How Much is Motorcycle Insurance

More than 8 million motorcycles are registered in the United States. But how much does a motorcycle cost to insure? Read on for the answer plus a breakdown of your coverage options.

|

| © CreditDonkey |

Average Cost of Motorcycle Insurance

|

| © CreditDonkey |

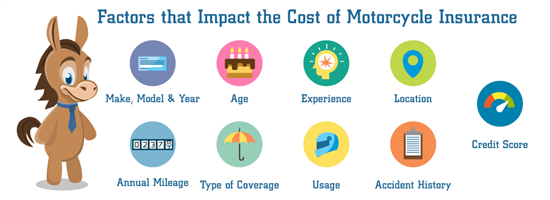

The average cost of motorcycle insurance in the United States is about $700 per year. Typically, the coverage is cheaper than car insurance.

But exactly what you'll pay depends on a variety of factors. Keep reading to learn what affects your motorcycle insurance premiums.

Location

Like car insurance, your zip code plays a big role in your insurance rates. You'll generally pay more in cities than the countryside for motorcycle insurance.

The 5 most expensive states for motorcycle insurance include:

- California

- New York

- Michigan

- Arizona

- Florida

These states have warmer weather and high populations, which allows people to ride more often (and potentially get into more accidents). Average annual premiums here can range between $900 and $1,300.

The 5 least expensive states for motorcycle insurance include:

- North Dakota

- Iowa

- Nebraska

- Maine

- Wyoming

These states have some of the lowest populations out of all U.S. states.[1] Average annual premiums here can range between $300 and $500.

But in rural West Texas, you'll likely be paying under $500/year.

Location, location, location… is only one part of the equation. Insurance companies factor in other personal details too.

Age

Riders under the age of 25 can expect to pay 30% to 50% more than an older driver for the same bike. Motorcycle coverage is most expensive for teens and young adults. Why?

It all comes down to risk. Young and inexperienced riders aren't used to the many safety precautions motorcyclists need to take. Young riders are more likely to get into accidents. This means more claims for the insurer to pay out.

The cost of motorcycle insurance will stay high until you build up experience. Riders over 25 will usually see their rates go down until they hit their 70s.[2]

But turning 25 doesn't magically lower your rates. You have to consistently prove that you're safe on the road too.

Driving History

Insurance companies check your driving record for accidents and tickets. Drivers with activity on their record are more likely to get in accidents while riding a motorcycle.

With most companies, you need 3 to 5 years of a clean driving record in order to qualify as a safe driver.

If you've had multiple accidents within the last 3 years, you'll likely have higher rates or pay a surcharge.

Safe driving isn't always enough to keep your rates down. See how your ride could spike your insurance rates below.

Motorcycle Type

It makes sense that the type of motorcycle you ride affects the cost of motorcycle insurance. Some bikes are worth more and cost more to repair. Some come with safety features that prevent accidents. Insurers take this into account when setting rates.

They also look at your specific motorcycle model. Models that are involved in more accidents or get stolen more often cost more to insure.

The most common motorcycle types include:

- Cruiser

- Sport bike

- Touring bike

- Trike

- Scooter

- Moped

Sport bikes are usually the most expensive to insure. They are involved in more accidents and the claim payouts tend to be high.

Choosing the Right Coverage

|

| © CreditDonkey |

Some insurers treat your motorcycle like a second car. You can add it onto your existing auto policy. Your bike will have the same liability limits as your other vehicles.

Other companies require you to buy a separate motorcycle policy. In this case, you'll have to choose new coverage amounts. See what it takes to protect yourself and others below.

Minimum Coverage Requirements

Most states require you to have liability insurance.[3] This includes bodily injury coverage and property damage coverage. If you cause an accident, these coverages pay for the other person's injuries and damages.

Liability is usually split into three limits. Here's what it means if you have limits of 25/50/25 ($25,000/$50,000/$25,000). If you get in an at-fault accident, your motorcycle insurance will pay a maximum of:

- $25,000 of bodily injury coverage per person

- $50,000 of bodily injury coverage for the whole accident

- $25,000 of property damage to the other vehicle

Motorcycle accidents are often more serious than car accidents. It's important to have the proper coverage limits in place. Otherwise, you'll pay the costs out of pocket.

Some states also require uninsured or underinsured motorist coverage. This protects you if the other driver causes an accident and doesn't have enough insurance to pay.

Your bike is your baby. Minimum coverage doesn't always cut it. Find out the other ways you can safeguard your motorcycle no matter the situation.

Standard Motorcycle Coverage Options

Liability-only insurance isn't always enough. According to the Insurance Information Institute, you should understand all your options to find the right level of coverage for you.[4] Here are common types of coverage that give you extra protection:

Comprehensive

Comprehensive coverage protects your motorcycle from "acts of nature" and things out of our control. It covers almost anything that could happen to your motorcycle other than a crash with another vehicle or object. It does not cover wear and tear.

Comprehensive covers events like:

- Fire

- Theft

- Windstorm

- Hail

- Falling objects (e.g., trees or rocks)

- Hitting an animal

Comprehensive deductible options for motorcycle insurance include $100, $250, $500, and $1,000. The higher the deductible, the lower the premium you'll pay.

Collision

Collision protects your bike from a crash with another vehicle or object like a building, tree, or telephone pole. It covers your motorcycle regardless of who is at fault. You'll need to pay a deductible before your motorcycle insurance pays out.

Uninsured/Underinsured Motorist (UM/UIM)

UM/UIM covers damages caused by another driver who doesn't have insurance or doesn't have enough insurance. It can be used to pay for medical treatment, lost wages, and property damage.

Medical Payments

This covers you and an extra rider for medical expenses due to an accident. It protects you no matter who's at fault. You can usually get limits of $500, $1,000, $2,000, $5,000, or $10,000.

Personal Injury Protection (PIP)

PIP pays out regardless of who's at fault. It has broader coverage than medical payments. It covers:

- Lost wages

- Occupational therapy

- Transportation expenses

- Hospital fees

- Other costs that aren't strictly medical

Cost and coverage are important when choosing motorcycle insurance, but so is customer service. A company that has high customer satisfaction will make your life a lot easier if you need to file a claim.

Use ratings from sources like J.D. Power and A.M Best to help you find the right insurer for you. J.D. Power releases an auto claim satisfaction study each year.[5] For information on a company's financial strength, check out A.M. Best ratings.[6]

Add-Ons to Your Motorcycle Policy

Customized Equipment

If you're into motorcycles, you might have added some personal touches to your bike. Those custom features can add up, so you might want additional coverage for the new parts.

Equipment examples include:

- Extra electronic equipment

- Trike conversion kits

- Sidecars

- Custom paint

- Exhaust

- Chrome plating

This can be especially important if you bought your bike from a private seller. They may have customizations that won't be covered unless you opt for extra coverage.

Safety Riding Apparel Coverage

Most motorcycle policies include $500 of coverage to replace your safety apparel. This includes:

- Helmets

- Jackets

- Gloves

- Boots

- Eyewear

You can purchase more coverage. But it's usually only available if you have a full-coverage policy.

That's a lot of coverage options and a lot of ways to increase your premium. Check out how you can lower your payments below.

How to Get Cheaper Motorcycle Insurance

If you want the best prices, make sure to shop around and compare quotes. Remember to ask the insurance company for any discounts you qualify for. Potential discounts include:

Lay-Up Period

If you only use your bike a few months per year, you can get a lay-up discount. The lay-up period is the amount of time you don't ride your motorcycle. It's common in states with cold, snowy winters.

Lay-up discounts pause your liability and collision coverage. Your motorcycle is still covered for comprehensive losses like theft and fire.

Some companies allow you to ride your motorcycle in very limited circumstances during the lay-up period. Others deny coverage if you get into an accident during that time.

Garaged Discount

You can get a discount if you keep your motorcycle parked in a garage when it's not in use. Garaging your motorcycle lowers the chance of theft and damage.

This discount can save you around 5% off your premium. If your carrier offers this option, jump on it. It's a great discount since it reduces your likelihood of having a claim.

Motorcycle Safety Course

If you take an approved motorcycle safety course, you'll save on your insurance. Most insurance companies accept completed courses within the last 3 years.

Heads up: you'll have to pay for the course. Most courses cost between $100 and $300. Check with your insurance company to make sure the course is approved. If it has any type of official accreditation, it should work just fine.

On average, you'll get a 10% discount. But the discount can range between 5% and 20%.

Association Discount

Do you belong to a motorcycle riding group like the AMA, USAA, or Harley Owners Group? If you do, many companies offer a wide range of savings. This includes:

- 5–10% off your motorcycle insurance

- Discounts on safety courses

- Apparel discounts

What the Experts Say

CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

The average cost of motorcycle insurance is $702 per year. Your personal details and your motorcycle will affect that number.

If you ride a motorcycle, you face unique challenges and risks that car drivers don't. It's important to carry the proper amount of insurance to protect yourself, others, and your bike. That might mean getting more than the state minimum limits.

Remember, you can find better deals by comparison shopping and asking about discounts. It's a small price to pay for your peace of mind.

References

- ^ World Population Review. US State - Ranked by Population 2020. Accessed 23 Nov 2020.

- ^ Progressive. Here's what affects your price for motorcycle insurance. Accessed 23 Nov 2020.

- ^ Insurance Information Institute. Background on: Compulsory Auto/Uninsured Motorists. Accessed 23 Nov 2020.

- ^ Insurance Information InstituteMotorcycle Insurance. Accessed 23 Nov 2020.

- ^ J.D. Power. 2019 U.S. Auto Claims Satisfaction Study. Accessed 23 Nov 2020.

- ^ A.M. Best. Company and Rating Search. Accessed 23 Nov 2020

Write to Andrew Flueckiger at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Read Next: