Retirement Statistics

Average American has only $96k saved for retirement. Read shocking stats on how most Americans are nowhere ready to retire. It's not too late to improve.

|

| © Alex (CC BY 2.0) via Flickr |

Between the impact of the recession on people's retirement savings and the outlook for Social Security, there's a lot of doom and gloom in the forecast.

Whether you're just entering the workforce or you're in your prime earning years, the underlying message is clear:

You can't afford to put off saving for the future.

While this seems like a simple enough concept, it's one that a shocking number of Americans have yet to put into practice. Maybe it's stagnating wages and huge student loan bills standing in their way. Or maybe it's just simple procrastination.

If you're one of the large majority that have yet to save for retirement, there is still good news:

Not all hope is lost. Even if you're well into your working life, and you haven't saved a cent.

Read on.

To get a feel for the current retirement situation in the U.S., we gathered some statistics on how much workers are saving. Then let's take a look at what you can do to change your situation.

HOW MUCH ARE AMERICANS SAVING?

THE AVERAGE AMERICAN SAVES NOWHERE CLOSE TO WHAT IS NEEDED FOR RETIREMENT

Whether your retirement plans include traveling the world, starting a business, or just spending a lot of time on the golf course, you need to make sure you have enough cash to finance your dreams.

To see how the numbers shake out, we looked at how much workers have saved on average and how their savings compare at different stages of life.

- The Average American has about $96,000 saved for retirement. But among those with an annual income of $250,000 or more, the typical nest egg is substantially higher, averaging more than $450,000.

- Today's 30-somethings have just $13,000 in their retirement accounts. As they move into their 40s, that figure jumps to a modest $31,000.

- By the time the big 5-0 rolls around, the average savings is just $60,000.

- And at age 65, the average retirement savings is $100,000 - still a far cry from the $1 million baseline that most finance experts recommend.

SOME WORKERS DELAY SAVING

Study after study shows that despite fears about Social Security being tapped out, millions of Americans are still not saving. Delaying can result in some potentially disastrous financial consequences, but a surprising number of workers are doing exactly that.

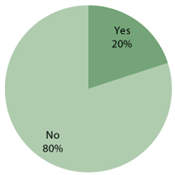

- A shocking 36% of Americans have yet to begin saving for retirement. 41% say they don't even have $500 socked away for emergencies.

- Incomes does make a difference: 68% of people who earn $35,000 or less have less than $1,000 saved, compared to just 3% of those who earn $75,000 or more each year.

- 60% of workers have less than $25,000 in retirement funds. 44% of those who contribute to a retirement plan through their job say they've accumulated assets totaling $50,000 or more.

- 43% of millennials (age 25-34) lack any kind of retirement savings.

LIFE AFTER RETIREMENT

Americans are still somewhat pessimistic about their future. For many seniors, that means delaying retirement a little longer than expected or continuing to work in a reduced capacity.

- Around 10,000 people retire every day. That comes out to just over 3.6 million each year.

- Seniors are staying in the workforce longer, with the average retirement age climbing to 62 as of 2014. That's an increase of three years over the last decade.

- The average age at which people expect to be able to retire is 66. Only 4% of workers believe they'll be able to stop working before age 55.

- As of 2013, 52% of baby boomers aged 66 or older have retired. That's a substantial increase over the 45% who said the same in 2011.

- Around 12% of retirees 66 and up say they're still working on a part-time or seasonal basis. Some do so as a means of staying active but for others, it's a matter of dollars and cents.

MANAGING RETIREE FINANCES

Part of developing your retirement strategy is coming up with an accurate estimate of what you expect your expenses to be and how much money you'll have coming in. A significant number of seniors include Social Security benefits when making their calculations, but it's not always enough to close the gap.

- As of 2013, 90% of seniors aged 65 and older were receiving Social Security benefits. That's nearly 40 million retirees and their spouses.

- Social Security benefits are meant to be supplementary to other retirement savings. However, 22% of married seniors and 47% of those who are single or widowed depend on social security almost completely, making up for 90% of more of their retirement income.

- In 2015, the average monthly benefit from Social Security was $1,328. The maximum monthly amount for someone who waits until full retirement age to receive benefits is $2,663.

- 29% of seniors 65 and up still owe money on their home mortgage. Another 27% are saddled with outstanding credit card bills.

- 3% of seniors 65 or older still have student loans. Altogether, seniors owe a whopping $18.2 billion in student debt, up from $2.8 billion in 2005.

WORKERS AND RETIREMENT

If you're fortunate enough to be offered a retirement savings plan through your employer, you definitely have an advantage over those who don't. Still, for some workers, having that built-in safety net isn't necessarily enough to make them feel 100% secure about their future financial prospects.

- As of 2014, nearly 80% of American workers had the option of participating in an employer's retirement plan. These include 401(k)s, 403(b)s and similar plans along with defined benefit pension plans.

- But just over 80% are actually make the effort to contribute. Companies that employ 500 workers or more tend to have the highest participation rates.

- Through the end of 2013, the average 401(k) balance came to $101,650. The median balance, on the other hand, was $31,396 (although both numbers represent an 80% increase over the previous five years).

- 13,000 401(k) participants take loans or hardship withdrawals from their retirement accounts each month. The average individual loan amount is just shy of $8,000.

- In 2014, just 18% of workers said they were "very" confident about having enough money to live comfortably during retirement. By comparison, 24% said they were not all confident about being able to stay afloat financially over the long term.

WHAT YOU CAN DO ABOUT IT

These statistics aren't easy to digest, but it's not too late to start doing something about it.

If your work offers a 401(k) plan with a matching contribution, immediately start to contribute to it, at least up to the amount that your employer matches. It's free money, after all. If you're 50 or over, you can contribute $6000 more.

If your work doesn't offer a retirement plan, start making contributions to a traditional or Roth IRA account.

For example, let's say you are 50 and have yet to contribute to a retirement plan. You start contributing now to an IRA after reading this article, and you max out the contribution every year at $6,500 (that's a little over $500 a month). Assuming an average return of 7%, your IRA balance could be worth $175,000 when you retire at 65.

You see, there is still hope.

Check out this article for the different types of IRA accounts and which one is best for your situation.

But remember, saving for retirement will go hand in hand with evaluating your lifestyle and seeing what areas of spending you can cut out. Here are some ways to save money and clear your debt.

CONCLUSION

As you can see from the numbers we've gathered, a substantial number of American workers are drastically unprepared for retirement. If you're one of nearly 4 in 10 workers who hasn't started saving yet, you can't afford to waste another second to start squirreling every extra penny away. Don't forget, it's not too late!

Sources and References:

- BlackRock

- CreditDonkey

- National Institute on Retirement Security

- MetLife

- Bankrate

- Pew Research

- Social Security Administration

- Government Accountability Office

- American Benefits Council

- Vanguard

- American Society of Pension Professionals & Actuaries

- Employee Benefit Research Institute

Rebecca Lake is a journalist at CreditDonkey, a credit card comparison and reviews website. Write to Rebecca Lake at rebecca@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next: