Infographic: Pet Care Statistics

Climbing Cost of Vet Care Means Owners Must Plan Ahead

In an era of tight family budgets and rising veterinary bills, pet owners should plan ahead for their animals' healthcare needs to avoid catastrophic financial and personal losses.

|

| Infographics: Pet Care © CreditDonkey |

In the aftermath of the financial meltdown of 2008, the media was filled with stories of pet owners forced to choose between paying their mortgages and caring for pets - sometimes abandoning sick animals they could not afford to treat.

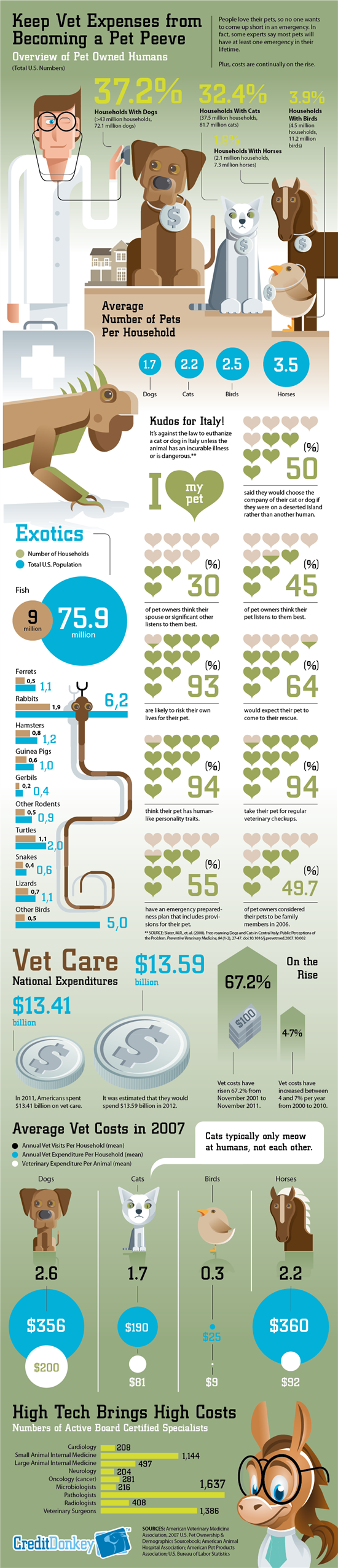

"According to the American Animal Hospital Association, while 93 percent of pet owners say they'd risk their own lives for their pets, and 64 percent would expect their pet to come to their rescue, only 55 percent have an emergency preparedness plan that includes provisions for their pet," noted Tran.

"It's likely that even fewer people have budgeted for emergency veterinary care, despite the fact that vet costs climbed 69.6 percent from 2001 to 2011, with the nationwide total reaching $13.41 billion in 2011."

On the bright side, the main driver of the higher costs has been the increased availability of specialized tests, treatments and vets for the nation's 81.7 million cats, 72.1 million dogs, 11.2 million birds and 7.3 million horses - not to mention exotics such as ferrets, hamsters, turtles, snakes and lizards. Many of the animals were once euthanized for conditions that are routinely cured today.

To better handle veterinary bills and other pet-related expenses, consider:

Ways to Pay

| Pros | Cons | |

|---|---|---|

| Emergency Savings Account | You can't be denied coverage like with insurance or other plans, so you can use all that you put in. | You may not be able to save enough by the time you have an emergency. |

| Vet Care Credit Cards | They typically offer lower interest rates than typical credit cards. | Must be approved by vet before use, so you need to make sure your vet takes these cards. Credit limit may be less than you need. |

| Low Interest Credit Cards | Credit cards do offer peace of mind, depending on their credit limit but are not without risks. | High interests can really hurt you financially. Plus, medical emergencies typically come with high credit card balances. |

| Pet Insurance | It offers greater security than many other options, if companies don't deny coverage. Insurance companies and plans vary widely. Read comparisons and user reviews. Some have glowing reviews, while others not so much. | You may not be covered for something if you misinterpret your policy or for other reasons. You often have to wait for reimbursement, but this is changing with some pet insurance companies. |

| Nonprofits | You typically don't need to pay grants back. There are national, local, and other types of nonprofits who offer this service. | You have to prove your financial need. People are turned away because of high demand, and there's often a waiting period. |

| Payment Plans with Your Vet | You may be able to avoid the interest rates of a credit card (if your vet decides not to charge interest or charges a low interest). | Not all vets offer this, and when they do, often it's for regular paying customers. |

More on Pet Insurance

- There's a lot of variety out there. There are several companies, and each company has its own plans. Some offer preventative care, while some just offer illness or catastrophic plans. Some cover alternative medical care; some don't. Most also allow you choices of co-pays and deductibles. Choose a plan that's right for you.

- Research different companies and plans by using comparison charts, going to pet insurance company websites, and reading customer reviews.

(Writing by Kelly; Graphic Design by Boris)

Kelly Teh is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Kelly Teh at kelly@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.