Mint Alternatives

Mint offers budgeting and expense tracking. But are other apps better? See how Mint compares to alternatives like Quicken, YNAB and Empower.

|

| © CreditDonkey |

Mint is easily one of the best personal finance apps you can get for free. Or was.

Its parent company, Intuit, has already announced Mint's imminent closure. Is this the perfect excuse to ditch it and look for something better?

Discover other budgeting apps that might not just replace Mint, but potentially offer even more insightful guidance and tools.

Here are the top 10 Mint alternatives you should consider:

- Empower for investment & retirement tracking

- You Need a Budget for those serious about saving money

- Tiller for customized spreadsheets

- Quicken Classic for all-inclusive software

- Quicken Simplifi for an upgraded Mint experience

- PocketSmith for budget forecasting up to 60 years

- Monarch for flexible budgeting

- EveryDollar for Dave Ramsey's "7 baby steps"

- Goodbudget for couples and roommates

- CountAbout for seamless Mint migration

Stock Advisor - $99/year for New Members

*$99 is an introductory price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then-current list price.

Get Matched with a Financial Advisor in 3 Minutes

- Get matched with a financial advisor who fits your unique criteria.

- Consult for free with no obligation

- In-person and remote advisory available

- All advisors are fiduciaries, meaning they put your needs and financial goals first.

- All advisors are registered with the SEC

Is Mint App Shutting Down?

Yes, Mint is discontinued as of January 1, 2024. If you're a Mint user, they're giving you the option to move your account to Credit Karma.

However, Credit Karma won't have the exact same features of Mint.

Although you can still view your linked accounts in one place and stuff, you won't be able to set monthly and category budgets on its app. It's also possible that Credit Karma does not yet support your bank accounts.

That could be disappointing enough for you to consider other personal finance management apps.

Top 10 Best Mint Alternatives

|

| © CreditDonkey |

With the above in mind, let's get into the best apps to help manage your money.

1. Empower

Free advanced investment & retirement tracking

Empower offers some of the most advanced financial tools on the market - for free.

It features an investment checkup tool showing if you are optimizing your portfolio. Empower can assess your current investment strategy and make personalized recommendations.

The app also has a fee analyzer to see any hidden fees within your funds.

Using its advanced retirement calculator, you can add different life scenarios (such as buying a house) to see how it'll affect your retirement.

Pricing, Features, and Reviews:

| Cost[1] | |

|---|---|

| Monthly fee | Free! |

| Features | |

| Synced financial accounts | ✓ |

| Customized budgets | ✓ |

| Goal tracking | x |

| Investment tracking | ✓ |

| Retirement planning | ✓ |

| Reviews | |

| Apple mobile app rating | 4.7 |

| Google mobile app rating | 3.9 |

Empower vs. Mint takeaway

Unlike Mint, you can't add manual transactions and customize alerts in Empower. But that might not be an issue for some. In any case, it's an excellent app for investors who need a detailed snapshot of their accounts, especially if you have a lot.

See our detailed breakdown of Empower vs. Mint.

2. You Need a Budget

Teaches beginners how to budget and save

You Need a Budget (YNAB) focuses on the "forward-looking" approach to budgeting. It forces you to assign every dollar a job. So you plan for the entire month's expenses in advance.

At the same time, YNAB teaches you to live on last month's income (money you already have, as opposed to budgeting based on future income).

Got a large expense coming up? YNAB helps you break it down and save throughout the year. When the time comes, you're ready and it won't hit your budget too hard.

You can adjust your budget if you accidentally overspend. Likewise, if you don't use up your set budgets, you can roll them over to the next month.

Pricing, Features, and Reviews:

| Cost (comes with free 34-day trial)[2] | |

|---|---|

| Monthly plan | $14.99 |

| Annual plan | $109 (or $9.08 per month) |

| Features | |

| Synced financial accounts | x (direct linking only) |

| Customized budgets | ✓ |

| Goal tracking | ✓ |

| Investment tracking | ✓ (requires manual input) |

| Retirement planning | ✓ (requires manual input) |

| Reviews | |

| Apple mobile app rating | 4.8 |

| Google mobile app rating | 4.8 |

YNAB vs. Mint takeaway

While you can link your financial accounts to YNAB, it does not sync automatically like Mint. Transactions that cleared before the date of the starting balance will not be imported. Instead, they'll only become available in your app within 24-72 hours.

