Best Quicken Alternatives for 2024

Best Alternatives to Quicken: Free and Paid Replacements

Is there a good replacement for Quicken? Check out this list of best alternatives (including free options) to manage your money.

|

| © CreditDonkey |

Quicken started in 1983 and was once the top choice for managing personal finances. But times have changed since the days of VHS tapes.

This tool tries to keep up, but many finance management apps have since emerged, boasting more advanced tools and features.

Its transition to a yearly subscription even made some people think it's not as great a value as before.

It might be time for something better. Discover the top easy-to-use alternatives to Quicken below.

| Quicken Alternative | Best For |

|---|---|

| 1. Empower | Overall personal finance |

| 2. You Need A Budget (YNAB) | Overall budgeting |

| 3. Tiller | Spreadsheet budgeting |

| 4. PocketSmith | Retirement planning |

| 5. Moneydance | Bill pay |

| 6. Banktivity | Mac/iOS |

| 7. CountAbout | Transferring data from Quicken |

| 8. EveryDollar | Budgeting beginners |

| 9. GnuCash | Personal accounting without a subscription |

| 10. Monarch | Serious savers |

| 11. Moneyspire | Managing personal and business finances |

| 12. Simplifi | Comprehensive yet simplified overview |

| 13. Dollarbird | Budgeting calendars |

| 14. Goodbudget | Couples and roommates |

PRO TIP: Try our free budget calculator to visualize your monthly expenses right now. No login required.

What are the best alternatives to Quicken?

Money management should be free from glitches and lag. Find out which Quicken competitors offer a better—and more affordable—user experience.

Quicken used to offer a free program called Quicken Online. But Intuit dropped the program after it bought Mint. Today, one of the best free alternatives to Quicken is Empower which lets you monitor all your financial accounts in one place.

Compare Top Deals and Promos

- Simple: The app should be easy to use.

- Secure: The app should have strong security features.

- Syncs: The app should sync seamlessly with your bank accounts and other financial tools.

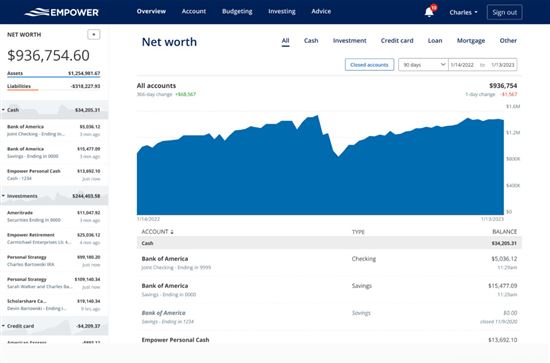

Best Overall: Empower (FREE)

If you want a full picture of your finances, Empower is your best bet. Like Quicken, Empower tracks your spending patterns and categorizes them. You can see your entire financial life in one place, including your net worth over time and your investments.

|

| credit empower |

Empower excels in investment tracking by offering personalized investing advice and deeper insights for your retirement planning. Plus, it's a completely free alternative to Quicken.

On the downside, there's no bill pay capability. You also can't add manual transactions and customize alerts. Nonetheless, this alternative still manages to pack in lots of useful features, including wealth management. Find out more

Key Features

- Pricing: Free

- Free Trial: N/A

- Accessibility: Web, iOS, and Android

- Import From Quicken: No

Quicken has more features. But for the value and its solid range of valuable tools, Empower is the winner.

Empower is great for long-term savers and investors. For better help with your day-to-day spending, don't miss the next app.

Learn more: Empower full review

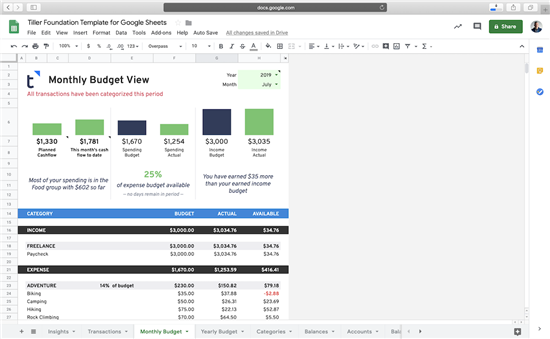

Best Budgeting Tool: You Need A Budget

You Need A Budget (YNAB) focuses purely on budgeting. It uses a strategy called "zero-sum budgeting." Every cent you earn must have a plan, whether it goes toward groceries, rent, or savings.

|

| Courtesy of YNAB |

YNAB also helps you plan for big expenses so that you have enough saved when they come. The app holds you more accountable than Quicken does. If you overspend, you'll get an alert. The app will help you adjust your budget by moving money from another category.

