Higher Education: Economic Boon or Bubble?

Is College Worth It? A Matter of Degrees, Demographics and Debt

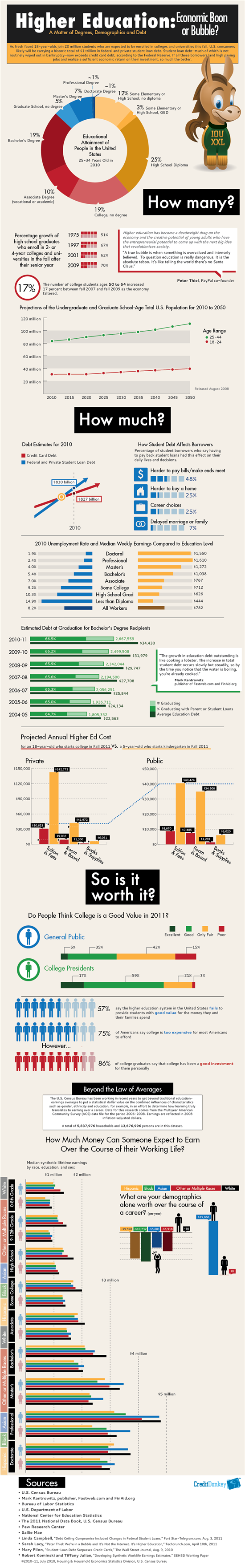

With the economic downturn of recent years, many Americans are wondering if a college degree is the answer to their employment woes.

If they return to school, will the cost of tuition, books and other school expenses pay off in the end? To answer that question, you have to look at the volume of students, volume of college debt and the resulting employment and earnings figures.

|

| Infographics: Education Earnings © CreditDonkey |

How many?

As of 2010, approximately 61% of Americans ages 25 to 34 had at least some college education. That number has been on the rise and is projected to continue to increase. From 2001 to 2009 alone, the number of high school graduates who enrolled in a 2 year or 4 year university the fall after their senior year went from 62% to 70%.

How much?

As the number of college students and graduates increases, so does the resulting college debt. As of 2010, the amount of federal and private student loan debt in the U.S. reached $830 billion, with the average education debt per individual weighing in at $34,430. But with many students graduating into a job market with very few prospects, an increasing number of individuals are struggling to pay back their loans.

And while 75% of Americans agree that college is too expensive for most Americans to afford, it is projected that the cost will only continue to increase. Current projections show future tuition and fees for the freshman class of 2023 weighing in at a hefty $40,424 (versus the $8,670 for the freshmen starting this fall).

So, is it worth it?

Data has been collected showing the lifetime earnings of individuals based on gender, race and education level. And that data does show that the higher an individual’s completed education, the higher their resulting lifetime earnings will be.

Probably unsurprising to many, the data also establishes that males make more than females. That gap starts to increase when it comes to bachelor’s degrees and beyond. The data also establishes that increased education does not level the income playing field when it comes to race, with White individuals continuing to earn more than individuals of other races.

Ultimately, whether or not college is worth the financial investment is going to vary depending upon the individual student. Many enter college to study a profession they know will not make them rich. But they view the education they gain as worth the cost. Others do see the profitable pay off. Whether or not they would have achieved the same level of professional accomplishments without their college education is largely unknown.

Perhaps what is most important is for families to carefully consider and plan how they are going to pay for the increasing education expenses. Credit cards come with high interest that starts immediately. Student loans have lower interest and the ability to defer payments but still have substantial interest costs over the life of the loan. Thankfully, there are tax-deferred savings options now available to parents with young children that will help off-set the costs for future generations of college students.

(Reporting by Annette; Infographics by Tina; Additional Writing by Meghan)

Annette O'Connor is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Annette O'Connor at annette@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.