Hispanics Drive America Forward as More Gain Access to Credit

Credit card trends among Hispanics and how they are shaping our economy.

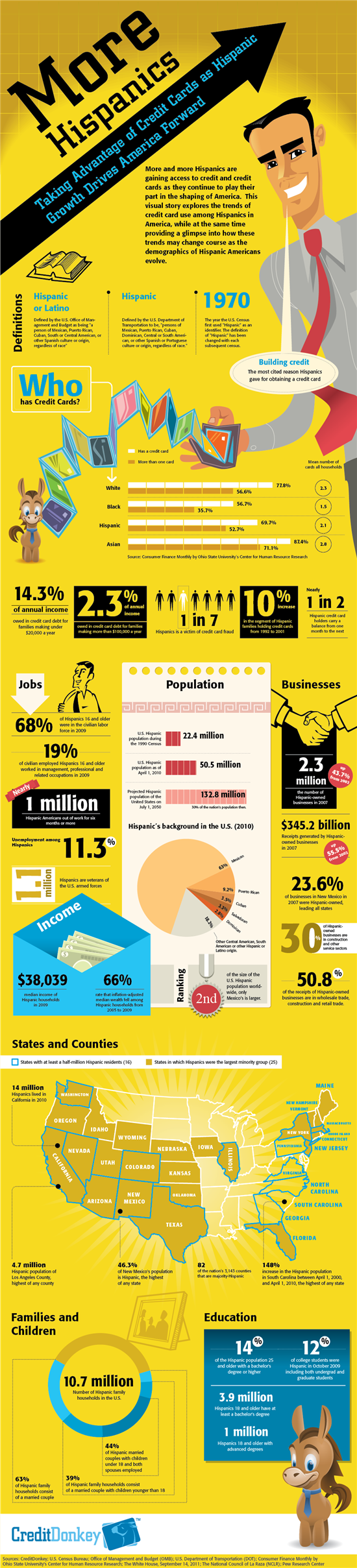

As more Hispanics gain access to credit and credit cards, they continue to play an expanding role in the American economy. Key demographic trends and credit card usage rates among Hispanic Americans show they are helping to drive the nation forward.

|

| Infographics: Hispanics Drive America Forward © CreditDonkey |

With 68% of Hispanics age 16 and older working in the civilian labor force and an estimated household median income of $38,039, according to U.S. Census Bureau, Hispanics represent a growing and thriving segment of the American population.

Research from the Center for Human Resource Research at Ohio State University, shows that 69.7% of Hispanics have at least one credit card. The number of Hispanic families holding a credit card has grown by more than 10%, according to The National Council of La Raza (NCLR).

The growth comes at a cost, as 1 in 7 Hispanics are a victim of credit card fraud and nearly 1 in 2 carry a balance from one month to the next.

"Consumer spending is responsible for upwards of 70% of the US economy. With the Hispanic population projected to reach 132.8 million by 2050, it is clear Hispanic consumers will be a leading force in America's marketplace," said Charles Tran, founder of the credit card comparison website, CreditDonkey.com. "It is important to ensure they have access to the financial tools, services and information required to support their contributions to the economy."

Read the infographic above to find out who are accessing credit cards, why Hispanics are using credit, how Hispanics manage credit, and where Hispanics are thriving. The full infographic also includes:

- Hispanic Labor Trends

- Hispanic Population Trends

- Hispanic Business Trends

- Hispanic Education Trends

- Hispanic Family Trends

Banks continue to offer incentives such as 0% promotional APRs to try to get consumers to switch credit cards. As nearly half of Hispanics carry a balance, we recommend that Hispanic consumers compare [low interest credit cards] to save money and optimize their personal finances.

(Graphic Design by Marcelo)

Andrew Green is a contributing writer at CreditDonkey, a credit card comparison and reviews website. Write to Andrew Green at andrew@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.