Betterment Review: Pros and Cons

Betterment offers low fees and good returns. But there are risks you should NOT ignore. Read this review to see if Betterment is better.

Overall Score | 4.1 | ||

Annual Fee | 4.5 | ||

Minimum Deposit | 5.0 | ||

Human Advisors | 3.0 | ||

Customer Service | 4.0 | ||

Pros and Cons

- No minimum investment

- Customized portfolios

- Automatically invest extra funds

- Limited investment options

- High fees for large investors

Bottom Line

Great robo-advisor for beginners with low fees, good tools, and tax strategies

Betterment is one of the oldest and most popular robo-advisors. With no minimum to get started and low management fees, Betterment has made it possible for anyone to enter the world of investing.

Robo investing means there's no direct human involvement in your investing. Betterment uses algorithms to determine the best strategy based on your goals and risk tolerance.

Since then, Betterment has expanded its services to also offer cash management accounts and financial planning packages.

Is it right for you? Read our in-depth Betterment review before you sign up.

- Fees: How Much Does It Cost?

- Is Betterment Safe?

- How To Get Started With Betterment

- Asset Classes and Allocation

- Goals and Returns

- Investment Portfolios

- Betterment's App

- Special Features

- Pros and Cons

What is Betterment: Overview

Betterment is an online platform for investing and cash management. They offer 3 main services:

- Robo advisor: Betterment offers automated investing starting at $4 per month for balances under $20,000. It picks investments for you based on your goals and risk tolerance. There is no minimum investment to get started.

- Checking and savings: Every user can open a Checking account with a free debit card, and a Cash Reserve account with a higher APY than traditional banks. Both have no monthly service fees.

- Financial advice packages: For an additional fee, you can book a session with a certified professional to get personalized financial advice.

Betterment is known for making investing accessible to everyone. But it's just as legit as traditional brokerages. They have:

- Over $40 billion of assets under management

- Over 800,000 customers

- Globally diversified portfolio of ETFs

- Automatic rebalancing and tax efficient strategies

- SIPC insurance

- $4 monthly fee for balances less than $20,000

- 0.25% annual fee for balances $20,000 or more or with monthly recurring deposits of $250 or more

- 0.65% for Premium (minimum $100,000)

- $0 minimum deposit

- Beginner to intermediate investors

- Young investors

- Retirees

- Investors without a lot of capital

- Hands-off investors

- Retirement planners investing for the long-term

How Much Does Betterment Cost?

|

Betterment charges an annual service fee to cover portfolio management and trading costs. The fee is split into four payments which are deducted from your account based on the average daily balance each quarter.

There are two service tiers:[1]

1. Digital Plan - $4/month or 0.25% annual fee

The pricing for this plan is $4/month for balances under $20,000, and then a 0.25% annual fee if you reach a balance of $20,000 or more across all your accounts or set up recurring monthly deposits of $250 or more.

No minimum required. The Betterment Digital service includes:

- Automated portfolio management

- Automatic rebalance

- Tax loss harvesting

- Sync external accounts

2. Premium Plan (minimum $100,000) - 0.65% annual fee

In addition to the basic features, the Betterment premium plan offers:

- Unlimited access to certified financial experts

- Guidance on life events and investments outside of Betterment

Each tier offers a 0.10% discount for Betterment balances over $2 million (excluding 401k investments). Only the portion above $2 million gets the reduced fee.

There are no additional trade fees or transfer fees.

Betterment also has a satisfaction guarantee. If you're not happy with Betterment's advisory service, you could get your management fees waived for up to 90 days.[2]

We'll explain more below. But first, let's highlight the current Betterment promotions.

Betterment Promotions

Is Betterment Safe?

|

Betterment is a registered broker with the SEC (CRD #149117). As a fiduciary, the company is legally bound to act in your best interests. It assumes responsibility for investing your assets while protecting them from:

Theft or security risks

Betterment uses industry standard security measures, including 256-bit SSL encryption and two-factor authentication. You can use an authenticator app on the smartphone or SMS text to access your account.

Loss if the company fails

The platform is a member of the Securities Investor Protection Corporation (SIPC), which insures investments made through Betterment Securities up to $500,000 (per account type). But the SIPC will NOT protect you from losing money through investing.

Betterment is not a bank so it is not FDIC insured. But the SIPC would cover your losses (up to $500,000 per account type) should the platform go out of business. In addition, Cash Reserve and Checking accounts are FDIC insured via their program banks. Learn more about those accounts below.

How To Get Started With Betterment

|

| © CreditDonkey |

1. First, you'll need to create an account by answering a series of questions like your age and annual pre-tax income.

You'll also state your investment goal (retirement, emergency savings, or general investing). Each goal will have a different suggested asset allocation of stocks and bonds.

2. Next, choose a type of account to open. Betterment offers the following account types:

- Individual taxable account

- Joint account

- Retirement accounts (Roth and Traditional IRAs)

- SEP IRA

- Trusts

| Good For | Account Type |

|---|---|

| Reaching your investment goals | Individual taxable account |

| Investing with a partner | Joint account |

| Planning for retirement | Roth and traditional IRA |

3. Finally, you'll need to link a bank account to fund your investment portfolio. And that's it. It's literally that easy.

Your portfolio will be funded automatically about 1 business day after you deposit money. The money you deposit is transferred to Betterment Securities, a FINRA member broker-dealer. You cannot fund your account by check, wire, debit or credit card.

Yes, you can withdraw funds back into your bank account at any time with no penalties or withdrawal fees (depending on the account). If you withdraw funds from an IRA account before age 59-1/2, there will be a tax penalty.

A withdrawal will generally take 4-5 days to complete.

Asset Classes and Allocation

Once you've set up your account, Betterment will develop a personalized portfolio of ETFs containing U.S. and international stocks and bonds.

The platform only invests in Exchange-Traded Funds (ETFs). Much like mutual funds, these are diversified collections of assets including stocks, commodities, and/or bonds. But unlike mutual funds, they are traded on an exchange, just like a stock.

Betterment invests in up to 13 different asset classes including:

Stocks

- U.S. Total Stock Market

- U.S. Value Stocks - Large Cap

- U.S. Value Stocks - Mid Cap

- U.S. Value Stocks - Small Cap

- International Developed Market Stocks

- International Emerging Market Stocks

Bonds

- U.S. High Quality Bonds

- U.S. Municipal Bonds

- U.S. Inflation-Protected Bonds

- U.S. High-Yield Corporate Bonds

- U.S. Short-Term Treasury Bonds

- U.S. Short-Term Investment-Grade Bonds

- International Developed Market Bonds

- International Emerging Market Bonds

You have the ability to adjust your portfolio at any time by changing your desired asset allocation. But since the portfolios are overseen by the platform's algorithm, you aren't required to monitor them.

Keep reading to see how to set your goals.

Compare Pricing

No. Betterment is a robo-advisor that automatically invests in a diversified portfolio of ETF funds. You cannot trade individual stocks or funds.

Setting Goals

You can set up multiple portfolios through the platform. For each, Betterment can automatically design the best strategy based on your risk tolerance, financial goals, and time horizon.

If you are uncomfortable with risk, or if you may need your money soon and couldn't withstand a loss of capital, Betterment will select an investment portfolio with less risk to your principal.

If you can handle some risk, Betterment will select a portfolio that will likely show more capital appreciation over time.

Some popular investment goals include:

- Major purchase

- Education

- Safety net (emergency fund)

- Retirement

- General investing

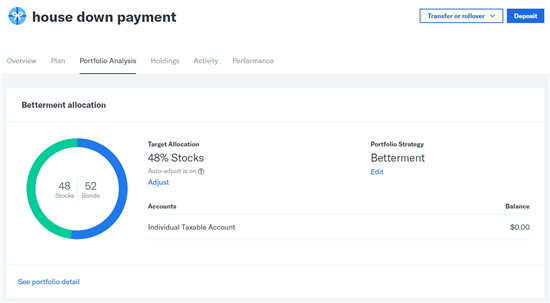

Let's say you want to save $25,000 over the next five years for a house down payment. You would pick "major purchase."

|

For this goal, Betterment selects an asset allocation of 48% stocks and 52% bonds. The platform estimates how much money you need to deposit each month to reach this goal. It also provides a rough projection of the total amount in 5 years for both average and poor market performances.

Betterment Returns

Like many robo-advisor platforms, Betterment diversifies your portfolio based on the Nobel prize winning Modern Portfolio Theory.[3] The goal is to earn steady average returns without extreme losses (or gains).

But it's important to remember that your returns will vary based on many factors, including the asset allocation of your portfolio. A more risk-averse allocation may result in lower returns during a strong market, but a stronger return (or lower loss) during a downturn.

The platform claims it would have outperformed the average investor with a financial advisor 88% of the time over the last decade.[4]

For a more detailed breakdown of Betterment's returns, check out our guide.

Betterment is ideal for newbies who aren't ready to invest on their own AND for investors who prefer the hands-off approach. The service fee is low, so you get to keep more of your profits. But like all investments, returns are not guaranteed.

Investment Portfolios Options

Betterment offers a variety of portfolio options, including:

- Betterment Core Portfolio

This standard Betterment portfolio is made up of globally diversified stock ETFs and bond ETFs. It is personalized for each individual person's goals and time horizons. If you have multiple goals, each one will have its own customized strategy. - BlackRock Target Income Portfolio

This portfolio only invests in bond funds. The goal is to generate income, without being concerned about growth or appreciation of principal. It's a great option for retirees looking for low-risk investments. - Goldman Sachs Smart Beta Portfolio

This investment portfolio aims to provide better returns. It's more heavily invested in companies screened for value, high quality, strong momentum, and low volatility. - Socially Responsible Investing (SRI) Portfolio

Betterment offers 3 SRI portfolios. Broad Impact focuses on companies that rank high on all ESG criteria. Climate Impact focuses on green companies. Social Impact focuses on companies that support diversity and minority empowerment.They also have a charitable giving tool that lets you donate tax-efficiently right from the app.

- Flexible Portfolio

Usually, Betterment decides your asset allocation for you. But the Flexible Portfolios allow you to modify your individual asset class weights to your preferences. Betterment will help assess the risk and diversification of your changes.

Betterment App

Betterment offers free apps for both iOS and Android users. Use it to:

- See your Betterment account balance and performance chart

- Review your activity history

- Make deposits into your Betterment account(s)

- See an overview of your external linked financial accounts

- See whether you're on track to your retirement goals and projections

- Set up and manage Checking and Cash Reserve accounts

- Send a message to customer support

Betterment's Special Features

|

| © CreditDonkey |

Keep reading for a look at some main Betterment features.

Tax Coordinated Portfolio

Available to those with multiple portfolios, this option aims to increase your after-tax returns.

Since assets that pay dividends are taxed annually at a high rate, these are placed into IRAs (which offer tax advantages). Other assets grow by increasing in value and are only taxed when you withdraw. These are better placed in taxable accounts.

You must have at least 1 taxable account and 1 retirement account (traditional, Roth, or SEP IRA) with Betterment to participate.

Invest Smarter

- Personalized portfolio options

- Automatically invest extra funds

- Turn investment goals into action

Rebalancing and Tax Harvesting

Betterment offers two ways to maximize your investments.

Automatic Rebalancing

When beginning a portfolio, you set your allocation (e.g., 70% stocks and 30% bonds). This ratio will shift over time since stocks and bonds increase at different rates. Betterment automatically rebalances your portfolio every 3 months to ensure the allocation stays in line with your goals and risk levels.

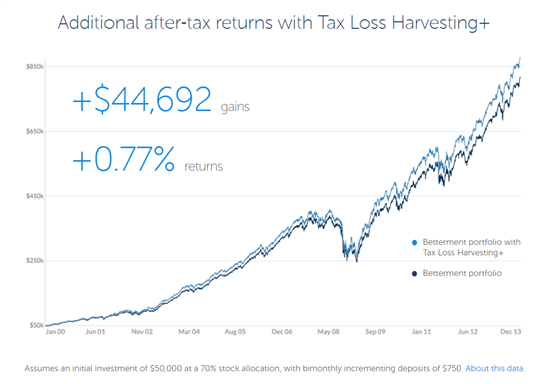

Tax Loss Harvesting

This strategy aims to increase after-tax returns by offsetting capital gains with capital losses to reduce your taxable income. If certain ETFs are experiencing losses, they'll be sold and replaced with similar securities (to maintain your portfolio allocation).