It also offers financial tools, such as daily webinars, to get you comfortable handling your own money. The service is an easy introduction to the world of budgeting. It's great for beginners looking to gain control of their finances.

Key Features

- Pricing: $14.99/mo or $99/yr[1]

- Free Trial: 34 days

- Accessibility: Web, iOS, Android, and Alexa devices

- Import From Quicken: Yes; QIF compatible

YNAB is great if you're serious about creating and sticking to a budget. It'll help improve your financial situation from the ground up. Quicken offers more comprehensive tools other than budgeting.

Learn more: You Need A Budget full review

For those who want to explore similar apps, here's our list of the top YNAB alternatives.

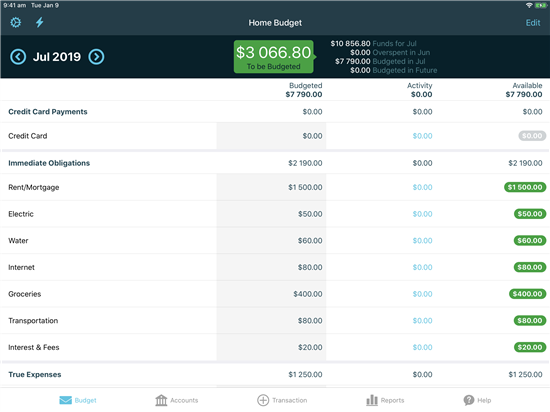

For Spreadsheet Budgeting: Tiller

Tiller is the ultimate budgeting service if you love seeing your numbers all neatly organized into spreadsheets. This web-based program is completely customizable and automatically updates your spending in Google Sheets. Create multiple budgets and track what's most important to you.

|

| Credit: Tiller Money |

Tiller's user interface is easier than Quicken's multiple drop-down menus. It concentrates on straightforward budgeting without the bells and whistles, so you'll need another tool if you're looking for investment tracking.

If spreadsheets are your go-to choice for organizing your financial life, this could be a great choice. The platform is free for the first 30 days and costs $79 per year afterward.[2]

Key Features

- Pricing: $79/yr

- Free Trial: 30 days

- Accessibility: Add-on for Google Sheets and Microsoft Excel

- Import From Quicken: Yes; CSV compatible

Tiller keeps it simple by feeding all your financial data into Google Sheets or Microsoft Excel. It's a good alternative if you're looking for spreadsheets that are more user-friendly than Quicken.

Tiller is also good for Chromebook users since Chromebooks can't run the full version of Quicken.

Your operating system shouldn't hold you back from quality budgeting tools. Apple fans, be sure to check out the succeeding apps.

Retirement Planning: PocketSmith

PocketSmith is a good tool for budgeting and tracking spending. But its stand-out feature is the ability to forecast your money based on current expenses, income, and spending habits. It can predict your account balances up to 60 years into the future with a Fortune plan.

Instead of simply listing your bank transactions, the program organizes them in a calendar. From there, you can also view your future income and expenses. If you're a visual person, this is a great way to understand where your money goes.

Another unique feature is the "what if" scenarios. You can test decisions to see how they would affect your finances. For example, you could predict how having a wedding would impact your future plans and finances.

PocketSmith's free plan only supports manual transaction import, while paid options provide automatic syncing. The latter offers more complex features like budget projections and an unlimited number of accounts, among others.

Key Features

- Pricing: Free, Foundation ($14.95/mo or $119.88/yr), Flourish ($24.95/mo or $199.92/yr), Fortune ($39.95/mo or $319.92/yr)[3]

- Free Trial: N/A

- Accessibility: Web, iOS, Android; Beta version for Windows, Mac, and Linux[4]

- Import From Quicken: Yes; QIF compatible, CSV (for Mac)[5]

Both programs offer a retirement planner. But PocketSmith has a slight advantage. PocketSmith gives you in-depth insight into your future finances. It's especially helpful if you have FIRE (Financial Independence, Retire Early) goals.

Bill Pay: Moneydance

Unlike most budgeting programs, Moneydance doesn't upload your data to the cloud. Your information is saved only to your hard drive—unless you download the app to your phone or sync to another computer.

This bill pay program offers advanced financial tracking and budgeting tools, such as financial graphs and reports, investment tracking, and bill reminders. It's also one of the few budgeting apps that offer bill pay.

Moneydance costs $65 for lifetime access to the current version of the program.[6] It has a 90-day money-back guarantee and a free upgrade to the next major release. You may also be entitled to discounts for succeeding upgrades.

Key Features

- Pricing: Free account with 100 transactions, Purchase ($65 one-time fee), Subscribe ($9/mo or $90/yr), Purchase addon: Moneydance Plus ($4/mo or $40/yr)

- Free Trial: 14 days (for Moneydance Plus subscription)

- Accessibility: Windows, Mac, Linux, iOS, Android[7]

- Import From Quicken: Yes; QIF compatible[8]

Moneydance comes with online bill pay included in its price. To use Quicken's Bill Manager function, you have to pay extra.[9]

You work hard for your money. Don't let a single dollar slip by unaccounted for. Whether it's euros, yen, or other currencies, stay on top with the app that works wherever you are.

Try Moneydance Free for 100 Transactions

Learn more: Moneydance full review

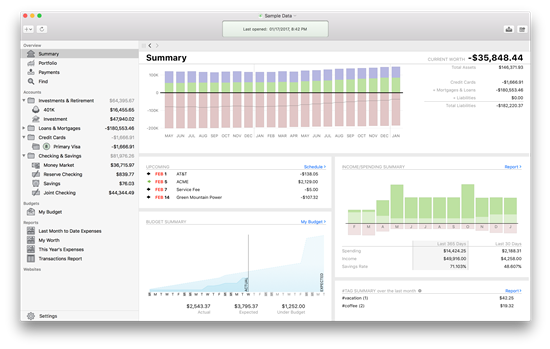

For Mac: Banktivity

Sick of missing out on Quicken features because you use a Mac? This app is for you. Banktivity is only available on MacOS and iOS, and it syncs across all your linked devices: Mac, iPhone, iPad, and Apple Watch.

|

| Courtesy of Banktivity |

Banktivity takes a zero-sum approach to budgeting. This means you'll "spend" all your money every month on either expenses, savings, or debt payments.

Other features include setting savings goals and paying bills from the app. You can also build interactive, custom reports that give you great insight on your financial health.

Banktivity offers 3 pricing tiers. The Bronze plan only tracks your banking and credit accounts. The Silver plan includes investments, loans, and real estate tracking. The Gold plan can track accounts in different currencies.[10]

Key Features

- Pricing: Bronze ($49.99/yr), Silver ($69.99/yr), Gold ($99.99/yr)

- Free Trial: 30 days

- Accessibility: Mac and iOS apps

- Import From Quicken: Yes; QIF compatible[11]

Quicken for Mac lacks some features of the Windows version. Banktivity includes features only found in Quicken for Windows, like portfolio analysis. Plus, it syncs across all your Mac and iOS devices.

Try Banktivity Free for 30 Days

Learn more: Banktivity full review

Looking for a Free Alternative?

Empower is the best free alternative to Quicken in terms of features. You can link all your financial accounts, and it even has advanced investment tracking and retirement planning tools that rival Quicken. Compatible with Mac and Windows.

Transitioning to a new app can be more of a headache than it's worth. But some make it easier to switch than others.

The next Quicken alternative allows you to start a completely new tracking system without losing all the progress you've made.

Transfer Data From Quicken: CountAbout

CountAbout is a budgeting tool that makes leaving Quicken easy. This program seamlessly imports your data from Quicken and Mint, so you can keep budgeting right where you left off.

Just like Quicken, CountAbout automatically syncs transactions across all your linked accounts (for Premium accounts only). But CountAbout shows even transactions that have not yet been processed.

CountAbout offers Standard and Premium accounts. The only difference between the two is the ability to sync your accounts with Premium automatically. Standard only offers manual entries. Both are paid ad-free accounts.[12]

Key Features

- Pricing: Standard Plan ($9.99/yr), Premium Plan ($39.99/yr)

- Free Trial: 45 days

- Accessibility: Web, iOS, Android

- Import From Quicken: Yes[13]

If you're paying for Quicken features you don't even use, consider simplifying with CountAbout. The program isn't as feature-rich as Quicken, but it's a simple app that can import data from Quicken and Mint.

Where will you be financially in 10 years? How about 20? Take the guesswork out of your future finances with the next smart app.

Try CountAbout Free for 45 Days

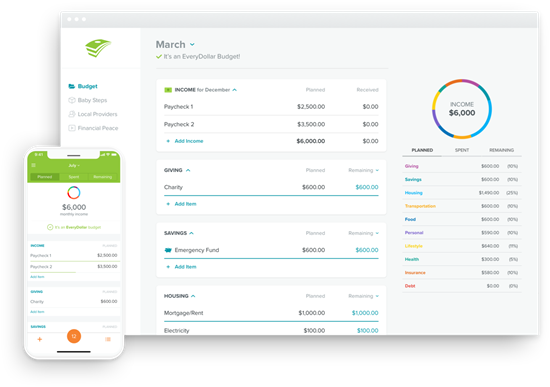

Budgeting Beginners: EveryDollar

EveryDollar is based on Dave Ramsey's 7 Baby Steps approach to personal finance. If you're not sure where to start your personal finance journey, this app can provide direction.

|

| Credit: Everydollar |

The steps include saving for an emergency fund and paying down your debts starting from the lowest balances. The idea is that you'll get a psychological boost with each little victory, so you'll actually stick to your financial goals.

The app uses zero-sum budgeting to make you assign every dollar a category. This is purely a budgeting app so you won't find any investing or retirement tools.

It costs $129.99 per year for the Ramsey+ account, which includes full access to EveryDollar and money lessons.[14] You can get the free version of the EveryDollar app, but it is very limited and requires you to track everything manually.

Key Features

- Pricing: Limited free version; Premium ($17.99/mo or $79.99/yr)[15]

- Free Trial: 14 days

- Accessibility: Web, iOS, Android

- Import From Quicken: No

Quicken is probably the most comprehensive financial tool on the market. But that can be a bad thing if you're new to money management. EveryDollar makes budgeting more accessible by breaking it down into easy steps.

Try EveryDollar for Free for 14 Days

Learn more: EveryDollar full review

Not all free programs are limited in features. Find out which Quicken competitor punches above its class—and doesn't cost a penny.

Personal Accounting Without a Subscription: GnuCash

If you're looking for an alternative to Quicken but aren't willing to give up the features that Quicken offers, GnuCash could be right for you.

GnuCash is a free, open-source accounting program. It can help you track your bank accounts as well as your investment portfolio. It can even help small business owners with bookkeeping and invoicing.

You can import QIF files from Quicken to make the switch even easier. Although it doesn't have all the custom options of other paid programs, it's a solid free alternative to Quicken.

Key Features

- Pricing: Free

- Free Trial: N/A

- Accessibility: Linux, Windows, Mac

- Import From Quicken: Yes; QIF, QFX, and OFX compatible[16]

This one isn't much of a competition. Quicken has switched to a subscription-only model, while GnuCash is available as a free, open-source program.

For Serious Savers: Monarch

Monarch adopts a flexible version of zero-sum budgeting. Although it makes for a more disciplined approach, it adjusts according to your financial situation.

When you set a target date, the app forms a bucket with a suitable monthly contribution. Thus, savings can only occur when monthly expenses are less than the income. You can easily monitor your progress with the widget display on your home screen.

Its powerful portfolio analysis tool allows you to stay on top of your asset allocation and adjust it if needed.

Monarch can also accommodate more than one user, allowing you to share budgets with your spouse or family. If you don't recognize a specific transaction, you can tag it as Needs Review so that your co-user can take a look at it.

Key Features

- Pricing: Monthly ($14.99/mo), Annual ($99.99/yr)[17]

- Free Trial: 7 days

- Accessibility: Web, iOS, Android

- Import From Quicken: Yes; CSV compatible[18]

With Monarch, you get a number of customization features that help gamify user experience. You can change your dashboard or set rules for each transaction. Quicken's interface, on the other hand, can be cluttered and overwhelming.

For Managing Personal and Business Finances: Moneyspire

If you are a small business owner, Moneyspire may be worth considering. Thanks to its customizable categories and reports, you can use one platform for both your individual and business financial management while keeping them separate.

You can save the report query, making it easy to adjust at a later time. Once you're done with an account or transaction, you can easily hide it from plain sight so it doesn't distract from other active transactions in your timeline.

It may be a bold claim, but this tool supports not just multiple but ALL currencies. A Japanese Yen account, you ask? No problem. And if you're not comfortable with syncing your bank accounts automatically, you can choose to go offline.

Key Features

- Pricing: Standard ($99.99 one-time fee), Pro ($129.99 one-time fee);[19] May offer limited-time discounts

- Free Trial: 14 days[20]

- Accessibility: Desktop, iOS, Android

- Import From Quicken: Yes; QIF, QMTF, OFX, QFX and CSV compatible[21]

Aside from tracking invoices, Moneyspire enables you to print checks (on pre-printed check stock). Quicken has extra tools for managing property rentals and tax prep.

Try Moneyspire Free for 14 Days

For Comprehensive yet Simplified Overview: Simplifi

Since Simplifi is also by Quicken, you can expect it to be a solid option for its target market like the Quicken Classic. It aims to simplify the money management process for a young audience, who are likely going to be casual users.

The app is user-friendly and very straightforward, allowing you to see the big picture at a moment's notice. Balances provided are always accurate since they always deduct pending transactions from total balances. With Quicken, you may be off a few cents and not know what caused it.

Simplifi features a Watchlist to monitor specific areas of spending through visual reports. It has also added investment tracking features for some cryptocurrencies.

Quite surprisingly, there is no data import tool from Quicken Classic to Simplifi. The only option is to do it manually by uploading a CSV file.

Key Features

- Pricing: $5.99/month[22] May offer limited-time discounts

- Free Trial: N/A

- Accessibility: Web, iOS, Android

- Import From Quicken: No

Although both Quicken products provide a comprehensive financial overview, Quicken is more granular than Simplifi. It allows you to create customizable budgets for up to 12 months. Simplifi's flexibility in accommodating any budgeting method appeals to many users.

It can be hard to gain insight from a laundry list of transactions. Instead, look for an app that visually organizes your money (like the one below).

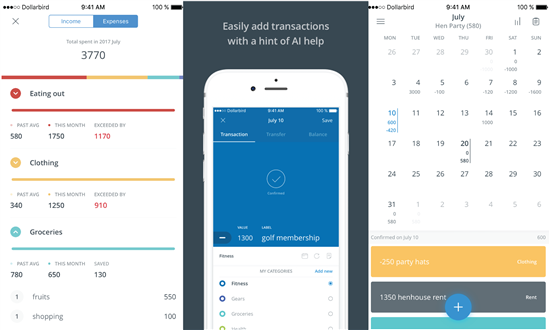

Calendar-Based Budgeting: Dollarbird

Most apps just list your expenses by category. But this doesn't help you plan out your expenses and prepare to pay bills.

Dollarbird is a calendar-based app that helps you manage your cash flow on a monthly and daily basis. If you have irregular income or unpredictable expenses, Dollarbird could be perfect for you.

|

| Screenshot of Dollarbird |

Dollarbird organizes your expenses into categories and monitors your typical monthly spending average in each category. This lets you know if you're spending much more than usual on things like eating out, groceries, or entertainment.

You can add future and recurring expenses. Dollarbird will track them and show your projected financial situation.

Note that Dollarbird does not connect to your bank accounts or credit cards. It's up to you to manually add your info and confirm the recurring transactions like credit card payments that Dollarbird's AI predicts.

Dollarbird Pro allows up to 20 calendars with up to 3 team members on each calendar.[23]

Key Features

- Pricing: Pro ($4.99/mo or $39.99/yr), Pro Unlimited ($6.99/mo or $59.99/yr), Business (custom pricing)

- Free Trial: N/A

- Accessibility: Web, iOS, Android

- Import From Quicken: No

Quicken has a calendar view, but it feels clunky compared to Dollarbird. Dollarbird also allows you to add multiple users. You can easily access and edit your calendar on mobile and desktop.

Couples & Roommates: Goodbudget

Goodbudget uses the envelope budgeting system to help you see how much money you can spend on each expense. You allot a set amount of money to an "envelope" for your spending categories.

|

| Screenshot of Goodbudget |

This straightforward platform doesn't restrict you from spending if you go over your allotted amount, but it will send you a notification. Quicken, on the other hand, trusts you to create and track your own monthly allowances.

The free version only allows one linked financial account and 10 envelopes. The paid version unlocks unlimited synced accounts and envelopes.[24]

Key Features

- Pricing: Free, Plus ($8/mo or $70/yr)

- Free Trial: N/A

- Accessibility: Web, iOS, Android

- Import From Quicken: Yes; QFX, OFX, and CSV compatible[25]

Quicken isn't designed to support multiple users or data sets. Goodbudget can be a great way for families or roommates to sync budgets and avoid surprises at the end of the month.

What are the best Quicken alternatives for small business?

From invoicing to bookkeeping to inventory tracking, there's a lot that goes into your business. Find a program that does it all with these powerful Quicken replacements.

1. Best Small Business Accounting: QuickBooks Online

QuickBooks Online is an excellent accounting program for small business owners. You can link up your bank accounts and credit cards, as well as over 650 business apps (including Shopify, Square, PayPal, and much more).

The software goes beyond just business expense tracking. It's also packed with features like invoicing, tax deductions, bank reconciliation, inventory tracking, and employee time tracking.

QuickBooks offers 3 pricing tiers for Quickbooks Online. Simple Start, Essentials, and Plus plans are geared toward small business accounts.

Key Features

- Pricing: Simple Start ($18/mo or $194.40/yr), Essentials ($27/mo or $291.60/yr), Plus ($38/mo or $410.40/yr);[26] May offer limited-time discounts

- Free Trial: 30 days

- Accessibility: Web, Mac, Windows, iOS, Android

Learn more: QuickBooks Online full review

2. Small Business Mac Users: FreshBooks

FreshBooks is an accounting program for freelancers and small businesses. It offers comprehensive tools like invoicing, expense tracking, and double-entry accounting.

The software integrates with more than 100 apps, so you can link your Shopify, Squarespace, Gsuite accounts, and more.

FreshBooks has a clean interface that works well on any platform. If you're a Mac user, you'll especially like how well it syncs across all your devices. With their mobile app, you can stay connected to your business no matter where you are.

FreshBooks has 4 pricing tiers. Lite, Plus, and Premium plans include billing for up to 5, 50, and unlimited clients, respectively. Or, you can go for the Select plan and get custom pricing for unlimited clients.[27]

Key Features

- Pricing: Lite ($17/mo or $204/yr), Plus ($30/mo or $360/yr), Premium ($55/mo or $660/yr), Select (custom pricing); May offer limited-time discounts

- Free Trial: 30 days

- Accessibility: Web, Mac, Windows, iOS, Android

3. Best for Growing Business: Xero

Xero has everything you need in small-business accounting software. Like the other programs, Xero handles invoicing, expenses, inventory, and lots more. You can also link your bank accounts and apps like PayPal, Square, and Gusto.

Xero also lets you connect data from other accounting programs, so you won't lose your old transactions. It also allows unlimited users with every plan, which lets you collaborate with your team and save time.

There are 3 plans available. The Early plan limits you to just 20 invoices and 5 bills. The Growing plan gets unlimited invoices and bill management. The Established plan includes project tracking and expense claims.[28] You can cancel your subscription any time with a 30-day notice.

Key Features

- Pricing: Early ($15/mo), Growing ($42/mo), Established ($78/mo); May offer limited-time discounts

- Free Trial: 30 days

- Accessibility: Web, iOS, Android

What are common complaints about Quicken?

If you're frustrated with Quicken, you're not alone. Some of the biggest concerns expressed by users are:

Issues with Syncing

The popular money management software allows you to link bank accounts, including credit cards, but many complain about accounts not syncing properly.

Poor Customer Service

Many have complained about Quicken's customer service. If you want assistance from an actual human on the phone, you'll need to buy Quicken's Premier or Home & Business product.

Desktop Software Required for Mobile Access

You can only use their mobile app if you already have a regular Quicken desktop account.[29] This is unlike other personal finance software that lets you operate exclusively from a mobile phone or tablet.

Not Sure How Long It'll Be Around

Quicken, once considered an innovative personal finance software, has been overshadowed by newer finance apps. Some versions of Quicken have even been discontinued, making the future of the program unclear.

How do I choose the right app?

Everyone's needs are a little different. The best financial app caters to you without skimping on the important stuff, like security.

Whether it's an app from this list, or a different one entirely, here's what to look for when test-driving a budgeting software:

Security Features

As with all online financial products, check the app's security measures before you commit. A few things to look for are two-factor authentication and encrypted data.

Ease of Use

It's important that you actually enjoy the interface of your money tool. After all, a tool is only helpful if you actually use it. If an app feels clunky and confusing during the trial period, it might not be right for you.

Flexibility

Your financial situation is unique. A personal finance or small business app should be able to support your needs. Look for apps that let you customize spending categories, invoices, or whatever else is important to you.

Relevance to You

Some apps offer an impressive roster of features. But, be realistic about how many of those are actually useful to you—especially if it's a paid app. You might find that a cheaper or free app has everything you need.

Synced Accounts

Software that syncs your bank, credit cards, and other accounts will save you a lot of precious time. This features ensures that you'll have an accurate picture of your finances at your fingertips at all times.

Choosing a new budgeting tool takes time and research. Find out below how to get insight on your finances right now—without needing to download any apps.

Free budget calculator

Take control of your finances by learning exactly where your money goes. Try our free monthly budget calculator to get a visual for your spending. Plus, find out if you're saving enough according to the 50/30/20 rule.

Setting a budget is way easier when you take some time to figure out what's important to you. Have a student loan debt you want to pay off faster? Or a vacation you want to save up for? Try reducing your budget in another area to see how much money you could free up.

Of course, you can still spend some money on fun stuff. But it's all about moderation and making sure you're in good financial health first.

Frequently asked questions

- What is the best financial software for personal use?

The best financial software depends on your needs and what kind of rates you're willing to pay. Empower is a great free option to start with. You can link all your accounts, view your credit score, and get professional financial advice. - Is Quicken being discontinued?

Quicken has no current plans to permanently close its services, though they have been discontinuing some versions of their software after Intuit sold Quicken in 2016. Quicken encourages customers to use the most up-to-date software to take advantage of the latest features and tools. - Is Quicken subscription only?

Quicken recently switched to a subscription model. Subscriptions can be purchased on a yearly basis, but the program is still a desktop software as opposed to cloud-based. - Do you have to renew Quicken every year?

Since Quicken is a desktop-based software, you could just let your subscription expire and not renew it. However, you will no longer get updates. But you can continue to use the latest Quicken version you had before your subscription expired. - Is Quicken worth it anymore?

Quicken could be still worth it for you if you have more complex finances to track. It's good if you have lots of investment accounts, a business, or properties to track. But if you just need an app for budgeting and simple expense tracking, there are lots of free alternatives. - What Quicken alternatives offer bill payment features?

Most money management apps offer bill reminders, but Moneydance is one of the only Quicken alternatives with a bill pay feature. It lets you schedule single or recurring bill payments to payees directly from the program. It only costs a one-time $65 fee for lifetime access. - Which Quicken alternative works with Windows?

Every platform in this article (except for Banktivity) is compatible with Windows computers. Most are web-based, meaning you can access them from your internet browser instead of having to download a separate program. - What is the best non-cloud alternative to Quicken?

If cloud-based software is a security concern, try Moneydance instead. It's local software, so all your data stays on your hard drive. The only time the program uses the cloud is when you choose to sync to another device. But your info is encrypted and they don't store it in the cloud. - What is zero-sum budgeting?

With zero-sum budgeting, you deliberately "spend" all your money until you're left with $0. Each dollar is designated for a purpose: rent, savings, debt repayment, etc. There are fewer surprises because you've financially planned out your entire month.

Bottom line

Budgeting is a crucial step toward financial freedom. If you're switching from Quicken or just need a new program to organize your money, you can't go wrong with the choices above.

For powerful financial tools without spending a lot of money, make sure to check out Empower. It's a great fit to keep your current finances in order and prep you for a successful retirement later on.

But a budget is only useful if it fits your lifestyle and preferences. Be sure to go with a program that's easy and enjoyable for you to use. Most of the programs on the list offer free trials. Take advantage to test out their service before you commit.

With just a little bit of help, you'll surely make progress with your financial goals.

References

- ^ You Need A Budget. Pricing, Retrieved 12/28/2023

- ^ Tiller. Try Tiller Completely Free, Retrieved 12/28/2023

- ^ PocketSmith. Plans & Pricing, Retrieved 12/28/2023

- ^ PocketSmith. Download the PocketSmith Personal Finance Desktop App, Retrieved 12/28/2023

- ^ PocketSmith. Importing Accounts and Transactions from Quicken, Retrieved 12/28/2023

- ^ The Infinite Kind. Purchase Moneydance, Retrieved 12/17/2023

- ^ The Infinite Kind. Downloads, Retrieved 12/29/2023

- ^ The Infinite Kind. Importing Data from Quicken in QIF Format, Retrieved 12/29/2023

- ^ Quicken. Bill Manager, Retrieved 12/29/2023

- ^ Banktivity. Pricing, Retrieved 12/29/2023

- ^ Banktivity. How Do I Move from Quicken Windows to Banktivity for Mac?, Retrieved 12/29/2023

- ^ CountAbout. Plans & Pricing, Retrieved 12/29/2023

- ^ CountAbout. Frequently Asked Questions, Retrieved 12/29/2023

- ^ Ramsey Solutions. EveryDollar Ramsey+, Retrieved 12/29/2023

- ^ Ramsey Solutions. Choose How You Want to Start Budgeting, Retrieved 12/29/2023

- ^ GnuCash. Quicken Migration, Retrieved 12/29/2023

- ^ Monarch. Pricing, Retrieved 12/28/2023

- ^ Monarch. Import Data Manually from Banks or Other Finance Apps, Retrieved 12/29/2023

- ^ Moneyspire. Buy Moneyspire, Retrieved 2/11/2025

- ^ Moneyspire. Download Moneyspire, Retrieved 12/28/2023

- ^ Moneyspire. Features, Retrieved 12/28/2023

- ^ Simplifi. Simplifi, Retrieved 09/04/2024

- ^ Dollarbird. Plans, Retrieved 12/29/2023

- ^ Goodbudget. Sign up, Retrieved 12/29/2023

- ^ Goodbudget. How to Import CSV Files, Retrieved 12/29/2023

- ^ QuickBooks. Choose a Plan That Works For Your Business, Retrieved 12/29/2023

- ^ FreshBooks. Pricing, Retrieved 12/29/2023

- ^ Xero. Pricing, Retrieved 12/29/2023

- ^ Quicken. Quicken Mobile Companion App User Guide, Retrieved 12/29/2023

Write to Anna Johnson at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Empower Personal Wealth, LLC (“EPW”) compensates CREDITDONKEY INC for new leads. CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

|

|

| ||||||

|

|

|

Compare: