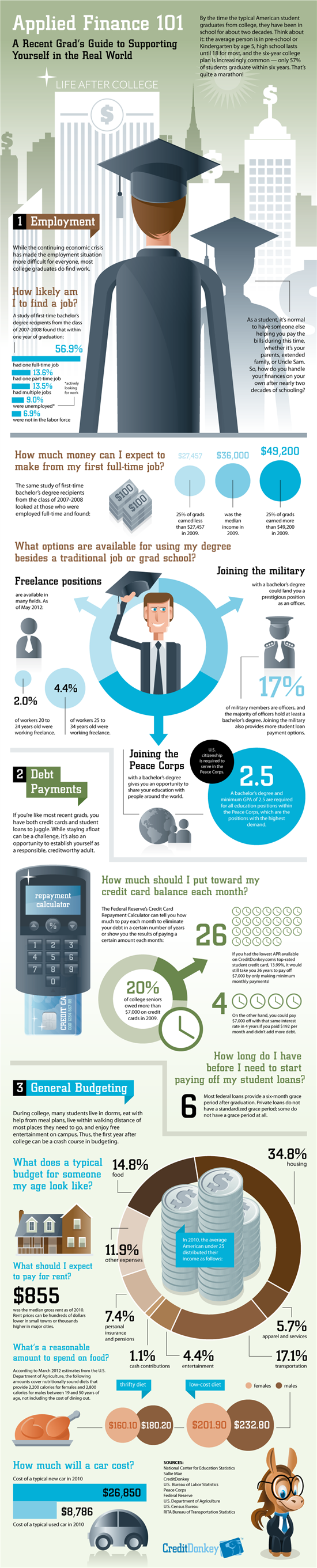

Life After College: Recent Graduate's Guide to the Real World

Explore the economic hurdles modern graduates face when they join the “real world”

While in college, it's normal to have help from parents or student loans in order to pay the monthly bills. So graduating and taking your first steps into the “real world” is often a very scary experience. This infographic helps to spell out the steps you'll be facing when it comes to independently handling your finances.

|

| Infographics: Life after College © CreditDonkey |

Employment

The good news is that despite the continued economic crisis, most college graduates are successful in finding work. While many continue to pursue the traditional positions aligned with their degrees, others are finding jobs in less conventional avenues. These paid positions include freelance gigs that can be completed from virtually any location thanks to continued advances in technology. Other graduates are using their degrees to gain leadership positions in the military or give back to the global community by joining the Peace Corps.

Debt Payments

Between credit card debt and student loans, establishing and maintaining a healthy credit history can be challenging. Thankfully, there are some tools available to young adults to help you get off to the right start:

- Credit card repayment calculator: The Federal Reserve has published a handy virtual tool that can help you determine how much to pay toward your credit cards each month so you can eliminate your debt by a specified date. You also can plug in the amount you allocated in your budget to calculate how long it will be before you've eliminated your debt.

- Student loan grace period: If you have federal student loans, you may have a built-in grace period before you have to start paying off your debt. This gives you some time to secure a job and get steady income to build up your savings. Be sure to look into the details of your specific loan, as each loan program has different terms. Read our full guide to learn more about how to get rid of student loans.

General Budgeting

Sitting down and creating an actual budget is an exercise that helps many college grads get off to the right start. Knowing exactly how much to allocate toward each expense category will help you know how much you have available each month and give you the opportunity to start saving for a new car, house, or even retirement.

While actual costs are going to vary depending on your geographic region and whether you live in a rural, suburban, or urban location, expenses are generally broken down to the categories below. A little research will help you determine what percentage of your income should be allocated to each category and what amount is reasonable for your desired location:

- Housing

- Utilities

- Transportation

- Food

- Personal Insurance and Pensions

- Apparel and Services

- Entertainment

- Cash Contributions

- Other

Once you've determined the appropriate amount to allocate toward each category, you'll want to track your spending for a couple of months to make sure you're on the right track. Many credit cards break down your purchases into expense categories, making this a relatively easy task.

Creating and sticking to a budget will take some time and effort. But putting in the hard work now to develop these and other savvy financial habits will help you build a positive credit history, saving you quite a bit of money down the road.

(Research by Astrid; Graphic Design by Boris)

Astrid Martinez is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Astrid Martinez at astrid@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.