E*TRADE Review: Pros and Cons

E*TRADE is a highly well-known name, but does that mean it is better than its competitors? Read our in-depth review and see how it compares.

Overall Score | 4.2 | ||

Stock Trading | 4.0 | ||

Options Trading | 4.0 | ||

Banking | 3.0 | ||

Mobile App | 5.0 | ||

Commissions and Fees | 3.5 | ||

Ease of Use | 5.0 | ||

Online Community | 4.0 | ||

Research | 4.0 | ||

Trading Platform | 5.0 | ||

Pros and Cons

- Expansive set of resources and tools

- Easy to use website

- Industry leader

- Trade fees

Bottom Line

Online broker with one of the best user interfaces

If you've watched any TV at all in the last few years, it's highly likely that you've come across a commercial for E*TRADE. Unlike some of its major competitors, E*TRADE is a highly advertised and fairly well known online brokerage, even outside financial circles.

But does the fact that it's such a recognized name mean it's that much better than its competitors?

Long-term, low-frequency traders and beginners will probably appreciate the investor guidance tools and access to help from live financial professionals.

Before we dive into the detailed review, let's go over the pros and cons.

Benefits: Why We Like It

- Beginner Friendly: E*TRADE's website is easy to navigate and has a great built-in investor education center. There's also the option to reach out to a broker or even open a managed portfolio with a financial advisor if you want to take a more hands-off investment approach. All this makes E*TRADE an easy-to-use online trading platform for even the most novice of investors.

- Breadth of Services: E*TRADE is pretty much a one-stop shop for financial services. Besides a large spectrum of investments ranging from stocks and bonds to ETFs and mutual funds, you can also open and maintain checking accounts and IRAs, and even apply for a mortgage.

- Tools: All traders have access to the basic research center, which features real-time quotes, interactive charts, and even tax advice. More active traders (30+ trades per quarter) are automatically upgraded to the E*TRADE Pro platform. This gives you additional tools like customizable watch lists, which centralizes all your investments and trading information into one place. E*TRADE Pro also comes with extended trading hours that begin at 7am EST.

Disadvantages: Why You Might Want to Look Elsewhere

- Account Minimums: You need a minimum of $500 to open a robo advisor account on E*TRADE. This isn't such a huge deal, but there are quite a few other online robo advisor services that have no account minimum for simple investments.

Other Investing Promotions You Should Not Ignore

J.P. Morgan Self-Directed Investing - Get Up to $1,000

- NEW! Get a cash bonus up to $1,000 when you open and fund a J.P. Morgan Self-Directed Investing account.

- $1,000 when you fund with $250,000 or more

- $325 when you fund with $100,000-$249,999

- $150 when you fund with $25,000-$99,999

- $50 when you fund with $5,000-$24,999

- Bank with Chase. Invest with J.P. Morgan. Get the best of both worlds on the Chase Mobile® app or chase.com.

- Choose from stocks, ETFs (from index funds to cryptocurrency), options, mutual funds, money market funds, treasuries and more.

- Get unlimited commission-free online trades.

- Choose an account that's right for you: General Investing, Traditional IRA or Roth IRA.

- Access our secure, easy-to-use trading experience online or through the Chase Mobile® app.

- Our powerful tools and resources are built to help you take control of your investments.

- Rollover your retirement accounts and keep track of your investments in one place.

INVESTMENT AND INSURANCE PRODUCTS ARE:

Transfer and Earn Up to $5,000 Bonus

Enroll your new eligible TradeStation account in this offer either by using promo code BDEVAGFG on your new account application or by requesting to enroll, via telephone, with a TradeStation Representative. Within 45 days of account enrollment, fund your account with at least $500. Maintain at least $500 in your account for 270 calendar days. New assets will be aggregated during the 45-calendar day period following the enrollment date to determine the amount of your cash offer.

| New Assets | Cash Bonus |

|---|---|

| $500 - $24,999 | $50 |

| $25,000 – $99,999 | $250 |

| $100,000 – $199,999 | $400 |

| $200,000 – $999,999 | $800 |

| $1,000,000 – 1,999,999 | $3,000 |

| $2,000,000+ | $5,000 |

Who E*TRADE Is Best For

|

| © CreditDonkey |

E*TRADE is a useful platform for investors along all experience levels who want to open stable, long-term investment accounts.

If you're someone who plans to make a few stock, mutual fund, or ETF purchases and hold them, E*TRADE is an easy-to-navigate, user-friendly platform that provides you with all the information and tools you need. Business News Daily even listed E*TRADE as one of the top three "do-it-yourself" brokerages.