This graph shows how tax-loss harvesting increased after-tax returns by 0.77% over a 13-year period (assuming an initial $50k investment with bi-monthly deposits of $750).

|

Betterment Retirement Guide

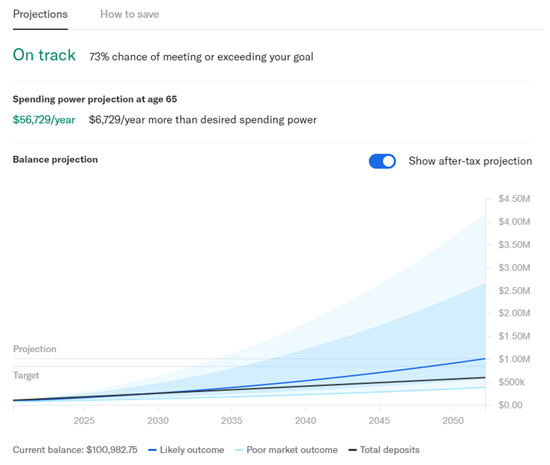

Betterment has a retirement planning tool (previously called RetireGuide) that calculates what your retirement may look like.

You can link your financial accounts, including banks and 401(k)s. And you have the option to upload your Social Security data. It syncs to your accounts daily so you can get the full picture of your retirement funds.

You input some answers about your desired retirement spending, age you'll retire, and planned annual contributions. Betterment will calculate your balance projection and how much per year you'll have to spend in retirement.

|

This is a helpful snapshot to see whether you're on track to your retirement goals. If you're not on track, Betterment will offer suggestions on how much to save each year in order to reach your desired spending goal.

Betterment Cash Reserve

Betterment recently launched a cash management platform as part of its services.

Betterment Cash Reserve - Earn 3.75% APY**

- FDIC insurance covering up to $2,000,000 at program banks†

- Access cash in 1-2 business days

- No minimum balance

- No fees on balance

- Unlimited withdrawals

The Cash Reserve operates much like an online bank savings account. Along with a competitive savings interest rate, it also has some specific advantages over traditional savings accounts, including:

- Unlimited withdrawals at no cost (unlike the 6 withdrawals/month limit for a bank savings account)

- Faster transfers between your linked banking account within 1-2 business days (instead of the usual 4-5)

- Transfer between your cash reserve and Betterment investment accounts

- FDIC insured up to $1,000,000 (instead of $250,000) at their program banks

Betterment also analyzes your expenses and tells you how much extra cash you have sitting in your external checking account. You can activate a two-way sweep feature, which will automatically move extra cash into your Cash Reserve account. This way, your money is being invested instead of sitting around unused.

If your checking account balance gets low, Betterment will move the money back. That way, you won't be charged an overdraft fee.

Betterment Checking Account

Betterment also offers a no-fee checking account. There is no initial deposit, no balance requirements, and no monthly fee.

It features:

- Contactless Betterment Visa debit card

- ATM fees reimbursed worldwide

- 1% Visa foreign transaction fee reimbursed

- Mobile check deposits

- No overdraft fees

- FDIC-insured up to $250,000

This is meant to be a fee-free alternative to a traditional bank checking account. Betterment checking is backed by NBKC Bank, so you can trust that your money is in a legit financial institution.

Every customer can open one Checking and Cash Reserve account.

Financial Advice Packages

Betterment's latest feature lets investors talk directly to a certified financial planner regarding their short and long-term goals. The platform offers two financial planning packages:[5]

Getting Started package

For $299, you get one 45-minute call with a licensed financial expert. This person will take you step-by-step through the process of setting up your Betterment account. You'll also receive a set of action items after the call designed to help you maximize your investments.

Specialized packages

For $399, you will get one 60-minute phone call to speak with a financial expert on one of four subjects, including:

- Financial checkup

- College planning

- Marriage planning

- Retirement planning

This package also includes an action plan developed by Betterment's certified financial planners.

Reasons Why We Like Betterment

|

| © CreditDonkey |

Passive investing

Just set up an investment account and transfer money and Betterment will do the rest. You can also take advantage of the platform's automatic rebalancing and tax-loss harvesting to stay on track and increase your overall earnings.

No account minimums

Start with whatever funds you have on hand. This makes Betterment great for young or newbie investors without a lot of capital.

Tax efficient strategies

Betterment's tax-loss harvesting can reduce your taxable income and maximize your annual return.

Fractional shares

Betterment will buy just a small fraction of a stock if you don't have enough money for a full share. Every single dollar is invested, instead of just sitting in your account as cash.

Goal-based saving

When you set up your account, the app suggests financial goals with target dates based on your inputted information. You can adjust the goals however you like. These specific goals can help keep you motivated and encourage you to save.

SmartDeposit

This feature automatically sends money to Betterment when your external bank account exceeds a certain balance. You can set up the frequency and maximum transfer amount to maintain total control.

Hours: Monday through Friday 9 am - 6 pm ET

Phone: (646) 600-8263

Email: support@betterment.com

Why Betterment May Not Be For You

Betterment isn't the right investment solution for everyone. Here are some reasons it may not be the best choice for you.

Limited number of investment products

Betterment only invests in ETFs. For those with more complex investing needs, the platform's offerings may be too narrow. In other words, if you're expecting Betterment to work like an E*TRADE account, you may be disappointed.

You have a lot of capital

The annual flat-rate fee for the Betterment Premium Plan can be a little steep—$100,000 in investments will cost $650 in fees at the 0.65% tier.

With a large amount of money to primarily buy and hold, you're probably better served by a broker with a per transaction fee.

You don't need personalized advice

If you understand investment strategy, you could make more in profits by selecting investments yourself.

Compare Pricing

Risks of Using Robo-Advisors

Robo advisors are a convenient, low-pressure option for inexperienced investors. But they do come with some downsides. Here are a few:

Limited personalization

Robo advisors get a snapshot, not a complete look, at your preferences and risk tolerance. That means your portfolio might not be as closely aligned with your goals as it would with an actual financial expert overseeing your investments.

Unpredictability

The algorithms that control your portfolio can behave unexpectedly during periods of volatility, including sudden market downturns. In some cases, random events and news items can also trigger activity.

Management fee

While robo services are often cheaper than human financial advisors, that's not always true. Depending on how much guidance you need—and how much you have to invest—you may be able to get an actual human advisor for roughly the same cost.

There are 2 Betterment accounts: Digital Plan (no account minimum, 0.25% annual service fee of total balance) and Premium Plan ($100,000 minimum, unlimited phone calls to financial planners, and 0.65% service fee).

Hear from an expert

Don't just take our word for it. CreditDonkey asked Professor Derek D. Klock from Virginia Tech some of readers' most pressing questions:

- Is an investor's financial information more or less safe with a robo-advisor than it is with a traditional brokerage?

- Is using a robo-advisor a reliable way to save for retirement?

- What advice do you have for someone who has never invested before who wants to use a robo-advisor?

Here's what he had to say:

How Betterment Compares

vs Wealthfront:

Wealthfront and Betterment offer similar services. The management fee for the basic service is the same for both platforms. However, the Betterment premium plan offers access to certified advisors, while Wealthfront has none at all. Wealthfront has a $500 account minimum.

If you have a lot to invest, Wealthfront has a few advanced features that Betterment lacks. It can also create more complex investment structures and can do a better job of avoiding taxes.

Wealthfront also offers free advanced personal finance tools for life events, such as calculators for college, retirement, buying a house, and travel.

Read our detailed compared guide on Betterment vs. Wealthfront.

Betterment | Wealthfront | |

|---|---|---|

Compare Pricing - | Wealthfront Cash Account - | |

Benefits and Features | ||

| Savings |

| |

| Annual Fee |

| |

| Minimum Deposit | ||

| Checking | ||

| Phone Support | ||

| Live Chat Support | ||

| Email Support | ||

| Human Advisors | ||

| Robo Advisor | ||

| Assets Under Management | ||

| Tax Loss Harvesting | ||

| Goal Tracker | ||

| Automatic Deposits | ||

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Banking | Offers checking account with a free debit card, and a high-yield cash account | |

| Mobile App | ||

| Single Stock Diversification | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Betterment: Pricing information from published website as of 01/12/2025 Wealthfront: Pricing information from published website as of 04/20/2024. | ||

vs Vanguard:

Vanguard is a huge investment management company. Vanguard offers a Personal Advisor service, which gives you an actual person managing your account to select investments based on your goals and financial situation.

Vanguard requires a minimum investment of $50,000 for this service. And it charges a flat 0.30% annual management fee.[6] Just like robo-advisors, Vanguard will do the work for you, including rebalancing the portfolio. Clients can contact the advisor whenever they like. For a low 0.30% flat fee, this is a great service if you have more to invest and want human interaction.

Betterment | Vanguard Personal Advisor | |

|---|---|---|

Benefits and Features | ||

| Savings |

| |

| Annual Fee |

| |

| Minimum Deposit | ||

| Checking | ||

| Phone Support | ||

| Live Chat Support | ||

| Email Support | ||

| Human Advisors | ||

| Robo Advisor | ||

| Assets Under Management | ||

| Minimum Investment | ||

| Tax Loss Harvesting | ||

| Goal Tracker | ||

| Automatic Deposits | ||

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Banking | Offers checking account with a free debit card, and a high-yield cash account | |

| Mobile App | ||

| Investment Tracking | ||

| Single Stock Diversification | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

| Annual Fee | ||

| Minimum Deposit | ||

| Human Advisors | ||

| Customer Service | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Betterment: Pricing information from published website as of 01/12/2025 Vanguard Personal Advisor: Pricing information from published website as of 04/04/2018 | ||

vs Acorns:

Acorns uses an "invest spare change" approach. You link a bank account and credit cards to your Acorns account. After every purchase, Acorns will round up the spare change and automatically invest it for you. There is no account minimum, but you need $5 to start investing.

This is a good way to invest without thinking. But you can't build real wealth from spare change. Betterment is better for those serious about retirement savings. And Acorns' monthly fee may be high if you keep a very small balance.

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

vs Empower:

Empower's main services are 1) free personal finance tools, and 2) paid wealth management service. The robo advisor service has a $100,000 minimum and a higher 0.89% fee, however, you get more a personalized strategy designed by financial experts. The higher fee may be worthwhile for individuals with more complex investment needs.

Empower's free financial tools are some of the best on the market. You can link all your external bank accounts, investments, loans, etc. to get a complete picture of your financial life in one place. It also analyzes your investments and offers personalized advice all for free.

Other Trading Apps You May Consider

J.P. Morgan Self-Directed Investing - Get Up to $700

- Get up to $700 when you open and fund a J.P. Morgan Self-Directed Investing account with qualifying new money.

- $700 when you fund with $250,000 or more

- $325 when you fund with $100,000-$249,999

- $150 when you fund with $25,000-$99,999

- $50 when you fund with $5,000-$24,999

- Get unlimited commission-free online stock, ETF, fixed income, and options trades when you open an account.

- $0 Online Commission trades

- Choose an account that's right for you: General Investing, Traditional IRA or Roth IRA.

- Access our secure, easy-to-use trading experience online or through the Chase Mobile® app.

- Our powerful tools and resources are built to help you take control of your investments.

INVESTMENT AND INSURANCE PRODUCTS ARE:

Compare Promotions

Bottom Line

Betterment has no account minimum and a low fee structure for those with little money to invest. If you have a lot of capital or if you want more control over the process, another brokerage service might be better.

Betterment makes a lot of sense for someone who has little or no experience and is uncomfortable with choosing their own investments. There's no guarantee your investment will grow, but we like your odds. And you can't start growing a nest egg without a little bit of risk.

References

- ^ Pricing at Betterment, Retrieved 12/14/2020

- ^ Betterment Satisfaction Guarantee, Retrieved 12/14/2020

- ^ The Nobel Prize, Prize in Economic Sciences 1990, Retrieved 12/14/2020

- ^ Betterment, Explore Betterment's Historical Performance, Retrieved 12/14/2020

- ^ Betterment Advice Packages, Retrieved 12/02/2023

- ^ Vanguard. Vanguard Personal Advisor Services, Retrieved 4/7/2022

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Get $100,000 Virtual Portfolio to Experiment

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

Write to Kyle Schurman at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Empower Personal Wealth, LLC (“EPW”) compensates CREDITDONKEY INC for new leads. CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

|

|

|

Compare: