|

Sign Up and Get $5 - | $20 Investment Bonus - | |

Benefits and Features | ||

| Savings | ||

| Stock Trading | Part of service fee. No add-on trading fees. | |

| Options Trading | ||

| Annual Fee |

|

|

| Minimum Deposit | ||

| Checking | ||

| Mutual Fund Trading | ||

| Phone Support | Yes - normal business hours, plus Sat & Sun 11a-5p ET | |

| Live Chat Support | ||

| Email Support | ||

| Human Advisors | ||

| Robo Advisor | ||

| Assets Under Management | ||

| Tax Loss Harvesting | ||

| Goal Tracker | ||

| Automatic Deposits | ||

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Banking | All users get a cash account with a debit card. No minimum balance, no overdraft fees, and free ATM access at 55,000+ ATMS. | Included in Acorns Bronze ($3/mo). Free metal debit card, no minimum balance, no overdraft fees, and 55,000+ fee-free ATMs nationwide. |

| Mobile App | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

| Learn More | Visit Site | |

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Stash: Pricing information from published website as of 11/30/2025. Acorns: Pricing information from published website as of 11/29/2024. | ||

Stash vs Robinhood: Investors mostly use Robinhood to trade stocks without paying commissions. Like Stash, though, they don't manage the investments for you or have robo-advising capacity. It's up to you to choose the investments and do the actual trading; they just guide you along the way.

| ||

| Learn More | Visit Site | |

Stash | Robinhood | |

|---|---|---|

Sign Up and Get $5 - | Get a Free Stock (worth between $5 and $200) - | |

Benefits and Features | ||

| Stock Trading | ||

| Options Trading | ||

| Annual Fee |

| |

| Minimum Deposit | ||

| Mutual Fund Trading | ||

| Phone Support | Yes - normal business hours, plus Sat & Sun 11a-5p ET | |

| Live Chat Support | Available 24/7 (requires sign in) | |

| Email Support | ||

| Human Advisors | ||

| Robo Advisor | ||

| Assets Under Management | ||

| Tax Loss Harvesting | ||

| Goal Tracker | ||

| Automatic Deposits | ||

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Banking | All users get a cash account with a debit card. No minimum balance, no overdraft fees, and free ATM access at 55,000+ ATMS. | Offers Robinhood spending account with Robinhood Cash Card issued by Sutton Bank |

| Mobile App | ||

| Forex Trading | ||

| Futures Trading | ||

| Trading Platform | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

| Learn More | Visit Site | |

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Stash: Pricing information from published website as of 11/30/2025. Robinhood: Pricing information from published websites as of 01/25/2025. | ||

Stash vs Betterment: Betterment is one of the leading robo-advisors, but with no required minimum, it can be good for beginning investors as well. If you are looking for human advice and a more hands-off approach to investment, Betterment would be a better option.

Stash | Betterment | |

|---|---|---|

Sign Up and Get $5 - | Compare Pricing - | |

Benefits and Features | ||

| Savings |

| |

| Stock Trading | ||

| Options Trading | ||

| Annual Fee |

|

|

| Minimum Deposit | ||

| Checking | ||

| Phone Support | Yes - normal business hours, plus Sat & Sun 11a-5p ET | |

| Live Chat Support | ||

| Email Support | ||

| Human Advisors | ||

| Robo Advisor | ||

| Assets Under Management | ||

| Tax Loss Harvesting | ||

| Goal Tracker | ||

| Automatic Deposits | ||

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Banking | All users get a cash account with a debit card. No minimum balance, no overdraft fees, and free ATM access at 55,000+ ATMS. | Offers checking account with a free debit card, and a high-yield cash account |

| Mobile App | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Stash: Pricing information from published website as of 11/30/2025. Betterment: Pricing information from published website as of 11/22/2025 | ||

How To Add Money To Stash

If you've decided Stash is for you, there are several ways to add money to your account.

Most customers will prefer to link their bank accounts. This is free and usually takes a couple of days for the transfer to go through.

