What Is A Good ROE

Unsure what a good ROE is? Learn how to calculate it and understand its meaning for better investment decisions. Read on.

|

Ever wondered if your investment is turning into real profit? This is where the return on equity (ROE) comes into play.

ROE tells you how well a company uses its shareholders' money to make more money. But there's more!

In this blog post, you will learn what a good return on equity (ROE) is and how to use it for wise investments.

What Is Return on Equity (ROE)

Return on equity (ROE) is a financial ratio that measures a company's profitability relative to the shareholders' equity. It simply shows how much profit a company generates for each dollar its shareholders have invested.

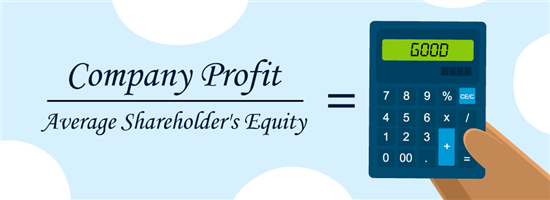

The formula for ROE is:

ROE = Net Income / Shareholder's Equity

- Net Income

This is the company's profit after all expenses, including taxes, have been deducted. You can find this on the company's income statement. - Shareholder Equity

This represents the total ownership interest of shareholders in the company. You can find this on the company's balance sheet.

So, to calculate ROE, you divide the company's net income by its shareholder's equity. The result is then expressed as a percentage.

Let's take a closer look at how it works.

How to Calculate ROE

Use this formula to calculate for ROE:

ROE = Net Income / Shareholder Equity (multiply it by 100 to get the percentage)

To better understand this, let's look at first what a company is made of:

- Assets: the value of all that it has (property, machines, tools)

- Liability: the value of what it owes

- Equity: the remaining value to shareholders (total assets minus total liabilities)

These components also make a balance sheet: Assets = Liability + Equity.

For example:

A bakery owns an oven worth $10,000, but they borrowed $6,000 to buy it. The bakery's net assets are only $4,000, the shareholders' equity. If the bakery makes a $1,000 profit in a year, we can calculate its Return on Equity (ROE).

In this case, the ROE would be 25% because $1,000 profit / $4,000 equity = 0.25 or 25%. This means the bakery earns $0.25 for every $1 invested, a good ROE for its industry.

A 30% ROE is generally considered a very good ROE, exceeding the 25% desirable mark for many industries. It indicates that the company efficiently uses its shareholders' equity to generate profits. Note that different industries have different standards for good ROE.[1]

How to Use ROE In Your Stock Analysis

ROE alone is not enough to truly analyze a stock, but here's how you can use it to find trade opportunities:

- Spot undervalued and overvalued stocks

- Buying undervalued stocks

A high ROE may suggest an undervalued stock. It hints that despite strong management and profitability, not many are investing. Thus, consider buying a stock with high ROE if you see potential growth. - Selling overvalued stocks

Low ROE can imply that a company is overvalued due to high capital but poor returns. This often indicates ineffective use of capital or equity. As a result, low ROE can prompt investors to sell the stock or go short.

An extremely high ROE should be interpreted carefully as it could also mean that the company has a lot of debt. - Buying undervalued stocks

- Industry Benchmarking

See how well a company does against its peers using ROE.Example: A technology company with an ROE of 18% and an industry average of 15% might indicate a strong performance.

- Trend Analysis

Check if a company can sustain its profitability based on its past ROE.Example: A consistently rising ROE suggests a positive growth trajectory, while a declining trend might indicate challenges or stagnant performance.

- Multi-Metric Analysis

Analyze other financial ratios along with ROE to provide a more balanced view. Avoid relying solely on ROE. Other helpful metrics include profit margin, asset turnover, and debt-to-equity ratio.Example: A high ROE accompanied by a low-profit margin may suggest unsustainable practices.

TIP: Brokers typically publish a stock's ROE on their platforms. However, a stock market analysis tool like Seeking Alpha can help you compare this ratio against others in the industry.

Limitations of ROE

It is important to consider multiple factors while evaluating a company's performance, as relying solely on ROE can be misleading. It's crucial to be aware of its limitations.

- Need for a Holistic Approach

To truly understand how well a company is doing, you need to compare ROE to other key measures. Profit margins show how much profit each sale brings in, while asset turnover tells how efficiently the company uses its resources and assets to generate sales. And don't forget about debt levels! High debt can weigh on a company, even with a good ROE. - Manipulation through Accounting Practices

A high ROE is good, but sometimes companies can "cheat" on the test to make their score look better than it really is. This is called accounting manipulation.What are accounting cheats on ROE?- Income Smoothing: They spread out their profits over different periods, making it seem like they're always doing well, even if they're not.

- Off-Balance Sheet Financing: They hide some of their debts, making their ROE higher because it's based on less money (equity).

- Aggressive Revenue Recognition: They count money as income before they've actually earned it, making their profits seem bigger. It's like counting your chickens before they hatch.

So, don't just rely on ROE alone! Look at other factors like debt levels, cash flow, and how long it takes them to turn inventory into cash. Also, watch out for sudden changes in accounting practices, as that might be a sign they're trying to hide something.

- Income Smoothing: They spread out their profits over different periods, making it seem like they're always doing well, even if they're not.

- Sensitivity to Accounting Changes

Changes in accounting rules can alter how ROE is calculated, making comparisons across different periods challenging.Track ROE trends before and after major accounting shifts to ensure accurate assessments. This reveals a company's true performance beyond the effects of rule changes.

- Failure to Capture Qualitative Factors

ROE doesn't capture important qualitative factors that can significantly impact a company's long-term success. Analyze qualitative factors alongside ROE to comprehensively understand the company's overall health and future prospects.

- Corporate governance: A company with strong governance practices is likelier to make sound decisions and create sustainable shareholder value.

- Brand value: A strong brand can command premium pricing and attract loyal customers, leading to higher profitability and ROE.

- Customer satisfaction: Satisfied customers are more likely to become repeat buyers and recommend the company to others, contributing to long-term growth.

Other Uses for ROE

Not only is ROE valuable in stock analysis, but it has various other practical applications. Here are some examples:

- Evaluating Management Performance

If a company keeps getting high returns on its owners' money, it's probably doing something right. And comparing those returns to other companies in the same business tells you who's the better manager. - Identifying Investment Opportunities

Finding companies with consistently high ROE can lead to promising investment opportunities, and comparing ROE across industries helps you choose the best ones based on potential return. - Comparing Investment Options

Investors with mixed holdings can compare ROE across different asset classes, like real estate, bonds, and even commodities. This reveals how well each area performs and its potential for future growth. But consider other factors like risk and flexibility to build a balanced and profitable portfolio.

A 50% ROE is exceptionally high and should be viewed cautiously and optimistically. While it significantly surpasses the "good" threshold of 15% and even the "excellent" range of 20%, it's crucial to consider the context before drawing any conclusions.[1]

Bottom Line

ROE is a pretty important metric for measuring a company's performance. But you can't just rely on this one number to tell you everything you need to know.

What makes a "good" ROE can vary depending on the company's size, industry, quality of its management team, and growth stage.

ROE is a useful benchmark for investors, but it can be misleading if used alone.

It is better to combine it with other financial metrics like profitability, efficiency, and leverage ratios. Qualitative factors such as corporate governance, brand value, and customer satisfaction also play a crucial role in a company's success.

References

- ^ Berkshire Hathaway. Berkshire Hathaway Letters, Retrieved 12/21/2023

Write to Miel Ysabel at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|