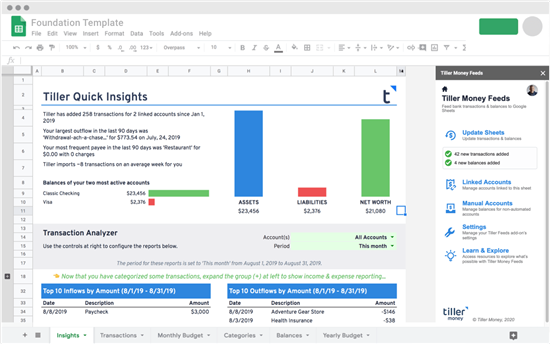

3. Tiller

Create customized spreadsheets

|

| Credit: Tiller Money |

Tiller is the ultimate budgeting tool for a spreadsheet fanatic. It combines the convenience of automatic data imports with the flexibility of spreadsheets.

Spreadsheets include net worth tracking, weekly spending, debt snowballing, and tons more. You can use pre-built budgeting templates, or mix-and-match templates to create custom workflows.

You can automatically update your transactions and balances into Google and Excel spreadsheets. No more manual data entry!

If you run a small business, you can track expenses and cash flow, and estimate your quarterly tax payments.

Pricing, Features, and Reviews:

| Cost[3] | |

|---|---|

| Yearly fee | $79 (with free 30-day trial) |

| Features | |

| Synced financial accounts | x |

| Customized budgets | ✓ |

| Goal tracking | ✓ |

| Investment tracking | x |

| Retirement planning | x |

| Reviews | |

| Apple mobile app rating | N/A |

| Google mobile app rating | N/A |

Tiller vs. Mint takeaway

Tiller does not have a mobile app which can turn off some users. Instead, it relies heavily on spreadsheets, which can be confusing to first-time budgeters. But it can provide more customized reporting than Mint.

4. Quicken Classic

All-inclusive personal finance software

Quicken offers perhaps the most comprehensive financial tools, with multiple plans available under their Quicken Classic line.

Quicken Classic Deluxe is your entry point to a more complex viewing of your finances. You get to create as many spending categories as you want and set a budget for each category.

It also features a Lifetime Planner, which lets you play with different life scenarios (like buying a house or paying for college) to see how they'll impact your retirement.

With a Quicken Classic Premier plan, you can compare your portfolio's performance to market benchmarks. It shows all your investment fees and your true market returns.

Pricing, Features, and Reviews:

| Cost (with 30-day risk-free guarantee)[4] | |

|---|---|

| Deluxe yearly plan | $65.88 (or $5.49/month) |

| Premier yearly plan | $71.88 (or $5.99/month) |

| Business & Personal yearly plan | $119.88 (or $9.99/month) |

| Features | |

| Synced financial accounts | ✓ |

| Customized budgets | ✓ |

| Goal tracking | ✓ |

| Investment tracking | ✓ |

| Retirement planning | ✓ |

| Reviews | |

| Apple mobile app rating | 4.7 |

| Google mobile app rating | 2.9 |

Quicken Classic vs. Mint takeaway

If you are willing to pay for an all-encompassing finance management program, you will benefit from Quicken. However, its software requires a computer download, and there may be unsupported features on different operating systems.

See our detailed breakdown of Mint vs. Quicken.

For mobile app users, Quicken has Simplifi, which is up next.

5. Quicken Simplifi

Upgraded Mint without the ads

Simplifi is Quicken's another option for IOS and Android users.

As its name suggests, it is a more user-friendly platform, providing a concise yet comprehensive view of your finances on your mobile device.

Simplifi doesn't impose on a single budgeting system; in fact, it can accommodate any method you like to use, such as zero-based budgeting, envelope budgeting, 50-30-20, and more.

You also get more customizable budgeting features, projected cash flows, and real-time spending alerts.

Pricing, Features, and Reviews:

| Cost (with 30-day money-back guarantee[5] | |

|---|---|

| Quicken Simplifi yearly plan | $35.88 (or $2.99/month) |

| Features | |

| Synced financial accounts | ✓ |

| Customized budgets | ✓ |

| Goal tracking | ✓ |

| Investment tracking | ✓ |

| Retirement planning | ✓ |

| Reviews | |

| Apple mobile app rating | 4.2 |

| Google mobile app rating | 4.1 |

Quicken Simplifi vs. Mint takeaway

Despite being a free app, Mint delivered a straightforward overview of your finances. However, if you're searching for more advanced features without being bombarded by ads, paying for a Simplifi plan may be worthwhile.

6. PocketSmith

Advanced forecasting & retirement planning tools

PocketSmith may be a pricier option, but it offers a variety of state-of-the-art tools that you might find worth paying for.

With its top-tiered Fortune plan, you can create financial projections from weeks up to 60 years by adding adjustable budgets on a downloadable calendar. This helps you formulate "what if" scenarios to see how they affect your finances.

PocketSmith even boasts global support, which is great for those with multi-currency accounts. It allows you to import data from over 12,000 supported institutions in 49 countries automatically.

Pricing, Features, and Reviews:

| Cost[6] | |

|---|---|

| Free plan | $0 |

| Foundation monthly plan | $14.95 (or $9.99 if billed annually) |

| Flourish monthly plan | $24.95 (or $16.66 if billed annually) |

| Fortune monthly plan | $39.95 (or $26.66 if billed annually) |

| Features | |

| Synced financial accounts | ✓ (except free plan) |

| Customized budgets | ✓ (except free plan) |

| Goal tracking | ✓ |

| Investment tracking | ✓ (except free plan) |

| Retirement planning | ✓ (except free plan) |

| Reviews | |

| Apple mobile app rating | 3.4 |

| Google mobile app rating | 3.4 |

PocketSmith vs. Mint takeaway

The features on PocketSmith's free plan may not be as generous as Mint's, but it is ad-free, which can be refreshing. PocketSmith is generally best for those looking for long-term financial planning.

7. Monarch

Flexible budgeting

Monarch is another great finance management app that has a bit of everything.

With its transaction tracker, you can organize your purchases into different layers of categories, from broad ones like "food and dining" to something more specific like "groceries" and "restaurants."

What's really cool is that you can even tag specific merchants, which is quite a unique feature.

You can create your own rules to automatically categorize future transactions based on factors like the merchant or the amount spent.

For joint users, you can even integrate your Venmo accounts, which retain their actual descriptions so you can easily categorize them in your budgets.

Pricing, Features, and Reviews:

| Cost (comes with free 7-day trial[7] or get a special promo for transitioning Mint users[8]) | |

|---|---|

| Monthly plan | $14.99 |

| Yearly plan | $99.99 (or $8.33/month) |

| Features | |

| Synced financial accounts | ✓ (manual input is also available) |

| Customized budgets | ✓ |

| Goal tracking | ✓ |

| Investment tracking | ✓ |

| Retirement planning | ✓ |

| Reviews | |

| Apple mobile app rating | 4.9 |

| Google mobile app rating | 4.7 |

Monarch vs. Mint takeaway

Monarch offers more comprehensive investment tracking than Mint, and rightfully so, since it's a paid app. It also accommodates joint budgeting but has no credit monitoring like Mint.

Start Managing Your Money

- Pay $99.99/year (yearly plan) or $14.99/month (monthly plan)

- Unlimited financial accounts

- Rollover budgeting

- Investment and subscription tracking

- Custom financial goals, reports, and categories

- Venmo, Coinbase, and Zillow support

- Unlimited collaborators

- Sync vehicle values

- Web and mobile apps

Monarch is safe to use because it employs industry-leading security practices. As an example, when you link a bank account to Monarch, it only has read-only access. Thus, it cannot initiate transactions, such as moving money out of your accounts.

8. EveryDollar

The 7 Baby Steps platform

EveryDollar is the budgeting app created by celebrity money expert Dave Ramsey. It follows the guidelines of his signature "7 Baby Steps" to financial success.

One of these steps includes the debt snowball method, where you pay minimums on most debts and allocate extra funds to the smallest balance.

EveryDollar Premium automates this method, offering guidance on when and how much to pay based on your financial situation.

Aside from the zero-sum budgeting system, it helps you break down large one-time expenses and create goals to fund them throughout the year.

Pricing, Features, and Reviews:

| Cost[9] (Get a special promo for transitioning Mint users)[10] | |

|---|---|

| Free plan | $0 |

| Premium monthly plan | $17.99 (comes with free 14-day trial) |

| Premium yearly plan | $79.99 (comes with free 14-day trial) |

| Features | |

| Synced financial accounts | ✓ (except free plan) |

| Customized budgets | ✓ |

| Goal tracking | ✓ (except free plan) |

| Investment tracking | x |

| Retirement planning | x |

| Reviews | |

| Apple mobile app rating | 4.7 |

| Google mobile app rating | 3.9 |

EveryDollar vs. Mint takeaway

Like Mint, EveryDollar does not have native investment tracking tools in its free plan. However, you will like this app if you want to set category-specific budget limits.

A budget serves as a spending plan, guiding how you allocate your money. Creating a budget is essential for avoiding financial shortfalls and enables you to save for your goals or unforeseen expenses.

9. Goodbudget

Share a budget between couples & roommates

Goodbudget upgrades the traditional "envelope system" into a user-friendly digital platform.

Instead of carrying around physical envelopes filled with money, just keep track of it all from your smartphone.

With shared financial planning, you and your partner/roommate can add transactions and make changes to your budget as needed.

Using Debt Account on its web version, track your debt payoff progress and see when you'll finally be debt-free!

Pricing, Features, and Reviews:

| Cost[11] | |

|---|---|

| Free plan | $0 |

| Premium monthly plan | $10 |

| Premium yearly plan | $80 |

| Features | |

| Synced financial accounts | ✓ (Premium plan only) |

| Customized budgets | ✓ |

| Goal tracking | ✓ |

| Investment tracking | x |

| Retirement planning | ✓ |

| Reviews | |

| Apple mobile app rating | 4.6 |

| Google mobile app rating | 3.9 |

Goodbudget vs. Mint takeaway

Don't expect much from Goodbudget's free plan because it has minimal features. But, beginners can benefit from the envelope budgeting method in visualizing their budget.

Not being able to sync your bank accounts is considered a major disadvantage of Goodbudget. It also lacks the bells and whistles of other apps such as investment tracking, credit monitoring and net worth calculator.

10. CountAbout

Users transitioning from Quicken and Mint

CountAbout is often thought of as a cloud-based alternative to Quicken, not just Mint. Aside from the seamless data import it provides, using it on the go is more convenient.

CountAbout has a FIRE widget, or "Financial Independence" and "Early Retirement."[12]

This tool helps you assess your future financial situation and estimate your potential passive income based on your assets.

For an additional yearly cost, you can also send automated invoices to bill clients for your side hustle or small business.

Pricing, Features, and Reviews:

| Cost (comes with a 45-day free trial)[13] | |

|---|---|

| Standard plan | $9.99 per year |

| Premium plan | $39.99 per year |

| Ability to upload images to transactions add-on | $10 per year |

| Small-business invoicing add-on | $60 per year |

| Features | |

| Synced financial accounts | ✓ (Premium plan only) |

| Customized budgets | ✓ |

| Goal tracking | ✓ |

| Investment tracking | ✓ |

| Retirement planning | ✓ |

| Reviews | |

| Apple mobile app rating | 4.2 |

| Google mobile app rating | 4.6 |

CountAbout vs. Mint takeaway

While both have limited investment tracking tools, CountAbout scores points with its account reconciliation similar to how you'd check and balance a checkbook. Plus, it has an invoicing option.

The main difference between CountAbout's two subscription plans is how bank accounts are made available on the app. CountAbout Premium plan automatically links your bank accounts, while a CountAbout Standard plan will require importing QIF files from banks.

How to Choose the Best Mint Alternative

Here are some things you need to look at when shopping for a potential Mint replacement.

Cost

Other apps may have "freemium" versions, but they either usually apply to a limited time or have very basic features. To get more from the app, you often have to shell out $8 to $10 per month.

Data migration

Since not all budgeting apps are built the same, check if the app can import your Mint transactions. Some use a custom data import tool, while others provide detailed instructions to execute the transfer.

Functionality

Try building a house, but you only have a hammer. What if you need a saw and a screwdriver? For example, it's nice to have an account reconciliation system, which Mint didn't have.

Security

Another thing that Mint was good at is its security protocols. This should be non-negotiable. Your chosen app has to surpass or match Mint's.

Compatibility

You know how some apps seem to "get" you? They give you personalized tips and insights that make your financial life more manageable.

FAQs

Why is Intuit shutting down Mint?

According to Intuit, they are reimagining Mint as part of Credit Karma, which is also one of their products. The goal is for Credit Karma to become a full-service financial platform eventually.

Is Quicken or Mint better?

Quicken provides a range of advanced features, including a more robust investment and retirement planning. In contrast, Mint offered a simpler and more user-friendly experience, focusing on personal finance.

Is there a completely free budget app?

Empower is a powerful personal finance management app that's completely free. Some apps like PocketSmith, EveryDollar, and Goodbudget have free options, while others provide a free trial of their services.

Can I migrate my transaction history from Mint?

You can export your transactions from Mint to other personal finance apps such as Countabout and PocketSmith. Both have custom Mint import tools that convert Mint data faster and easier.

Is Empower better than Mint?

Empower is better than Mint with long-term endeavors like investment management and retirement planning. On the other hand, Mint exceled in day-to-day money management, such as budgeting, debt planning, and credit monitoring.

Bottom Line

Despite Mint shutting down soon, it's good to know that you have several alternatives that offer better features, albeit at a cost. After all, budgeting is an important step towards complete financial freedom.

Although Empower could be the only option matching Mint's freemium plan, most apps offer a free trial period to test their services.

Take your time to find the best one for your needs.

References

- ^ Empower. Empower Experience, Retrieved 11/08/2023

- ^ YNAB. Pricing, Retrieved 10/31/2024

- ^ Tiller. Pricing, Retrieved 11/08/2023

- ^ Quicken. Plans and Pricing, Retrieved 10/31/2024

- ^ Quicken. Simplifi, Retrieved 10/31/2024

- ^ PocketSmith. Plans & Pricing, Retrieved 11/08/2023

- ^ Monarch. Pricing, Retrieved 11/08/2023

- ^ Monarch. Monarch Is The Best Mint Alternative, Retrieved 11/09/2023

- ^ Ramsey Solutions. EveryDollar Premium, Retrieved 11/08/2023

- ^ Ramsey Solutions. Offering Free, 60-Day Premium Trial for Former Mint Users, Retrieved 11/09/2023

- ^ Goodbudget. Pricing, Retrieved 10/31/2024

- ^ CountAbout. CountAbout introduces FIRE tools, Retrieved 11/29/23

- ^ CountAbout. Plans & Pricing, Retrieved 11/08/2023

Acorns Early Kids' Debit Card

- Real-time spend notifications.

- Block and unblock cards easily.

- Teach financial independence safely.

FamZoo Prepaid Card for Kids and Teens

- Order Online

- No Credit Check

- Try for Free

Write to Anna Johnson at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Empower Personal Wealth, LLC (“EPW”) compensates CREDITDONKEY INC for new leads. CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

|

|

|