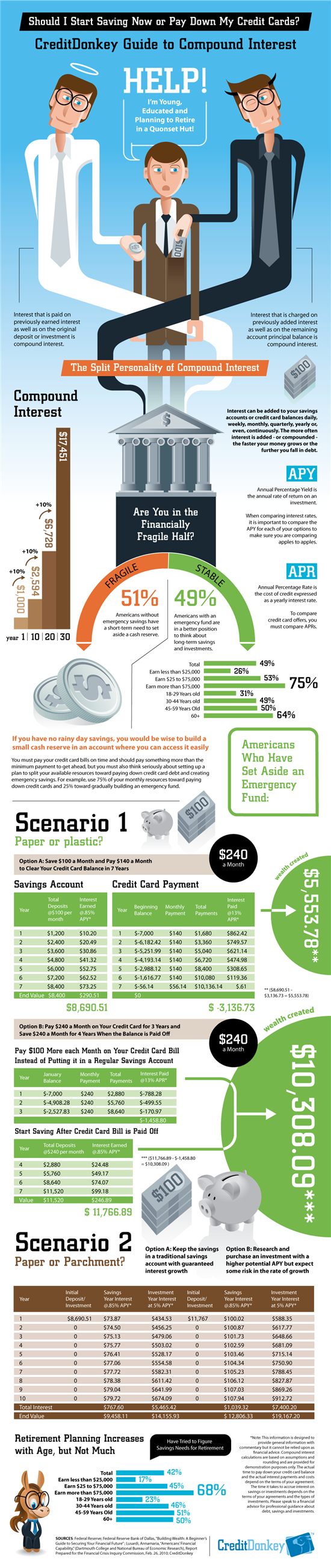

Compound Interest: Split Personality

Compound interest – the wonderful banking principle that helps your savings grow at a faster rate each year. Simply set up automatic deduction from your paycheck, sit back, watch your retirement grow and let your worries fly away. If only it were that easy.

Unfortunately these days, American consumers have more to worry about than just accumulating savings. There are also bills to pay, and many of us have turned to plastic over the past several years to help cover our basic needs. Thankfully, the economy has started to recover and many people now find themselves back in the fortunate situation where they can start funneling money back into savings.

If you find yourself in this situation, you may be wondering where your money will most effectively work - in your savings or paying down your credit card debt. Here's some info to help you answer that question.

|

| Infographic: Compound Interest © CreditDonkey |

The Split Personality of Compound Interest

Consumers often associate compound interest with savings accounts but it actually applies to your credit card debts as well, giving it a split personality of sorts.

- Savings: With your savings accounts, you are not only earning interest on your original deposit(s), you're also earning interest on the interest payments that have already been applied to your account. This rate is known as your APY (annual percentage yield), which is a fancy term for the annual rate of return on your cash investment.

Related: Best Online Savings Account

- Credit Card Debt: Likewise, with your credit card accounts, you're accruing interest on not only your balance but also interest that was previously charged. Your credit card rate is known as your APR (annual percentage rate), which helps you compare the cost of the various cards in your wallet.

As you can see, compound interest can be a great benefit to your finances while at the same time cost you money. The trick is to take advantage of the APY while diminishing the balance affected by APR.

Creating an Emergency Fund

Whether you're focusing on building your retirement, chipping away at credit card debt or a little of both, it's always smart to have an emergency fund tucked away just in case. Emergency savings funds can be relatively easy to build. Simply take a look at your available resources to determine how much you have available to set aside each month.

This may take precedent over your retirement or paying down debt for a couple of months. While you'll still want to make more than just the minimum credit card payment each month, you may end up funneling some of your funds earmarked for credit card payoff toward emergency savings until that account is where you'd like it to be. A general rule of thumb is for your emergency fund to amount to at least 2 to 3 months of your take-home salary.

Paper Versus Plastic?

Once you've built your emergency fund, you can turn your attention back to retirement and credit card debt. And here comes the big question - do you pay off all your debts first or do you split your attention between the two?

The answer to that question ultimately depends upon your situation and what makes you most comfortable. But before making a choice, it's always good to see a snapshot of your earnings potential in each scenario. We've included a sample snapshot but you'll want to run your own scenarios as your APY, APR and balances will make a huge difference in your compound interest earning potential.

If you start to feel overwhelmed by your choices, it's time to take a step back. Really, what this all comes down to is this: who is paying more in compound interest - the bank (for your savings) or you (for your credit card debt)?

Paper or Parchment?

Of course, there are more factors to this scenario than just savings versus debt. You will also need to choose the savings vehicle for your money.

If you have a company sponsored retirement plan or an IRA, you may find that splitting your funds between savings and debt makes more fiscal sense. Alternatively, if you're planning on putting your savings in a bare-bones account, you're not likely to see much along the lines of compound interest as most bank accounts offer a fraction of a percent when it comes to the APY.

It's always a wise idea to meet with a financial professional who can help you evaluate your savings options. They will be able to guide you to the accounts that make the most sense for your lifestyle and match your risk comfort level. They can also help explain the ins and outs of compound interest and how to factors into your unique financial profile.

(Additional Writing by Meghan)

Annette O'Connor is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Annette O'Connor at annette@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.