Holiday Shopping Trends: Save Money

Make the most out of your holiday shopping

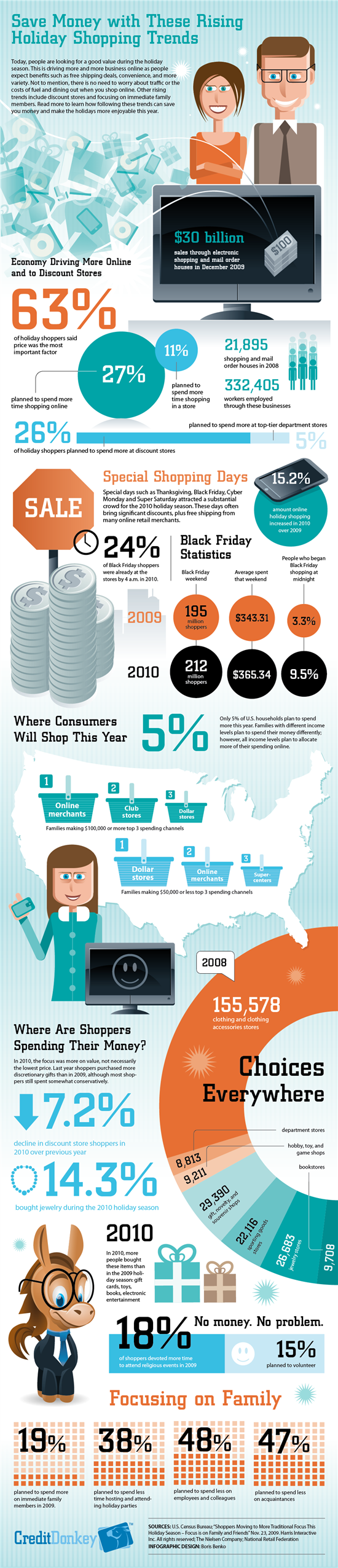

More Americans are looking for a good value this holiday season. This is driving consumers online as people expect benefits such as free shipping deals, convenience and more variety. Not to the mention, there is no need to worry about traffic or the cost of fuel and dining out when you shop online.

Other rising trends include discount stores and focusing on immediate family members. Read the infographic below to learn how following these trends can save you money and make the holidays more enjoyable this year.

|

| Infographics: Holiday Shopping Trends © CreditDonkey |

The statistics above show that many shoppers will spend more at discount stores this year. Online holiday shopping also continues to grow each year. Here is a summary of how consumers are saving money during the holidays in these tough economic times:

- Focusing their spending on immediate family members and less so on coworkers and acquaintances

- Saving on travel, dining out, and taking advantage of deals and free shipping by shopping online

- Shopping on special shopping days when stores have good deals

- Arriving at stores earlier to take advantage of Black Friday specials

- Spending more time on religious services and family activities

- Spending less money attending and hosting holiday parties

- Giving back by volunteering

Preventing Fraud

Usually, credit cards offer more security and protection than debit cards. Consider using a credit card instead of a debit card this holiday season.

Fraud Tips for the Holidays

- Do not give out any account information to fraduluent sources that call you or email you. During the holidays, callers and emailers often pose as banks, retailers, credit card companies, and even charities to swindle unsuspecting consumers.

- Make sure gift card offers are legitimate. Scammers often email fake gift card offers during the holidays. If it looks too good to be true, it probably is.

- Keep your account information private, and only share it when necessary.

- Shred all documents containing your account information, whether it is banking, credit/debit or other financial information. Better yet, consider opting to receive your statements electronically.

- Review your credit report. You are entitled to a free credit report annually.

- Review your credit card statements regularly to make sure there are no fraudulent purchases. If there is, learn how to dispute a credit card charge.

- If your credit card is lost or stolen, report it immediately.

Kelly Teh is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Kelly Teh at kelly@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.