Survey: Tax Paying Statistics

Few Taxpayers Will Use Credit Cards to Pay Their Taxes

Although a number of third-party companies are now offering to let taxpayers settle their tax bills with credit cards instead of cash, a CreditDonkey.com survey suggests that this is an idea whose time has not yet come.

Of those respondents who expect to owe additional taxes on their 2012 income (12.4%), only 21 people plan to pay with plastic

The downside of paying taxes with a credit card is the ‘convenience fee’, ranging from 1.88% to 2.35%, that the companies charge to process tax payments with a credit card. Still, many taxpayers who owe more than they expected might have little choice but to use their card and take their time paying back the taxman.

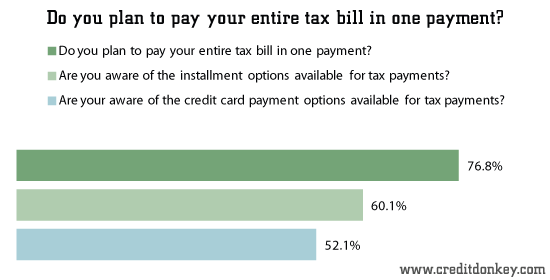

Almost 77% of the survey respondents who think they’ll owe money to the IRS plan to settle that bill with a single cash payment, even though 60.1% are aware of the installment options for tax payments and 52.1% realize they could pay with a credit card. Only 23.2% of those owing taxes plan to take advantage of any type of installment plan.

|

| Do you plan to pay your entire tax bill in one payment? © CreditDonkey |

Of the poll’s “lucky” respondents (those expecting refunds), most already have plans for the anticipated windfalls:

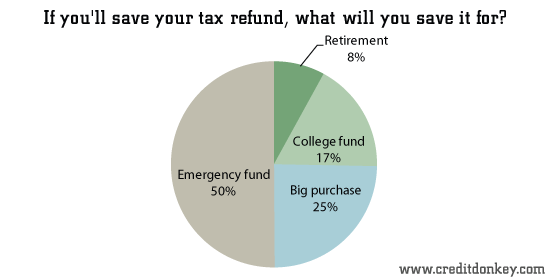

56.1% plan to put the money away for a “rainy day.” Among the savers, 8% will set aside the money for retirement, 17.3% will put it toward a college fund, 24.6% will save for a big purchase, and 50.1% will put the money into an emergency fund.

|

| If you'll save your tax refund, what will you save it for? © CreditDonkey |

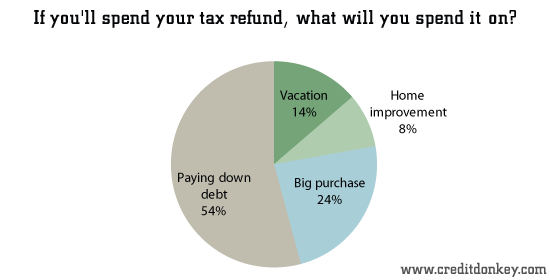

Among those who plan to spend the refund, 13.7% will use it for a vacation, 8.5% for home improvements, 23.6% for a big purchase, and 54.2% for paying down their debt.

|

| If you'll spend your tax refund, what will you spend it on? © CreditDonkey |

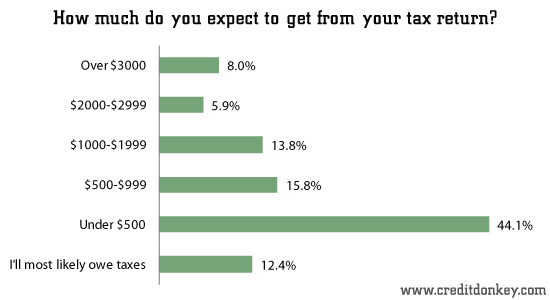

44.1% of those surveyed expect a refund of less than $500, 15.8% anticipate a refund of $500 to $999, 13.8% expect $1,000 to $1,999, and 13.9% plan to receive a check for more than $2,000.

|

| How much do you expect to get from your tax return? © CreditDonkey |

If you do owe taxes, there are ways to cut your losses – and even come out a little ahead.

If you have a credit card that requires a high spending minimum to qualify for extra bonus points, a high tax bill could easily cover that amount. You could also pay with a new card that offers a 0% introductory APR for a set period. That way, in exchange for the convenience fee, you’ll receive some interest-free breathing room for a while.

From January 15 to January 22, 2013, CreditDonkey surveyed 1,109 people on the subject of personal income taxes.

Charles Tran is the founder of CreditDonkey, a credit card comparison and reviews website. Write to Charles Tran at charles@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.