What's the difference between objective forecasting and cockeyed optimism? A new survey by CreditDonkey.com suggests that it's the difference between some people's saving habits and their idea of a “comfortable retirement.”

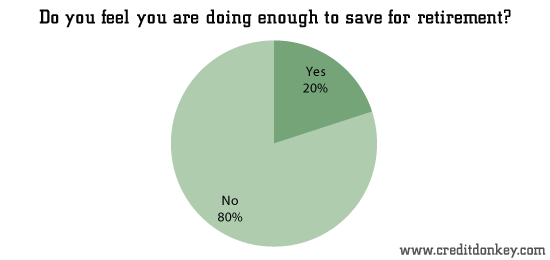

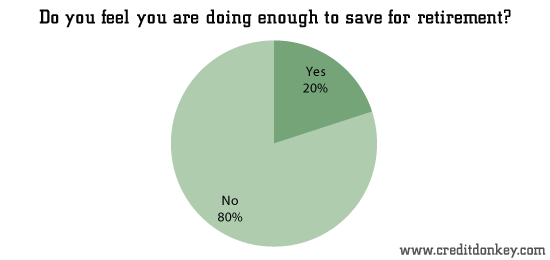

Although 80 percent of the more than 1,100 people surveyed said they were not doing enough to save for retirement, 65.8 percent reported having no financial plan for retirement and 59.9 percent said they lived paycheck to paycheck, 44.7 percent still expected to (somehow) retire comfortably.

|

| Do you feel you are doing enough to save for retirement? © CreditDonkey |

![Do you have a financial plan for retirement? © CreditDonkey Do you have a financial plan for retirement?]() |

| Do you have a financial plan for retirement? © CreditDonkey |

![Do you live paycheck to paycheck? © CreditDonkey Do you live paycheck to paycheck?]() |

| Do you live paycheck to paycheck? © CreditDonkey |

![Do you think you will be able to retire comfortably? © CreditDonkey Do you think you will be able to retire comfortably?]() |

| Do you think you will be able to retire comfortably? © CreditDonkey |

In the wake of the Great Recession, Americans are saving more and reducing debt, including credit card debt. Despite the trend toward more frugal behavior, however, many people still aren’t saving enough to justify their expectation of a comfortable retirement. No doubt, many are simply hoping that the economy will rebound before it’s time for them to retire.

Among the other findings of the Credit and Saving Survey:

Only 48.6 percent of respondents said they have $1,000 in accessible savings, and just 43.5 percent have saved even $1,000 for retirement.

![Do you have at least $1000 in readily accessible savings? © CreditDonkey Do you have at least $1000 in readily accessible savings?]() |

| Do you have at least $1000 in readily accessible savings? © CreditDonkey |

![Do you have at least $1000 saved for retirement? © CreditDonkey Do you have at least $1000 saved for retirement?]() |

| Do you have at least $1000 saved for retirement? © CreditDonkey |

37.6 percent said they have less than $100 in cash on hand.

![Do you have at least $100 cash on hand? © CreditDonkey Do you have at least $100 cash on hand?]() |

| Do you have at least $100 cash on hand? © CreditDonkey |

Unsurprisingly, only 34.9 percent of those polled think Social Security should be privatized.

![Should Social Security be privatized? © CreditDonkey Should Social Security be privatized?]() |

| Should Social Security be privatized? © CreditDonkey |

75.2 percent believe that credit card issuers should be subject to more regulation.

![Should credit card issuers have more or less regulations? © CreditDonkey Should credit card issuers have more or less regulations?]() |

| Should credit card issuers have more or less regulations? © CreditDonkey |

45.9 percent believe they are paying more income taxes than they should, and 67.6 percent of the respondents said the current income tax code is not fair.

![Do you feel you pay more income tax than you should? © CreditDonkey Do you feel you pay more income tax than you should?]() |

| Do you feel you pay more income tax than you should? © CreditDonkey |

![Do you feel the current income tax code is fair? © CreditDonkey Do you feel the current income tax code is fair?]() |

| Do you feel the current income tax code is fair? © CreditDonkey |

While it’s easier to save for retirement when you have a higher income, even people with modest incomes can do more to save for retirement. To start, they should look for credit cards with rewards, including lucrative bonus point deals and cash back on certain purchases. In addition, consumers should avoid carrying balances on credit cards and put away a small amount every week or month. Seemingly insignificant amounts can produce a healthy return over time.

About the Survey

From January 4 to January 8, 2013 CreditDonkey polled 1,109 Americans, age 18 and over, for their views on credit cards, saving, retirement planning and other financial issues with thirty-eight multiple-choice and yes/no questions.

Crosstabs by Gender (who says yes)

- Do you feel you are doing enough to save for retirement: Male (23.3%), Female (15.4%)

- Do you have a financial plan for retirement: Male (36.3%), Female (31.6%)

- Do you live paycheck to paycheck: Male (55.8%), Female (65.3%)

- Do you think you will be able to retire comfortably: Male (48.3%), Female (39.7%)

- Do you have at least $1000 in readily accessible savings: Male (52.4%), Female (43.5%)

- Do you have at least $1000 saved for retirement: Male (45.6%), Female (40.4%)

- Do you have at least $100 cash on hand: Male (66%), Female (57.8%)

- Should Social Security be privatized: Male (35.6%), Female (34.1%)

- Should credit card issuers have more or less regulations: Male (74.6%), Female (76%)

- Do you feel you pay more income tax than you should: Male (44.2%), Female (48.3%)

- Do you feel the current income tax code is fair: Male (32.4%), Female (32.1%)

Additional crosstabs (e.g.: age, marital status, education, household income, accessible savings, cash on hand) available upon request.