Financial Infidelity: Marriage and Money

Don’t Try to Hide Your Lyin’ Wallet

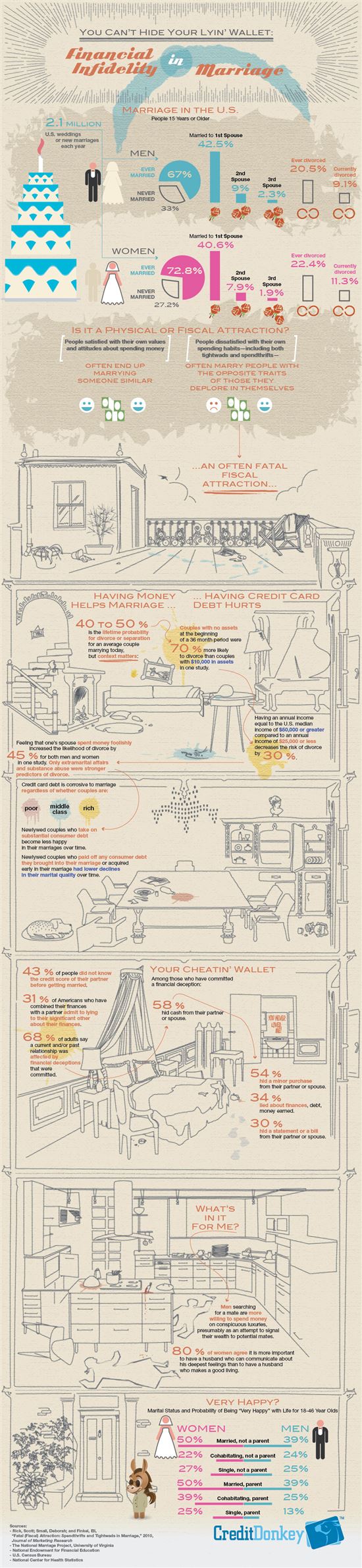

Married people are happier by many measures, yet many marriages are unhappy or fail because couples bring to the partnership significant debt, including student loans and credit card balances, as well as self-deceptions and outright lies about money. Our new research infographic urges couples to take a clear-eyed look at their prospects for happiness if they are not honest with themselves and their partners about money.

|

| Infographics: Financial Infidelity by the Numbers © CreditDonkey |

“The data shows that it is difficult to build a happy married life on delusion and dishonesty about money,” says Charles Tran, founder of CreditDonkey. Couples must define a financial philosophy or strategy that suits their unique situation, but important questions men and women should ask themselves and their partners before the wedding are:

- What is in your credit report?

- Are you carrying any credit card debt?

- Do you consider yourself a spender or a saver? Why?

- Do you consider your partner a spender or a saver? Why?

Four Questions About Money Couples Need to Answer Before the Wedding

Where Does the Money Go Each Month?

Talk to your partner about your monthly bills and spending habits whether or not you have combined some or all of your finances before the wedding. Taking a good look at where your money goes each month is a healthy discussion for any couple planning to get married as well as a healthy long-term habit for families.

How Does Debt Make You Feel?

Talk to your partner about debt—actual debts and feelings about debt. Every person’s overall tolerance for debt and ability to manage debt is a matter of personal opinion, values and varying financial knowledge. You and your partner will benefit by discussing and understanding your differences.

- Aspirational debt can include such things as a home mortgage or a student loan. When these types of debts are thoughtfully planned, they can help couples build a better quality of life. But you should realize that a high quality of life is different from living a better lifestyle than you can afford.

- Consumer debt can be detrimental for young couples, but that does not mean you should never carry a balance on a credit card. It is quite reasonable for those with background knowledge about compound interest rates to use a short-term line of credit to purchase a durable item such as an appliance or mattress. That is because an appliance or mattress is likely to last many years, so you are merely spreading the cost of a durable item across more years of its useful life. That’s a common business practice. But there is a limit to how long you should carry a balance for these items and you should only buy large items that you can afford comfortably within a short and defined payoff period.

When Can We Tap Our Savings?

Talk to your partner about any savings or investments either of you bring into the marriage. Discuss the expectations each person has for the use of savings or its long-term growth potential for supporting your children’s educations or planning for retirement. Define the types of emergencies that might be cause to use money in savings in the short term. Define the types of broad expenditures or investments—such as a down payment on a house or a special vacation—that might warrant tapping savings.

Think about what you would do if a close family member or friend fell on hard times and asked to borrow from your savings. Having a plan and presenting a united front can help a couple when facing a challenging social and emotional situation.

Which Laws Apply to Combining Debts, Income and Savings When Married?

Different laws about combining finances and creating joint accounts for married couples apply in different states. The laws that will apply to your marriage depend on the state where you are “domiciled.”

According to the Internal Revenue Service (IRS), some of the factors considered in determining domicile include:

- Where you pay state income tax

- Where you vote

- Location of property you own

- Your citizenship

- Length of residence

- Business and social ties to a community

Can marriage survive financial infidelity? Let us know your thoughts.

(Writing by Annette; Graphic Design by Marco)

Annette O'Connor is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Annette O'Connor at annette@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Read Next: