You Need a Budget Alternatives

These YNAB competitors help get your finances in shape and eliminate financial stress. Review the best free and paid alternatives to You Need a Budget.

|

- Qube Money: Best Envelope Method

- Empower: Best for Investing

- Tiller: Best for Spreadsheet Fans

- EveryDollar: Best for Paying Off Debt

- Pocketsmith: Best for Side Hustlers

- Goodbudget: Best for Hands-On Budgeting

Founded in 2010, YNAB has become one of the most popular budgeting apps available.

But with a price tag of $14.99/ month, you might want a less expensive (or even free) alternative.

See how YNAB compares with other popular budgeting apps, including price and features. Plus, learn what to look for in a budgeting app.

Why You Might Want to Skip YNAB

YNAB is popular for a reason. It offers a tried-and-true method for getting your finances in shape.

But YNAB isn't right for everyone (and that's okay!). Here are a few reasons why you might want to look elsewhere for a budgeting app:

- You want a budget-friendly option: YNAB's $14.99 per month fee can add up fast. Luckily, some options on this list are cheaper, and some are even free.

- You want investment tracking tools: YNAB focuses on budgeting and lacks the investment tools that some people want.

- You want the long-term picture: YNAB does encourage you to "age" your money (instead of draining your accounts every month), but it doesn't offer long-term retirement tracking.

Ready to pick your new favorite budgeting app? Review the alternatives below to find one that's right for you.

What are the Best Alternatives to YNAB?

|

Below, review the top alternatives to You Need a Budget based on price, availability, and features. We excluded alternatives that did not offer a substantial improvement over YNAB in at least one category.

| Alternative | Price | Key Features | How it Compares |

|---|---|---|---|

| Qube | Free | Family finances | More parent/kid-focused |

| Empower | Free | Investment tools | More long-term planning |

| Tiller | $79/year | Spreadsheets | Easier for beginners |

| EveryDollar | $79.99/year | Simple interface | Easier than YNAB |

| Pocketsmith | $119.95/year | Live account updates | Better for irregular income |

| Goodbudget | Free | Envelope method | More hands-on than YNAB |

This rule helps you remember the key aspects to consider when choosing an alternative to YNAB:

- Data sync: Ensure the app syncs seamlessly with your bank accounts and other financial tools.

- Organization: Look for features that help you organize your finances effectively.

- Navigation: The app should be easy to navigate and use.

- Knowledge: The app should provide insights and tips to help you manage your money better.

- Expense tracking: Ensure the app offers detailed expense tracking and categorization.

- Yield: Look for tools that help maximize your savings and investments.

Qube Money - Best Envelope Method Budgeting

Qube takes the envelope method a step further by offering a debit card combined with a simplified category system.

Each time you spend money with your Qube debit card, funds are taken out of that spending category.

Key Features of Qube Money:

- FREE account option for individuals

- Premium (including Qube for Couples): $12 billed monthly OR $108 if billed annually[1]

- Qube for Family: starting at $19 per month

- Google Pay and Apple Pay compatibility

- Streamlined user experience: no confusing spreadsheets

- Personal, Joint, and Family account options

Qube Money vs. YNAB

One big advantage of Qube over YNAB is the Qube for Families plan, which offers accounts for up to 5 kids, chore tracking, parental safety controls, and different card options for adults, teens, and kids.

While Qube Money offers additional features, its Family plan is priced slightly higher than YNAB's monthly plan and does not include a free trial.

- Email support@qubemoney.com

- Visit qubemoney.com to talk with an automated assistant.

- Leave a voicemail toll-free at (800) 226-2261.

An agent will get back to you within 1-2 business days.

Qube Money: Digital Cash Envelopes Banking and Budget App

Empower - Best for Investing

|

| credit empower |

Empower is a free, online budgeting service that allows you to track all your assets in real-time to monitor your net worth.

Empower also offers a flexible, low-cost way to invest for any of your financial goals.

You can even open a brokerage account with Empower. (Note that this feature is only available to individuals with more than $100,000 in investable assets.)[3]

Key Features of Empower:

- Pricing: Free

- Net worth tracker

- Free investment analysis

- 256-bit encryption (vs. 128-bit for YNAB)

Empower vs. YNAB

Empower offers a more holistic and long-term view of your financial habits, while YNAB focuses squarely on day-to-day expenses and budgeting basics.

If you need to learn how to budget, go with YNAB. If you understand budgeting essentials and want next-level advice on your investments, choose Empower.

You Need a Budget offers a 34-day free trial (because the company says it takes about a month to get used to the program). After that, it's $14.99 per month or $99 for the year.[4]

Tiller - Best for Spreadsheet Fans

|

| CREDIT: tillerhq |

Tiller uses a spreadsheet format to help you organize all of your financial data into a single location.

You can link all your financial accounts to Tiller, which will then automatically update a spreadsheet in Google Sheets or Microsoft Excel every day.

You can use Tiller's available spreadsheet templates or construct your own custom spreadsheet to fit your needs.

Key Features of Tiller:

- Pricing: $79 per year[5]

- 30-day free trial

- Bank-grade 256-bit AES encryption

- Weekly webinars and Q&As to learn about money management

- Debt-snowball spreadsheet option (similar to EveryDollar's "Baby Steps" method)

Tiller vs. YNAB

Tiller is best for organizing your financial information into a spreadsheet formula but offers less of a hands-on way of helping people learn how to budget compared to YNAB or EveryDollar.

However, the Tiller Community, weekly webinars, and Q&A offer ample opportunities for people with less experience in budgeting and saving to level up their financial knowledge.

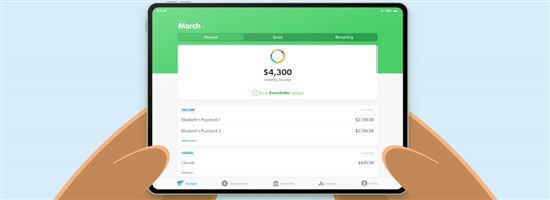

EveryDollar - Best for Paying Off Debt

|

| CREDIT: ramseysolutions |

EveryDollar was created by finance guru Dave Ramsey with the primary goal of helping people become debt-free.

EveryDollar uses Ramsey's "Baby Steps" method of paying down your smallest debts first before tackling larger debt burdens. The idea is that paying off smaller debts first gives you a sense of accomplishment that makes it easier to get rid of debt once and for all.

Key Features of EveryDollar:

- Pricing: $79.99 per year after 14-day free trial[6]

- Simple app interface with no learning curve

- Customized categories and savings goals

EveryDollar vs. YNAB

There are more similarities than differences between YNAB and EveryDollar — but there are some key distinctions.

With EveryDollar, you plan your budget for the entire month ahead. With YNAB, you can only budget with money you already have. So, if your paycheck and current savings only cover the next two weeks of expenses, you have to wait to get paid again before planning further ahead.

EveryDollar is also considered to be more intuitive and user-friendly than YNAB.

Pocketsmith - Best for Side Hustlers

|

| CREDIT: pocketsmith |

Pocketsmith is great for people with fluctuating income or other unusual financial situations, such as Airbnb owners, side hustlers, and people with accounts in multiple currencies.

This app allows you to get financial projections up to 30 years into the future with its most expensive option, but the standard Premium plan allows for a 10-year financial outlook.

Key Features of Pocketsmith:

- Pricing: $119.95/year for Foundation plan; $199.95/year for Flourish plan; $319.95/year for Fortune Plan[7]

- Live bank account updates

- Connect to 12,000+ institutions across 49 countries[8]

- Budget calendar to view upcoming expenses and bill payments

Pocketsmith vs. YNAB

One drawback of Pocketsmith is the absence of a free trial — a big issue since this is the most expensive option on our list.

However, this app does appear to be the best option for people with a lot of savings and cash flow (like rental property owners) who are looking to manage their money more efficiently.

Goodbudget - Best for Hands-On Budgeting

|

| CREDIT: goodbudget |

Last but not least, there's Goodbudget. This app is best for people who want to understand their spending habits, not just view them.

Goodbudget's philosophy is based on understanding the "why" behind expenses to create values-based budgeting.

GoodBudget uses a version of the envelope method. And since you're responsible for manually entering account balances and setting up categories, you'll have a more in-depth understanding of your finances.

The free version allows you to open a single account and use up to 10 regular envelopes and 10 additional envelopes. The Plus version allows for unlimited accounts and envelopes.

Key Features of Goodbudget:

- Pricing: FREE basic plan for individuals; $80 per year for Premium plan[9]

- Envelope budgeting method

- Manual account inputs

Goodbudget vs. YNAB

If you're a hands-on saver who doesn't mind needing to manually enter your account balances, this is a good (and free) upgrade to your grandparent's envelope and cash budget method.

However, the manual inputs may not be right for those who want an automated budgeting app like YNAB, EveryDollar, and Tiller.

What to Look for in a Budgeting App

When choosing your next budgeting app, look for features that fit into your life and make the budgeting process easy for you. Here's what to look for:

Fits Your Budgeting Know-How

Are you looking to learn the basics of budgeting and saving? Or are you a savvy budgeter who just needs a place to consolidate all your financial data?

Some apps, like YNAB and EveryDollar, are geared toward people with more hands-on budgeting experience. Others, like Goodbudget, are more appropriate for people who are looking to learn.

Top-Notch Security

Budgeting apps will typically have access to all your financial data. So you need to make sure that your information is secure to reduce your exposure to fraud risk.

Look for features such as bank-grade encryption and two-factor authentication to keep your money and data safe.

The Ability to Customize Categories and Goals

Budgeting apps frequently categorize income and expenses incorrectly, so you want to make sure that you can customize transactions and ensure they're accounted for properly.

Automatic Transaction Updates

Some apps, like Goodbudget, require you to manually enter all of your financial transactions, which is unmanageable for most people.

Make sure that the app you choose syncs to all your financial accounts and updates your transactions automatically.

Free (or Offers a Free Trial)

Don't get stuck paying for a budgeting app before you've had the chance to try it. While many free options are available, these often have limited features, come with distracting ads, or sell your data to advertisers.

Not ready to pass on YNAB? Review how YNAB works to see if it could be the right choice for you.

How Does YNAB Work?

You Need a Budget uses a philosophy called "the envelope method." YNAB is different from traditional budgets because it embraces a fluid and ever-changing way of looking at your finances.

YNAB revolves around four specific rules of money management:[10]

- Give every dollar a job

The first rule is to earmark every dollar of your income for a specific purpose. This includes everything from savings, necessities like rent and food, and fun money like shopping and eating out. - Embrace your true expenses

Instead of letting large, unexpected expenses derail your financial goals, embrace them! For example, if you normally spend about $600 on gifts during the holidays, save up $50 a month for this specific purpose so you're prepared. - Roll with the punches

Sometimes you'll overspend in one area of your budget, such as eating out with friends. Instead of feeling guilty, just shift money from another category into that category for the current month. - "Age" your money

To get out of the habit of living paycheck to paycheck, you want to set a goal to pay this month's expenses with last month's income. This is a different way to think about saving up three to six months of income for your emergency fund.

The Bottom Line

YNAB offers a fun and useful way to learn about budgeting and gain control over your finances. However, users often complain about the price tag and learning curve attached to this platform.

For more user-friendly and affordable options, consider these alternatives to find the budgeting app best suited to your financial needs and goals.

References

- ^ Qube Money. Pricing, Retrieved 10/24/2022

- ^ Qube Money. Contact Us, Retrieved 4/27/2024

- ^ Empower. What does your investment advice cost?, Retrieved 4/27/2024

- ^ YNAB. Pricing, Retrieved 10/24/2022

- ^ Tiller. Pricing, Retrieved 4/27/2024

- ^ EveryDollar. Pricing, Retrieved 10/24/2022

- ^ PocketSmith. Pricing, Retrieved 4/27/2024

- ^ PocketSmith. Automatic bank feeds to most banks worldwide, Retrieved 4/27/2024

- ^ Goodbudget. Pricing, Retrieved 4/27/2024

- ^ YNAB. Four rules for less money stress, Retrieved 4/27/2024

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Buy $100 in Crypto and Get $10 Bonus from eToro USA LLC

- Sign up for an eToro account

- Deposit funds

- Invest in $100 worth of crypto

You'll automatically receive $10 directly to your account balance. Offer only applies to US customers. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Write to Justin Barnard at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Empower Personal Wealth, LLC (“EPW”) compensates CREDITDONKEY INC for new leads. CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

|

|

| ||||||

|

|

|