Average Checking Account Balance

How much does the average person have in their checking account? The average checking account balance in the U.S. may surprise you.

|

| © CreditDonkey |

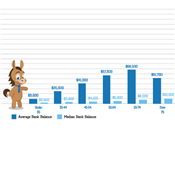

The average checking account balance for Americans is $10,545, according to the Survey of Consumer Finances (SCF) conducted by the Federal Reserve.

Since the survey first started, the average has increased—with the exception of the 2009 recession. Here's a breakdown of the average checking account balance:

- 2001: $6,404

- 2004: $7,382

- 2007: $6,203

- 2010: $7,036

- 2013: $9,132

- 2016: $10,545

Add the daily balance of your account for every day of one billing cycle, and then divide the total number by the number of days in that cycle. You must add the balance for each day even if your balance hasn't changed.

An average checking account balance may not represent the typical balance. A family may be going through temporary financial hardship or some other life event. For example, between 2013 and 2016, the amount of families with credit card debt increased.

Other factors, such as demographics, also affect the overall distribution of average checking account balances. Keep reading for a breakdown of average checking account balance based on these factors.

What is the median checking account balance?

The median checking account balance is $2,900. This figure is much lower due to how it is calculated.

A median balance is the middle number in any set list. An average is the sum of all those numbers divided by the total number. As such, averages are affected by outlying numbers (both higher and lower).

AVERAGE CHECKING ACCOUNT BALANCE BY AGE

Here's a detailed breakdown of average checking account balances, according to the Survey of Consumer Finances:

- Under 35 years old: $4,013

- 35–44: $9,593

- 45–54: $10,337

- 55–64: $11,098

- 64–75: $15,752

- Over 75 years old: $15,803

In general, older households tend to have a higher checking account balance.

Banks can reject your application for a checking account. Some things that mark you as a risk include fraud, low credit scores, and too many overdraft checks. If you are turned down, consider opening a prepaid checking account.

AVERAGE CHECKING ACCOUNT BALANCE BY INCOME

Here's more breakdown, according to the Survey of Consumer Finances:

- Less than $25,000: $2,018

- $25,000–$44,999: $4,303

- $45,000–$69,999: $6,492

- $70,000–$114,999: $8,593

- $115,000–$159,999: $12,939

- More than $160,000: $42,293

People in the highest income bracket have average checking account balances significantly higher than other income brackets—especially the lowest income bracket. That's because the highest income bracket comprises a wide range of income levels.

On the other hand, 27% of the people surveyed earning less than $25,000 have no checking accounts at all.

AVERAGE CHECKING ACCOUNT BALANCE BY GENDER

Sorting the average checking account balance by gender shows a large discrepancy between men and women.

The average checking account balance for women is $5,284, while the average checking account balance for men is $12,451.

In addition, men who led their households reported more than double the income than women who led their households.

The significant disparity between men and women may be the result of: children, marital status, and other factors.

AVERAGE CHECKING ACCOUNT BALANCE BY RACE

Take a look at a more detailed breakdown of averages:

- Black: $3,762

- Hispanic: $4,940

- White Non-Hispanic: $12,408

- Other: $14,513

The "other" category consists of several races, including Asian, American Indian, Alaska Native, Pacific Islander, and more.

Before analyzing the data, it's important to remember that larger, deep-set economic and social factors likely affect these numbers. One of the larger factors playing a role is likely income. Census data has shown that whites make, on average, more money annually than blacks.

The Federal Reserve survey also tracked historical data of Americans' checking account balances. This number includes all funds in accounts that can be used to pay bills. In the survey of more than 6,000 households, 7.1% of the households did not have checking accounts at all.

How Much Money Can You Have in a Checking Account?

There is no limit to the amount of money you can store in checking accounts. However, these accounts may not be the best place to store all your savings since many do not offer you any interest.

A savings account, particularly a high-yield one, will allow your money to accrue interest at a fixed rate.

Still, it's important to keep the right amount of money in your checking account for daily and larger expenses. Read on to learn more.

Where to Keep Your Money

From traditional to online-only banks, there are more places than ever to keep your money. Picking the right checking account can help you save and avoid costly fees.

Here are some questions to consider:

- How often will you use the account?

- Do you use ATMs frequently?

- Do you want your account to earn interest?

- Is there easy online and mobile access?

- What fees does the bank have?

One of the most important factors when choosing a checking account are the fees. These charges vary by bank, with some not charging any fees at all.

Here are some common fees to avoid:

- Monthly Maintenance Fee

Some banks charge these just for having an account. They can sometimes be waived by meeting certain requirements, like a minimum daily balance or a regularly scheduled direct deposit. - Overdraft Fees

Banks will charge you if you spend more than the money in your account. This can easily cost at least $20 per occurrence—and sometimes up to $40. - Out-of-Network ATM Fee

If you find yourself withdrawing cash often, pick a bank with a large ATM network to avoid paying fees. In some cases, you could get charged by your bank AND the bank that owns the out-of-network ATM.

If you have substantial savings, you should consider opening a savings account. Even an interest-bearing checking account likely won't have the same rates. If you don't need immediate access to your funds, a CD may offer even more interest.

HOW TO MANAGE YOUR ACCOUNT

The best way to manage your checking account is to track the money coming in and out. Be sure to regularly review your transactions, including:

- ATM withdrawals

- Checks

- Debit card purchases

- Deposits

Make sure to calculate your spending each month to avoid any overdrafts. Checking your transactions will also help you spot any fraudulent activity.

Many banks will let you set up alerts on your checking account to ensure your funds don't fall below a certain balance.

THE BOTTOM LINE

Keeping track of your checking account balance will help you understand your financial progress compared to the general public. It can also help you stay on top of your finances and avoid unwanted fees.

Write to Samantha Tatro at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

|