The History of Money - Past, Present and Future

As the popular saying goes, “Money makes the world go round.” As long as there are products to consume, a monetary system will be needed to enable the trade of these goods. Taking a glimpse into our ancestors’ methods provides us with an interesting history lesson to help us understand why our currency methods are ever evolving.

|

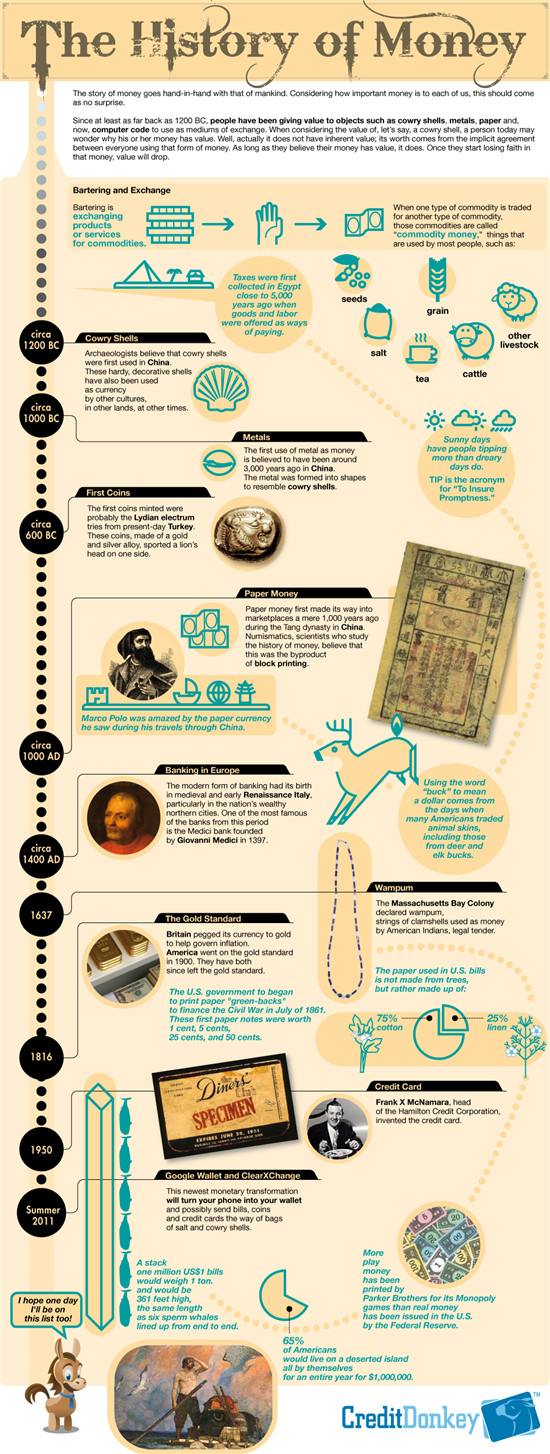

| Infographics: History of Money © CreditDonkey |

Past

Before capitalism came into existence, our ancestors relied on bartering to secure the goods and services they needed to keep their families healthy and happy. But it wasn’t long before they realized the need for a currency system.

As depicted on “The History of Money” infographic, the first formal form of currency was cowry shells, all the way back in 1200 BC. Over time, the currency evolved as humankind developed new technologies and increased its knowledge. From shells to metals and then paper, more durable and convenient methods rose in popularity.

Present

Paper money and coins still exist but plastic, in the form of credit cards and debit cards, has proven to be the most popular monetary device in the 21st century. In fact, according to a study published by the Federal Reserve Bank of Boston in January 2010, there are 609.8 million credit cards held by consumers in the U.S. alone.

The first credit card, the Diners Club card, was developed in 1950, making the need to carry cash not as important as it had been. With more consumers than ever carrying plastic, when will paper and coin currency be a thing of the past?

Future

Soon - this summer, in fact - consumers will no longer need to carry paper, coins or plastic to make their purchases! With the upcoming launch of Google Wallet and ClearXChange, consumers will be able to use their handy smartphones when they’re on the go to pay for their purchases.

It’s amazing to see all of the changes that have taken place over the centuries. As our knowledge and technological capabilities continue to evolve and improve, even the smartphone apps will one day be an archaic monetary method!

Andrew Green is a contributing writer at CreditDonkey, a credit card comparison and reviews website. Write to Andrew Green at andrew@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.