Ghost of Christmas Could Haunt Average American for 4 Years

How to manage holiday debt repayment to avoid the ghost of Christmas

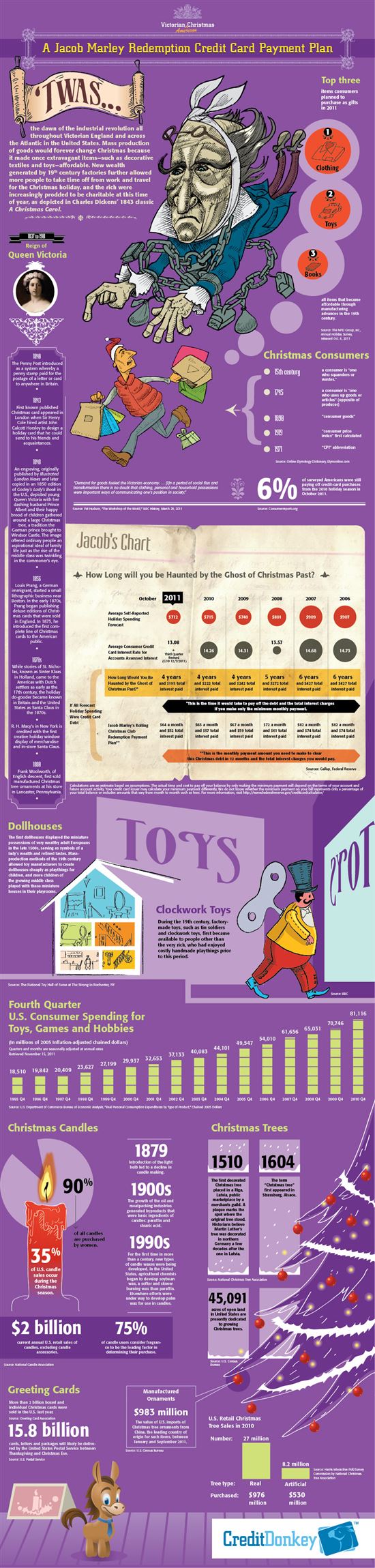

The average American could be haunted by the ghost of Christmas for the next four years and pay $195 in interest charges on holiday debt if he or she pays only a minimum monthly credit card payment.

|

| Infographics: Ghost of Christmas 2011 © CreditDonkey |

“Americans spend quite a bit using credit cards around the holidays,” said Charles Tran, founder of CreditDonkey.com, a credit card comparison. “But they don’t always recognize the negative implications of only making minimum bill payments.”

The “Jacob Marley Christmas Debt Chart,” developed using data compiled separately by Gallup and the Federal Reserve, is designed as a tool to educate consumers about wise use of credit cards at the holidays. The chart estimates an average American consumer needs to add about $64 a month to his or her regular credit card payment to clear this year's holiday debt in time for next year's Christmas.

The estimates are surrounded by images and data that put Christmas celebrations in the historical context of Charles Dickens’ Victorian England, the dawn of the industrial revolution when religious, social and consumer traditions became the foundations of the holiday most Americans know today.

Taking data from Gallup’s monthly survey of consumers about their planned holiday spending and applying to that the Federal Reserve’s average credit card interest rate (13.08% APR for accounts assessed interest in Q3 as of December 7, 2011), the chart creates a prototypical American consumer and projects how long it would take him or her to clear holiday debt by making minimum credit card payments. For comparison, the chart also calculates an alternative monthly payment sufficient to clear the same debt in 12 months.

While few people today plan far enough ahead to put a monthly deposit in a segregated, interest-bearing Christmas Club account, consumers still can strategically amortize the cost of Christmas 2011 across 12 months and minimize the interest they pay. The Jacob Marley Christmas Debt Chart shows young consumers how to develop and manage their own rolling Christmas Club using credit.

“A strong fourth quarter is always good for the American economy, but it’s never good when consumers come out of the holidays loaded down with unmanaged debt,” said Tran. “We’re suggesting people pick up some of the old habits of discipline and apply them to convenient new credit tools to participate more productively in a healthier economy.”

How are you managing your holiday debt?

Annette O'Connor is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Annette O'Connor at annette@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.