Your Refrigerator Can Provide Cold Hard Lessons in Personal Finance

Shoppers of all incomes, backgrounds and lifestyles agree on one thing: cold food storage

Buying a refrigerator is likely the only big-ticket consumer shopping experience all Americans universally will share at some point in their adult lives, based on government data showing that this commonplace appliance is used by 99.8 percent of the households in the United States. Although it may seem simple at first, purchasing a refrigerator requires careful consideration of not only its features but how you are going to finance the purchase.

|

| Infographics: Appliances © CreditDonkey |

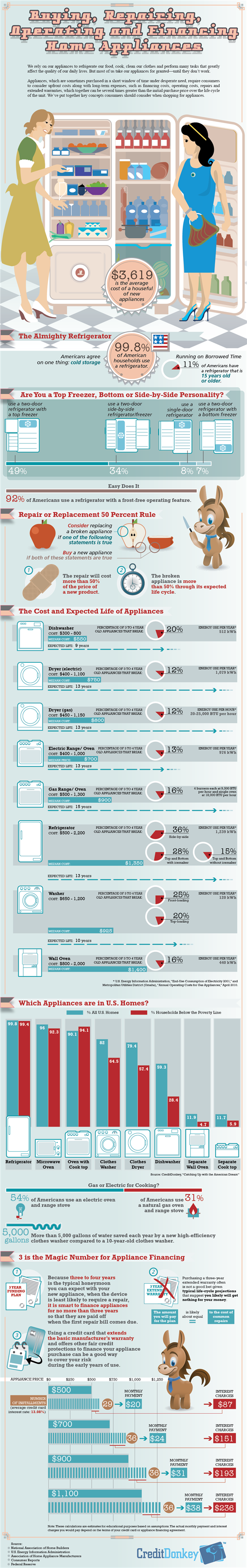

Painting a picture of all the financial considerations involved in buying home appliances, which last a long time but require consumers to consider ongoing operating expenditures as well as repair costs, is a good foundation to help consumers examine the benefits and features of various credit or financing options in the context of a purchase they are likely to make at some time in their lives.

The infographic shows consumers:

- Data about the types and features of appliances in American homes

- A range of prices for the most common appliances

- Expected years of useful life

- Reliability data

- Annual energy usage

- A three-year amortization schedule

Three Years is the Maximum Period to Finance any Appliance

If you have not been socking away money on a monthly basis to replace your refrigerator, this may be a big expense to cover with cash when it needs to be replaced. And, because it is not reasonable to live without a refrigerator for too long, many of us are likely to find ourselves needing a new refrigerator quickly at some point in our lives. And this is where a financing plan or credit card can come in handy.

Despite the general mantra that all responsible people should pay off their entire credit card balance each month, it is quite responsible to use a short-term line of credit to purchase a refrigerator and carry a balance from this purchase over time. That is because a refrigerator is likely to last many years and you are merely spreading the cost of a durable item across more years of its useful life. That’s a common business practice.

But there is a limit to how long you should carry a balance for an appliance. In the first place, you should calculate your exposure to interest charges when you purchase the item. That will help you choose an appliance you can afford as well as analyze the value of particular sales promotions or pricing differences.

Almost as important as calculating your interest charges, you should consider the lifecycle data for contemporary appliances that suggest you should only count on about three years of repair-free performance. In some cases, well-made devices will go much longer than that before they malfunction, but the data generally suggests you are on borrowed time with any appliance after about three years. After that, your exposure to the risk the appliance will need to be replaced increases each year, and you may need to pay for repairs. That’s why three years is a good upper limit guideline to any financing plan for an appliance.

Extended Warranty

Another feature of some contemporary credit card plans is an extended warranty option, which, along with other fair credit protections provided by credit cards, could be a good way to cover the small risk of a malfunction in the first years of appliance use. Check with your credit card company to understand the warranty that may be included.

Many major appliances today carry only a one-year manufacturer’s warranty on parts and service, and consumers are often pushed to purchase an extended plan at the time of the sale. Conventional wisdom and lifecycle data suggest that purchasing an extended warranty that covers three or fewer years is not a good bet because appliances are unlikely to break down during that period. There are exceptions: refrigerators with icemakers, which are the appliances most likely to malfunction within three years of purchase, according to Consumer Reports consumer survey data. Front-loading washers are the next most likely to need a repair after a few years of use, but 75 percent of them do not break down in the first three to four years.

Bottom Line

A refrigerator can be an expensive item, and chances are you will need to finance it. Although it’s important to decide on the features you want, also keep in mind the cost involved and how you are going to pay for it. In summary:

- Calculate your monthly payment based on a three-year repayment window as you consider your monthly budget based upon the various brands and price ranges.

- Don’t buy an appliance you cannot pay off in three years.

- Consider using a credit card that allows you to break up your debt into pieces and set up individual amortization plans for big-ticket items.

- For most refrigerators, an extended warranty covering only its first three-four years is not worthwhile.

Annette O'Connor is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Annette O'Connor at annette@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.