E*TRADE FEES EXPLAINED

|

Here are a few of the fees that are significant to online investors:

- Stocks, Options and ETFs: $0 per trade (plus $0.65 per options contract). If you make over 30 trades a quarter, $0 per trade (plus $0.50 per options contract)

- Bonds (secondary): $1 (minimum $10, maximum $250)

- Broker-Assisted Trades: $25 added to fee

- Mutual Funds: $19.99 (no fees for no-load, no-transaction fee funds)

- Professional Managed Investments: Annual advisory fee plus $25,000 minimum investment

Opening the account: There is no minimum deposit to open a brokerage account. If you want to get a diversified portfolio that's monitored and managed, E*Trade's Core Portfolios robo-advisor service has a low annual advisory fee of 0.30% and $500 minimum initial investment.

Always keep in mind that there are numerous other applicable fees, including those in conjunction with retirement funds and banking. The CreditDonkey comparison of E*TRADE with other top discount brokerages will help you gauge how E*TRADE's fees fare in the competitive market.

If you want to go with a low-cost online broker, check out Ally Invest. Ally does not require a minimum account balance.

E*TRADE RESEARCH

We really like E*TRADE's website, as it's loaded with helpful resources unavailable on other sites. E*TRADE's research, tools, and guidance are second to none. You'll find grids, easy-to-read fee charts, tax advice, and downloadable forms - all laid out in a user-friendly interface.

Where E*TRADE really excels is with its real-time market streaming, an invaluable asset for any investor. While you don't exactly feel like you're on the market floor, there's still a bit of a rush watching your stocks move (hopefully upward) while it's happening.

E*TRADE PRO Review

Those who want even more intensive tools and a more customizable experience could benefit from using E*TRADE Pro.

Let's say you're a novice investor who has made a little cash and got caught up in the frenzy of the market. Your trading has increased, and before you know it, you're making multiple trades a month. This is when you've hit the "big-time" as far as E*TRADE is concerned. You're rewarded with access to the E*TRADE Pro platform, which is automatically available for free to active traders who make at least 30 stock or option trades per quarter.

This more sophisticated, customizable desktop platform has technologically advanced trade tools that are not available on the basic brokerage site. And if you're trading at that level, you'll appreciate these additional tools designed to assist in positioning you as optimally as possible in the market.

Among its advantages, E*TRADE Pro offers:

- extended hours for trading, beginning at 7 a.m. EST

- real-time technology that allows you to track the top performing sectors and industries as they're happening

- ability to create customized streaming lists of specific stocks you're interested in, so you don't have to wait for the board to scroll through countless ticker symbols that you don't care about

- ability to chart risks

Please note: while E*TRADE rewards its active investors with the bells and whistles of Pro, it doesn't eliminate your fees. You still pay the standard per trade fees, plus $25 for any broker-assisted trade. You'll also be charged an additional $0.005 per share for any extra-hours trading.

PENNY STOCKS

|

If you've seen The Wolf of Wall Street, you've heard of penny stocks and have seen the big payday they can offer, as well as their downside. Because penny stocks can take some finesse and a deft hand to trade, they're not for everyone.

The Securities and Exchange Commission defines a penny stock (also known as an over-the-counter, bulletin board, or Pink Sheet stock) as any common stock trading under $5/share. With their extreme cheapness comes risk. In fact, not all online brokerages will allow you to trade them.

E*TRADE does, but with caveats.

First off, only limit orders (set buy and sell prices) are allowed. Short selling (trading on a borrowed stock) is not allowed, and you can't trade any stock with a market value of less than $10/share until seven business days after your account application is approved. If you need assistance on a penny stock trade, you can call customer service, but keep in mind you'll be charged that $25 fee for a broker-assisted trade.

BANKING

|

E*TRADE is not only a brokerage, it's also an FDIC insured bank. There are two types of checking accounts you can open:

- For a non-interest bearing checking account, a $100 minimum deposit is required; there are no minimum balance requirements, no monthly fee, and a free debit card. You get free, unlimited online bill payment and unlimited transactions, as well as unlimited ATM refunds for withdrawals. This is a real plus.

- E*TRADE's Max-Rate checking account is an interest earning account. You have to keep a monthly balance of at least $5,000. There is a fee of $15/month for this account, but you can get it waived if you set up one direct deposit of at least $200/month, keep a total combined balance of $50,000 or more across all your E*TRADE accounts, or execute at least 30 trades per quarter. If you do a lot of business with E*TRADE and have a fair amount of money deposited with them, the Max-Rate checking account seems like a good option.

E*TRADE IRA

|

It's never too early to start saving for retirement, and IRAs (Individual Retirement Accounts) make it possible to accumulate the wealth you need in addition to the 401(k) you get from your employer.

E*TRADE is a good place to start your first IRA investment because there are no annual fees and no account minimums. It offers several types of IRAs, including Traditional, Rollovers, and the Roth IRA. You also get many low-cost options, including 1,300 no transaction fee mutual funds and over 200+ commission-free ETFs.

MANAGED PORTFOLIO

If you're still a little green at investing and want some assistance, you have the option of using a professional financial advisor. E*TRADE offers a Capital Management team to help you diversify your investments and gear them towards your specific needs.

They charge on a prorated basis, based upon your portfolio's worth. Despite the fee, it might be worth utilizing, especially if you're not a financial whiz and find the whole thing overwhelming. But be aware, if you do go with an E*TRADE advisor, you can't make trades on your own anymore.

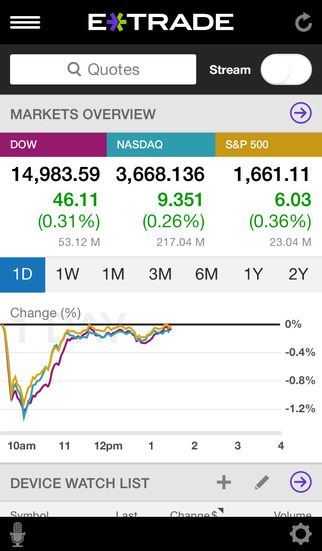

E*TRADE MOBILE APP

|

The E*TRADE free mobile app is available on both Apple and Android devices, and will essentially allow you to make trades while you're getting breakfast at the drive-thru.

You can also manage your accounts and get free real-time quotes, news, and charts. If you're on the go and see a company you're considering investing in, the mobile app allows for barcode scanning to access information about the company. It also has voice recognition (an online brokerage "Siri," if you will) and lets you make mobile check deposits into your E*TRADE account.

Some services, such as Bill Pay, are available on smartphones but not their tablet counterparts, so be sure to check E*TRADE's website to see what applications can be performed on your preferred device.

Pros and Cons of E*TRADE

We're nearing the end of the review now, so before we get onto comparisons with other online brokerages, let's recap the pros and cons.

Pros:

- Expansive set of resources and tools

- Clear, easy-to-use website

- Industry leader

Cons:

- Might have too many options and overwhelm people

- Branches are not available in every state

How It Compares

E*TRADE vs TD Ameritrade:

Ameritrade offers a great trading platform and research offerings that will suit more experienced investors.

E*TRADE | TD Ameritrade | |

|---|---|---|

Benefits and Features | ||

| Stock Trading | $0 commission for online stock, ETF, and option trades | |

| Options Trading |

| |

| Annual Fee | ||

| Minimum Deposit | $0 for self-directed brokerage accounts; Managed portfolios start at $500 minimum | |

| Mutual Fund Trading | $0 for no-load, no-transaction-fee funds; $19.99 for transaction-fee funds | Up to $49.95 or $74.95 for buys. $0 for sells |

| Commission Free ETFs | ||

| Live Chat Support | ||

| Penny Stocks | ||

| Broker Assisted Trades | ||

| Inactivity Fee | ||

| Maintenance Fee | ||

| Online Platform | ||

| Banking | Checking account offers no minimum balance requirements, free online bill pay, and unlimited debit card and check transactions. | Cash Management account offers free ATM withdrawals, no monthly maintenance fees, free online bill pay, and free check writing. |

| Mobile App | ||

| Desktop App | Power E*TRADE Pro (requires you to execute at least 30 trades during a calendar quarter or maintain brokerage account balance of at least $250,000) | |

| Forex Trading | ||

| Futures Trading | $1.50 per contract, per side + fees (excluding bitcoin futures) | $2.25 per contract (plus exchange & regulatory fees) |

| Bond Trading | ||

| CFD Trading | ||

| Currency Trading | ||

| Customer Service | ||

| Locations | More than 100 locations in 34 states | |

| Seminars | ||

| Trading Platform | ||

| Virtual Trading | ||

| Stock Trading | ||

| Options Trading | ||

| Banking | ||

| Mobile App | ||

| Commissions and Fees | ||

| Ease of Use | ||

| Online Community | ||

| Research | ||

| Trading Platform | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. E*TRADE: Pricing information from published website as of 11/18/2025. TD Ameritrade: Pricing information from published website as of 09/05/2023. | ||

TD Ameritrade: Commission-Free Trading - Online Stock, ETF and Option Trades

Applies to U.S. exchange-listed stocks, ETFs, and options. A $0.65 per contract fee applies for options trades, with no exercise or assignment fees.

E*TRADE vs Fidelity:

Fidelity is another great comprehensive online brokerage offering a wide range of services and in-depth research.

E*TRADE | Fidelity | |

|---|---|---|

Benefits and Features | ||

| Stock Trading | ||

| Options Trading |

| |

| Annual Fee | ||

| Cryptocurrency Trading | ||

| Minimum Deposit | $0 for self-directed brokerage accounts; Managed portfolios start at $500 minimum | |

| Mutual Fund Trading | $0 for no-load, no-transaction-fee funds; $19.99 for transaction-fee funds | |

| Commission Free ETFs | ||

| Penny Stocks | ||

| Broker Assisted Trades | ||

| Inactivity Fee | ||

| Maintenance Fee | ||

| Banking | Checking account offers no minimum balance requirements, free online bill pay, and unlimited debit card and check transactions. | |

| Mobile App | ||

| Desktop App | Power E*TRADE Pro (requires you to execute at least 30 trades during a calendar quarter or maintain brokerage account balance of at least $250,000) | |

| Futures Trading | $1.50 per contract, per side + fees (excluding bitcoin futures) | |

| Customer Service | ||

| Trading Platform | Desktop, Web Trading, Mobile Apps | |

| Virtual Trading | ||

| Fractional Shares | ||

| Stock Trading | ||

| Options Trading | ||

| Banking | ||

| Mobile App | ||

| Commissions and Fees | ||

| Ease of Use | ||

| Online Community | ||

| Research | ||

| Trading Platform | ||

| Savings | ||

| Fees | ||

| Customer Service | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. E*TRADE: Pricing information from published website as of 11/18/2025. Fidelity: Pricing information from published website as of 07/05/2024. | ||

E*TRADE vs Ally:

Both E*Trade and Ally Invest offers stock trades with no minimum deposit. E*Trade has a $500 minimum deposit for Core Portfolios, E*Trade's robo-advisor service.

E*TRADE | Ally Invest | |

|---|---|---|

Benefits and Features | ||

| Stock Trading | ||

| Options Trading |

| |

| Annual Fee | ||

| Minimum Deposit | $0 for self-directed brokerage accounts; Managed portfolios start at $500 minimum | |

| Mutual Fund Trading | $0 for no-load, no-transaction-fee funds; $19.99 for transaction-fee funds |

|

| Commission Free ETFs | ||

| Penny Stocks | $0.01 per share on the entire order for stocks priced less than $2.00. | |

| Broker Assisted Trades | ||

| Inactivity Fee | ||

| Maintenance Fee | ||

| Banking | Checking account offers no minimum balance requirements, free online bill pay, and unlimited debit card and check transactions. | Integrated with banking on ally.com. Manage your Ally banking and investment accounts in one place. |

| Mobile App | ||

| Desktop App | Power E*TRADE Pro (requires you to execute at least 30 trades during a calendar quarter or maintain brokerage account balance of at least $250,000) | |

| Forex Trading | ||

| Futures Trading | $1.50 per contract, per side + fees (excluding bitcoin futures) | |

| Customer Service | ||

| Trading Platform | ||

| Virtual Trading | ||

| Stock Trading | ||

| Options Trading | ||

| Banking | ||

| Mobile App | ||

| Commissions and Fees | ||

| Ease of Use | ||

| Online Community | ||

| Research | ||

| Trading Platform | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. E*TRADE: Pricing information from published website as of 11/18/2025. Ally Invest: Pricing information from published website as of 02/20/2026. | ||

BOTTOM LINE: Why Use E*TRADE

You get what you pay for, and in E*TRADE's case, you get a lot. More than just a discount brokerage, E*TRADE borders on being a full-service financial institution, with many options at your disposal. It can assist you in developing from a beginner to an active investor. At the same time, realize there is no such thing as "get rich quick"; you can and will likely lose money when you invest in riskier products, like stocks, so you need to tread carefully, know your risks, and, as always, do your homework.

Fund and Get 4% Match Bonus

Enroll in this offer, and transfer or deposit $100,000 or more to your Webull account. Maintain a total net qualifying funding amount of $100,000 or more until the payment date of the final installment of the match bonus. The match bonus will be paid in 6 installments. The first installment will be issued on or about May 15, 2026.

Transfer and Earn Up to $5,000 Bonus

Enroll your new eligible TradeStation account in this offer either by using promo code BDEVAGFG on your new account application or by requesting to enroll, via telephone, with a TradeStation Representative. Within 45 days of account enrollment, fund your account with at least $500. Maintain at least $500 in your account for 270 calendar days. New assets will be aggregated during the 45-calendar day period following the enrollment date to determine the amount of your cash offer.

| New Assets | Cash Bonus |

|---|---|

| $500 - $24,999 | $50 |

| $25,000 – $99,999 | $250 |

| $100,000 – $199,999 | $400 |

| $200,000 – $999,999 | $800 |

| $1,000,000 – 1,999,999 | $3,000 |

| $2,000,000+ | $5,000 |

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Write to Cynthia Cohen at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next:

Compare: