Infographic: Black Business Statistics

Black Businesses Are on an Upward Trend

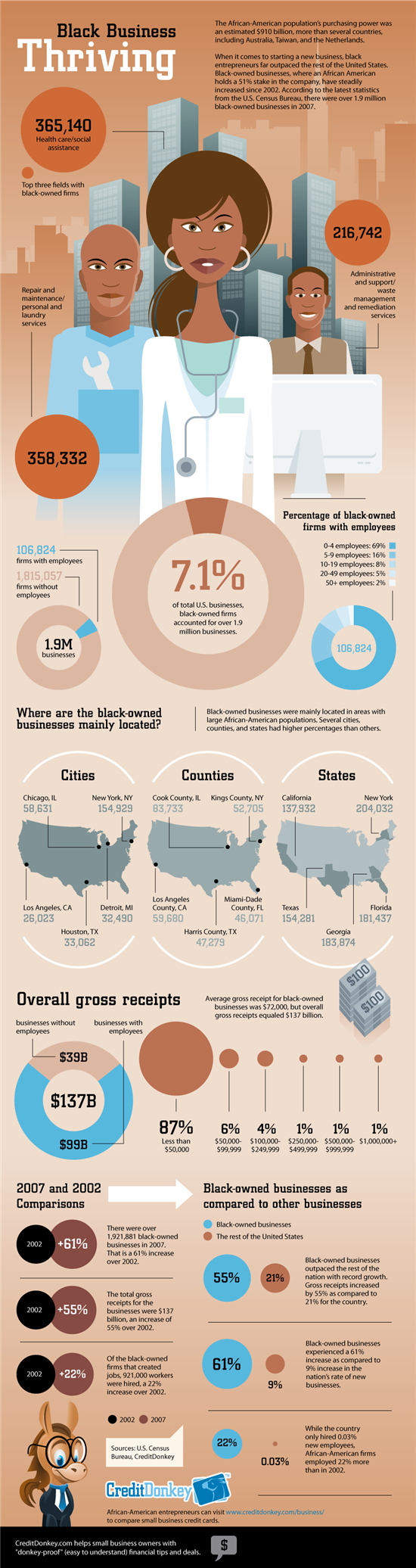

Of all the minority groups, African-American owned businesses posted the most gains in the early 2000s. This CreditDonkey infographic explores the gains the black community achieved, as well as some tips on how those who own small businesses can continue the trend of upward growth.

|

| Infographic: Black Business Thriving © CreditDonkey |

Ownership and Employees

In 2007, when the U.S. Census collected its most current statistics, there were over 1.9 million black-owned businesses in the country. That amount accounts for 7.1% of all the businesses in the United States. Compared to the previous collection of statistics, in 2002, these businesses experienced a 61% increase in number, while the national average increase was a mere 9%.

The 2007 figures also show an increase in the number of black-owned businesses that had one or more employees. While the majority of African-American firms remain one employee enterprises, 106,824 of the businesses that responded to the Census Bureau had one or more additional employees. This represents a 4% increase over 2002.

Another positive update was an increase in the overall number of employees hired by black-owned firms. It’s reported that these companies hired a combined total of 921,000 workers, representing a 22% increase. The national increase was only 0.3%.

Business Sectors

The types of African-American owned businesses have crossed every sector, with the majority of firms in the healthcare/social service field. The other two top sectors are repair and maintenance/personal laundry services and administrative and support/waste management and remediation services. These are all fields that are expected to continue to grow in the coming years.

Financial Numbers

More important than the number of businesses is the money that they represent. And the good news for black-owned ventures is that they have also experienced an increase in receipts. In fact, these increases outpaced the rest of the country; African-American businesses with employees grossed $99 billion in 2007. Those firms without employees earned $39 billion. Combined, that represents a 55% increase over 2002 figures.

Of all businesses, this group experienced the best growth in this five-year period. In the same time period, the national gross receipt increase was just 21%.

New Business Startups

These statistics have made one thing certain: African-American businesses are on the fast track. Entrepreneurs need to stay grounded if they want to succeed and follow these tips.

- To keep afloat, Kelly Teh at CreditDonkey recommends new business owners separate their personal identity from their business identity, which many new owners, especially those who are the sole proprietor, hold off on doing. This will help protect your personal finances and your personal credit history, while also opening the door to a wider range of business credit opportunities that can help you gain the financial foothold you need to expand your venture.

- To stay fiscally sound, black business owners need to stay in the positive, and one way is to have a business credit card to cover everyday business expenses. Before choosing a credit card, Meaghan Clark at CreditDonkey suggests studying your spending habits and reviewing the expenses from the past quarter to help you identify the specific credit card features that will most benefit your business.

- To ensure you remain on the right track, remember to perform regular credit checkups. Review your spending and credit habits on a quarterly basis to make sure you’re staying on the straight and narrow. It’s best to check both your personal and business credit reports to make sure you’re keeping everything separate and to catch any errors before they make a negative impact on your business.

(Research and Writing by Ashyia; Graphic Design by Boris; Additional Writing by Meghan; Editing by Maria and Sarah)

Ashyia Hill is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Ashyia Hill at ashyia@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Read Next: