How to Open a Free Business Checking Account

Looking for a free business checking account you can open with $0? Find out how to open an account online in minutes and what documents you need.

|

No one likes banking fees. Luckily, small business owners have a lot more options for free business checking accounts.

A free account gives you all the features you need without eating into your profits. No more worrying about meeting balance requirements or getting ripped off by fees.

In this article, you'll learn:

- How to open a free business checking account

- What documents you need

- Best free business accounts with no monthly service fees

How to Open Business Checking Account for Free

|

Below, review the documents required to open a business checking account. These requirements may vary slightly by bank, based on the structure of your business. But in general, you should have the following prepared.

Free business checking typically means an account with no monthly maintenance fee. But it could have other fees like overdrafts, excess deposit fees, wire transfer fees, out-of-network ATM fees, etc.

You won't find a completely free business account with no fees at all. Compare different accounts and their fees to see which works best for your needs.

Documents Needed to Open Business Checking Account

|

You will need to provide the following information:

- Name, address, and date of birth

- Driver's license or state ID

- SSN or EIN

- Business license (if your state requires)

- Proof of address

- Industry

- Years in business

- Approximate annual revenue

- Have a small business (even if it's new)

- Be at least 18 years old

- Be a U.S. citizen or permanent resident

- Have a valid U.S. mailing address

Next, find out which additional documents you may need, depending on your specific type of business.

Opening a Business Account as a Sole Proprietor or Freelancer

If you're a sole proprietor or freelancer, you can open a business checking account with only your Social Security number. You don't need an EIN, which is a business tax ID from the IRS.

If you have registered your business as a DBA, you may be asked to provide the certificate.

Usually, sole proprietors can open a business checking account online. You don't need to visit a physical bank.

Absolutely. Even if your business is new and you don't yet have revenue, you can still open a business checking account. Don't lie on the application. Just say the truth.

Opening a Business Account as an LLC

You can form an LLC as a single member or with multiple owners. If you have multiple owners, it's important to look for a bank that allows for joint accounts.

You will need to provide:

- Employer Identification Number (EIN)

- LLC agreement - a document outlining the ownership and member duties of the LLC

- Articles of Organization - certificate establishing the LLC with your state

- Business license

Some banks will let you open a business bank account online as an LLC. Others may require that all owners meet with a banker in person to apply.

Opening a Business Account as a Corporation

If your business is a corporation, you will need to provide:

- Employer Identification Number (EIN)

- Corporate bylaws - the legal document outlining the rules and regulations of the corporation

- Articles of Incorporation - certificate establishing the corporation with your state

- Business license

Again, refer to the requirements of the bank you're considering. Some may require that all owners be present.

Opening a Business Account as a Partnership

If you have a partnership, you will need to provide:

- Employer Identification Number (EIN)

- Business license

- Partnership Agreement - the agreement between all individuals outlining the terms and conditions of the partnership

- Certificate of Partnership - the legal document registering your partnership with your state

Again, some banks may require that all partners be present.

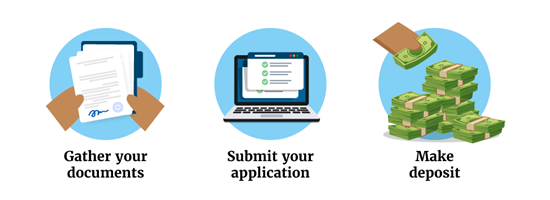

Submitting Your Application

If you're opening a business account online, you can submit your forms digitally. The application will have a section for you to upload files. Have the above forms ready first, so the process goes faster.

Usually, online banks have a fast approval process. You can even be approved in just minutes. Sometimes, the bank may ask for additional verification or information.

If you're opening a business bank account in person, make sure to have physical copies of your documents. You should also have a check ready to make a deposit to open the account.

Once your account is opened, all you have to do is link an external account and fund it. Then you can start making transfers, paying bills, etc.

If you're a sole proprietor, you don't need a Tax ID, or EIN. You can open a business checking account with just your Social Security number. But LLCs, corporations, and partnerships need to have an EIN to open a business bank account.

Best Free Business Checking Accounts with No Monthly Service Fee

|

Now, we'll go over some of the best free business checking accounts.

These are truly free accounts with no monthly service fees or minimum balance requirements.

There are plenty of business bank accounts with no opening deposit, like Chase and Bluevine. You can open an account with $0 and fund it later. Other banks may require $25, $50, $100 or more deposit.

Novo: Best Free Business Checking Overall

Novo is a digital challenger catering to entrepreneurs and small business owners. It accepts online applications for sole proprietors, LLCs, partnerships, and corporations.

Free Business Checking

- Minimum Deposit to Open: $50

- Balance Requirement: $0

- Monthly Fee: $0

- APY: N/A

- ATMs: Up to $7 per month ATM fee reimbursement worldwide

- Perks: Thousands of dollars in exclusive perks from popular business services

What sets Novo apart is its integrations with popular business software, like QuickBooks, Slack, Xero, Shopify, and Stripe. Plus, it offers thousands of dollars of discounts on business services (for example, $5,000 in free possessing with Stripe).

Though there's no paper checks, you can request to have checks sent on your behalf for free in the app.

Free Business Checking

- $0 monthly service fee

- $50 deposit to unlock all features

- ATM fee refunds up to $7 per month

Bluevine: Best Free Business Checking with Interest

Bluevine's Business Checking offers 3.25% APY on balances up to $3M for Premier customers; 2.00% APY on balances up to $250,000 for Plus customers; 1.30% APY on balances up to $250,000 for Standard tier customers that meet monthly eligibility requirements. This is one of the highest interest rates in the market.

Free Business Checking - Up to 1.3% APY

- Minimum Deposit to Open: $0

- Balance Requirement: $0

- Monthly Fee: $0

- APY: 1.3% APY on balances up to $250,000 with monthly eligibility requirements; 0% APY on balances over $250,000

- ATMs: Approximately 40,000 MoneyPass ATMs

- Perks: 1 free checkbook for the life of the account; No non-sufficient funds fee

It's a good basic business account if you occasionally need to deposit cash. You can do so at 90,000+ Green Dot locations and 1,500+ Allpoint+ ATMs (though fees apply). You also get free checkbooks, unlimited invoicing, and payment links.

It also gives you free sub-accounts. This makes it easier for you to manage expenses and save for different things. All your accounts are eligible to get interest too. Plus, you can also order multiple debit cards for your team at no extra cost.

Generally, it is smart to have both business checking and savings accounts. The business checking account is for daily operating needs, while the business savings account is for storing funds for emergency/future use.

Free Business Checking - Earn $500 Bonus

To earn the $500 bonus, customers must apply for a Bluevine Business Checking account anytime between now and 01/31/2026 using the referral code CD500.

After opening your account, deposit a total of $5,000 within the first 30 days. After 30 days, maintain a minimum daily balance of $5,000 while also completing at least one of the following eligibility requirements every 30 days for 90 days:

- Deposit at least $5,000 from eligible merchant services to your Bluevine account OR

- Make at least $5,000 of outbound payroll payments from your Bluevine account using eligible payroll providers OR

- Spend at least $2,000 on eligible transactions with your Bluevine Business Debit Mastercard® and/or Bluevine Business Cashback Mastercard®

Banking services provided by Coastal Community Bank, Member FDIC

U.S. Bank: Best Physical Bank with Free Business Checking

If you'd rather use a physical bank where you can meet with a banker, look at U.S. Bank. It has 2,000+ branches. But they're mostly in the Western states.

U.S. Bank Business Essentials

- $0 monthly maintenance fee

- $100 minimum opening deposit

- Minimum Deposit to Open: $100

- Monthly Fee: $0

- ATMs: No ATM Transaction fees at U.S. Bank ATMs

Even if you don't live close to a U.S. Bank location, it has an excellent mobile app to bank from anywhere. And you can use any of the 40,000 MoneyPass ATMs with no surcharge.

Here are some bank accounts with ways to waive the monthly service fee.

When to Open Business Checking Account And Why

Many freelancers and side business owners start off with using their personal bank account. But when is it time to open a business checking account? Here are some good reasons:

When you incorporate your business

LLCs and corporations are legally required to keep business finances separate. These business structures protect you from personal liability if your business gets sued. You can lose that protection if you muddle personal and business finances.

Here's a list of the best bank accounts for LLCs.

When you start to make or spend money

The business bank account will keep track of all your business income and expenses. This makes doing tax so much easier.

If you work with suppliers/vendors

You need a business checking account to pay your vendors. You look less professional if payments are coming from you as an individual instead of the business. Suppliers may not want to establish trade credit with you.

If you apply for a business loan

Getting a business loan or line of credit will require a business bank account. Again, you won't look credible to lenders without one.

A loan can give your business the boost it needs to grow or keep it afloat during hard times. It's good to be prepared in case you need some extra cash fast, even if you don't need it now.

If you accept credit card payments

If your customers pay by debit or credit card, you need to sign up for merchant services. You'll need a business bank account to deposit the funds from your credit card sales.

If you hire employees

Adding employees is exciting but also adds more responsibility. It's smart to even have a dedicated business account for payroll in addition to the main business checking account. This way, you won't get it mixed up with your other expenses.

What to Look for in a Free Business Checking Account

It's important to find the right bank that fits your needs and will grow with your business. Consider these factors:

Account balance requirements

Free does not always mean free. Some banks require a certain account balance to avoid a service see. Sometimes, this is okay if the bank fits your needs and you're able to comfortably meet the requirement.

Other fees

Most banks will have a schedule of fees on their website. Make sure you understand all potential costs, like fees for overdrafts, wire transfers, paper checks, etc.

Physical location

A physical bank will allow you to bank in-person and develop a personal relationship. But if you can manage your business finances completely online, you have more free options with online-only accounts.

Cash deposits

Do you need to deposit cash for your business? If you're considering an online bank, see what the options are. Usually, this means using a money deposit service, which charges an extra fee. If your business deals with lots of cash, then a physical bank may be more ideal.

Number of owners

Some small free business checking accounts don't allow for joint owners. If you're a sole proprietor, that's fine. But if your business grows, you may outgrow the limitations of the account.

Other banking services

If you think you may need a loan later on, it's smart to choose a bank with small business financing. Having a relationship with your bank can help you get approved for a loan and get better rates.

Bottom Line

Nowadays, digital banks provide an affordable and easier way for small business owners to manage their money. You can keep a free checking account without having to worry about meeting any requirements.

But also be aware of the limitations of digital banks too (like inconvenient cash deposits). Before opening a new bank account, do some research and compare banks to see which is best for you.

Anna G is a research director at CreditDonkey, a credit card comparison and reviews website. Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|