Infographic: Ebooks Statistics

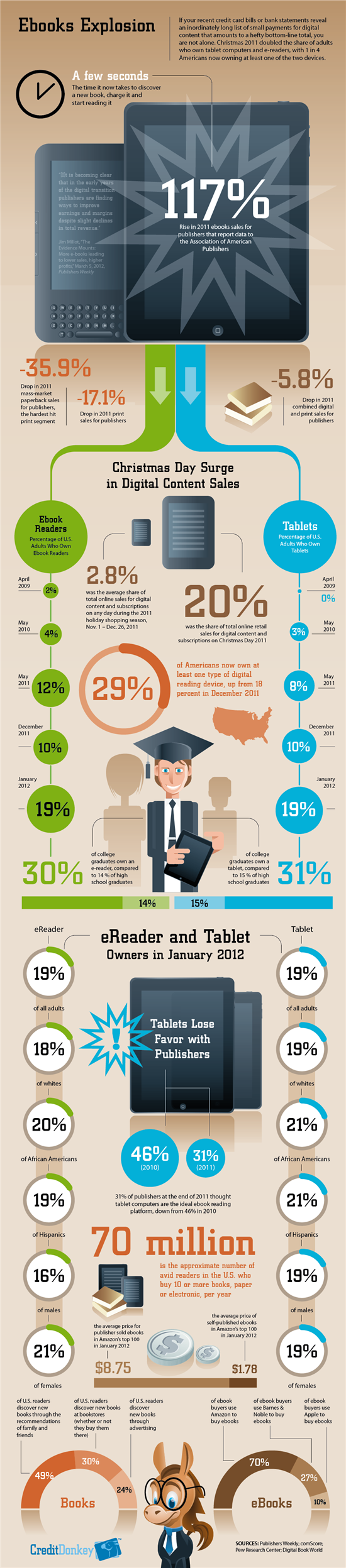

Americans are finding their credit card bills and bank statements riddled with a mounting tab of new charges for digital books after sales of eReaders and tablets exploded at the end of last year.

|

| Infographics: eBooks Growth © CreditDonkey |

The recent explosion in sales of digital ebooks is rearranging the world of publishing faster than many people anticipated. The roles of consumers, sellers, readers, writers and industry gatekeepers likely will be totally reshaped in the next few years in much the same way the arrival of digital music upended the recording industry.

“We now have a growing virtual economy of non-tangible digital goods on one hand and non-tangible digital payment systems on the other,” remarked Charles Tran, founder of CreditDonkey.

Highlights

- 1 in 4 Americans now owns an eReader or tablet (Pew Research)

- Sales of ebooks increased 117 % in 2011 (Association of American Publishers / Publishers Weekly)

- Publishers are seeing decreased overall revenue, yet profits are up because digital books cost less to produce

- Authors can now market their work directly to the 70 million avid readers in the United States (Verso Digital / Digital Book World)

- $1.78 was the average price of self-published books in Amazon’s top 100 for the month of January 2012, compared to the $8.75 average price for publisher sold books on the same bestseller list

Credit Card Tips for Avid Readers

Intellectual Crack—Book lovers who have had a hard time controlling their buying impulses need to recognize digital media purchases as a potential budget threat that can cause them to make unwise spending decisions when they are most vulnerable: tired, bored, anxious or lonely. Small micropayments can add up and significantly increase credit card debt if they are combined with minimum balance payments each month. The worst-case scenario for any consumer is carrying any amount of credit card debt for ebooks long after they have been read. Digital music, in contrast, has a bit of a shelf life if it is replayed, but it is still foolish to pay interest on it.

Free Mind Candy—Smart book readers, on the other hand, will recognize ways to make credit card rewards work in their favor and pay for the new expense of building their digital libraries. They can use a premium rewards credit card for everything they buy and pay their balance in full each month, racking up rewards credits—digital money that can be used for digital mind candy. Those who carefully budget monthly expenditures can easily estimate their rewards and stick to a digital media budget. That budget can go a long way, especially for those avid readers who take the time to discover and enjoy low-cost but high-interest self-published books.

There’s an App for That—Whether you are dangerously addicted to intellectual crack or enjoying free mind candy with digital rewards money, inexpensive apps can help with budgeting, tracking purchases and paying bills to manage your digital payments and digital media.

Security is Paramount for Digital Media Accounts

Readers of ebooks variably use credit, debit, bank account transfers and online payment systems as their payment method of first choice in their accounts. But in the shifting landscape of virtual payment systems and intangible goods, security should be a primary consideration.

Credit Cards

- Offer consumers a high level of fraud protection. Depending on your card, you may enjoy 100 percent protection from fraud or theft as well as other merchandise protections.

- Provide relatively easy methods of disputing overcharges or errors without added expenses.

- Help build your credit reputation if you pay your bills on time and avoid racking up debt.

- Provide rewards that can be converted into revenue to support your new digital media expenses.

- Expose users to a risk that they will spend more than they earn, amass debt and suffer significant financial hardships in the short and long term.

Bank Account Debit Cards

- Protect consumers from spending more than they have.

- Offer some protections from fraudulent charges based on your card’s limitations, but debit cards do not, generally, offer the level of fraud protection available to credit card holders.

- Expose users to overdraft charges if they exceed their available bank balance.

- Offer little support to build a good credit record and can hurt your credit record if you do not quickly resolve overdrafts.

Prepaid Debit Cards

- Protect consumers from spending more than they earn and from accruing overdraft charges.

- Avoid exposure of bank account numbers to potential fraud.

- Offer little to support a good credit record but cannot hurt your credit record because overdrafts are not possible.

Online Payment Systems

- Provide users a secure link to their bank accounts, debit cards or credit cards, and, in many cases, transactions are covered by 100 percent fraud protection.

- Allow users to choose a method of payment at the time of checkout.

- Expose users to fees, charges, and overspending noted previously depending on the method of payment used on any given transaction.

- Expose users possibly to some risk based on the sellers’ data and security protections.

Wireless Plan

- Allow cell phone and tablet users to purchase digital goods and charge them to their monthly bill or prepaid phone account.

- Fraud protections vary depending on their wireless carrier's policies.

- Expose users to fees, charges, and overspending.

(Writing by Annette; Graphic Design by Boris)

Annette O'Connor is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Annette O'Connor at annette@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.