Transfer Money From Your Bank Account

- On the Home screen, select Link Your Bank Account.

- You can choose Instant Verification or Manual Verification. With Instant Verification, you'll input your bank's login details. With Manual Verification, you'll input your bank's routing and account numbers.

- Once your bank account is linked, select Transfer. Fill out the details and Confirm. You can transfer up to $300 per day.

A convenient feature of Stash is that you can add money using multiple methods.

Transfer Money Using Other Methods

- In-person: You can add money to your Stash Stock-Back Card at a participating retailer like Walmart, Walgreens, Rite-Aid, or CVS Pharmacy. Some fees apply and you can only add $3,000 per day.

- Payment app: You can add money from Venmo, Paypal, or the Cash app. Just add Stash's Stock-Back® Card

as a payment method in your payment app. Then transfer your cash balance to Stash. There is a fee for this service.

- Direct deposit: You can download the form to give to your employer and follow the directions to Set Up Direct Deposit.

FAQ

What bank does Stash use?

Stash offers FDIC-insured bank accounts through Stride Bank.

How old to use Stash?

According to the law, you must be 18 years old to invest in the USA. But a parent can open a custodial account and invest in their child's name. Stash supports custodial accounts.

Is Stash safe to give SSN?

Stash protects your data like your social security number with 256-bit encryption. Your communications are protected with Transport Layer Security (TLS). You can also set up two-factor authentication and biometric recognition for added security.

Does Stash pay dividends?

You can earn dividends in Stash by investing in stocks that pay dividends. These payments will usually go to your Cash Balance. Dividends are typically paid four times a year. If a stock pays dividends, you'll be paid in Stash as well.

Does Stash have index funds?

Stash offers many options for index funds, including the Match The Market ETF (IVV). This fund tracks the S&P 500, a fund tracking America's largest companies.

Does Stash charge to sell?

There are no fees to sell your investments with Stash.

How long does Stash take to deposit?

When withdrawing your funds from Stash, it takes up to 5 business days to receive your money.[8]

How long does it take for Stash to buy?

Stash has 4 trading windows per day — 2 in the morning and 2 in the evening. These windows may vary based on market conditions. When you make a trade, your trade will be listed as "pending" until the next trading window. Then your trade will be completed.

Can I buy AMC on Stash?

AMC Entertainment (AMC) is available for purchase on Stash. Since Stash offers the option to buy fractional shares, you can invest in AMC with as little as $1.

Bottom Line

Is Stash the choice for you? It depends if you are a true beginner and only have small amounts to invest.

If you really want to get the hang of investing, this can be a great starting point. If you are more of a hands-off investor, this may not the best choice for you as you make all of the decisions and manage the funds. A robo-advisor could be a better option for those looking for a more hands-off approach.

References

- ^ Stash. Pricing, Retrieved 10/19/2023

- ^ Stash. All About Stock-Back Rewards, Retrieved 10/19/23

- ^ Stash. How do I transfer or withdraw my money?, Retrieved 10/19/23

- ^ Securities and Exchange Commission. SEC Adopts T+2 Settlement Cycle for Securities Transactions, Retrieved 10/19/2023

- ^ SIPC. What SIPC Protects, Retrieved 10/19/2023

- ^ Stash. Apex FDIC-insured Sweep Program, Retrieved 10/19/2023

- ^ Acorns. What are Round-Ups?, Retrieved 10/19/2023

- ^ Stash. How long does it take for money to reach my bank account after I withdraw it from Stash?, Retrieved 10/19/2023

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Fund and Get 4% Match Bonus

Enroll in this offer, and transfer or deposit $100,000 or more to your Webull account. Maintain a total net qualifying funding amount of $100,000 or more until the payment date of the final installment of the match bonus. The match bonus will be paid in 6 installments. The first installment will be issued on or about May 15, 2026.

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

Donna Tang is a content associate at CreditDonkey, a personal finance comparison and reviews website. Write to Donna Tang at donna.tang@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|

Compare: