What Makes Small Businesses Sink or Swim?

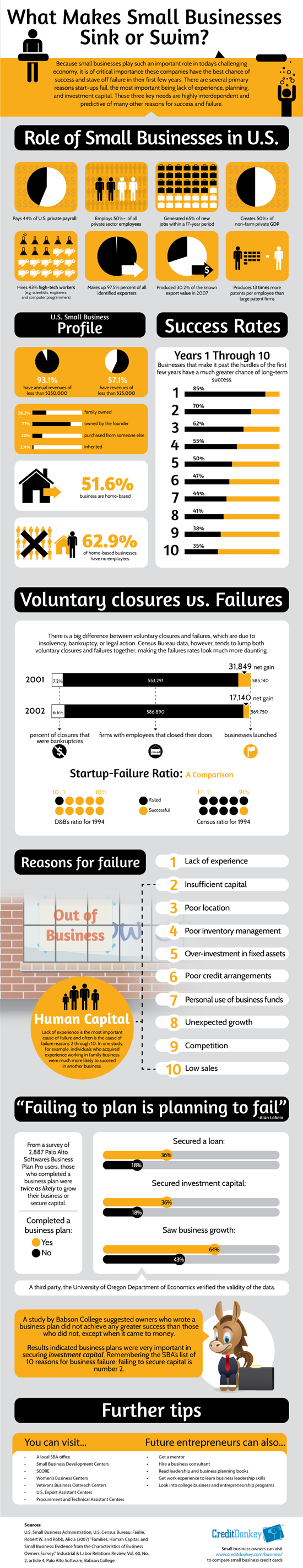

With small businesses paying 44% of U.S. private payroll and employing 50% of all private sector employees, it goes without saying that they are an important part of the U.S. economy. Unfortunately, while these ventures play an important role in the U.S., a great number of them fail every year.

Want to Start a Business? Statistics You Should Know

But the fail rate of small businesses shouldn’t necessarily deter entrepreneurs from pursuing a business idea. Instead, they should be aware of the factors that cause others to fail in their pursuits and apply those lessons to their idea so they can strive for success.

|

| Infographic: What Makes Small Businesses Sink or Swim © CreditDonkey |

Voluntary closures versus failures

Small businesses close their doors for a variety of reasons. It’s important to keep that in mind when determining the likeliness of success of your potential business. Failures are due to insolvency, bankruptcy or legal action.

Many statistics looking at closed businesses lump voluntary closures and failures together, which can make your odds look grimmer than they actually may be. For example, D&B’s startup failure ratio for 1994 was 10:1 (one failure for every 10 startups) but according to the Census Bureau it was 1.1:1 (one failure for every 1.1 startups); this discrepancy is because the Census Bureau data lumps together voluntary closures and failures.

In 2002, there were 586,890 businesses with employees that closed their doors. Of these firms, only 6.6% were due to bankruptcy. Of course, you will still want to use plenty of caution when pursuing your venture and ensure you are doing your due diligence to help ensure its success.

Related: Startup Failure Rate

Reasons for Failure

Human capital and lack of experience is a major underlying factor in business failure. Couple this lack of experience with failure to plan and you have a recipe for business disaster.

It was found from a survey of Palo Alto Software’s Business Plan Pro users that those who completed a business plan were twice as likely to grow their business or secure capital. While writing a business plan in itself will not guarantee success, the Small Business Association has noted that failing to secure adequate capital is one of the top 10 reasons small businesses fail.

Tips for Avoiding Failure

Knowledge is the first step to success. Now that you know the top reasons why business fail, you can employ these tips to help you swim instead of sink:

- Visit or contact a local SBA office to learn about the resources that are made available to small business owners.

- Get matched with a mentor through SCORE, an organization that offers free mentoring and resources to current and future small business owners.

- Create a business plan. It will help you organize your thoughts and ensure that you have fully thought out your venture. It is also the first step in helping to secure capital so you can get your startup off the ground.

- Don’t overlook business credit cards. In the first months of startup, many businesses experience cash flow problems. Business credit cards will help cover your needs until you have a steady cash flow. Many also provide perks like discounts on office supplies and cash back opportunities.

- If you lack experience, look into college business and entrepreneurship programs and look for work opportunities that will help you gain experience in the industry you would like to break into.

Related: Successful People Do These 23 Things Daily

(Additional Writing by Meghan)

Kelly Teh is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Kelly Teh at kelly@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

|