Term vs Whole Life Insurance

Term insurance is affordable, but expires. Whole life insurance is costly, but lasts for life and has a cash value. Which is best for you? Learn the difference.

|

When shopping for life insurance, the first step is to decide which type of insurance best fits the needs of you and your family.

There are three main differences between term and whole life insurance: length of coverage, investment component, and how much the insurance costs.

Term life insurance is generally less expensive than whole and provides coverage for a specific length of time. Whole life, on the other hand, provides lifelong coverage with an additional investment component.

With either policy, the benefit is guaranteed as long as you pay the insurance premiums.

Learn about the subtle differences between term and whole life, and how to know which is best for you.

- What is Term Life Insurance

- Pros and Cons of Term Life

- What is Whole Life Insurance

- Pros and Cons of Whole Life

- Whole Life Insurance & Retirement Planning

- Should I Get Term or Whole Life

- Best Term Life Companies

- Best Whole Life Companies

- How Much Life Insurance Do I Need

- Average Term and Whole Life Rates

What is Term Life Insurance?

|

| © CreditDonkey |

Term life policies are designed to cover you for a specific period of time, or a term. If you die during the term, the death benefit is paid to your beneficiary. If you're still alive at the end of the term, the policy expires.

The downside is that policy expiration means you're no longer covered. To avoid losing coverage, you can renew your policy (usually at a higher premium, since you're older), or convert to whole life insurance.

Greg Klingler, director of wealth management for the Government Employees' Benefit Association

What is a death benefit?

In the context of a life insurance policy, the death benefit is the sum of money that is paid to the beneficiary after the insured person passes away. Death benefits are usually paid out as a lump sum but can also be disbursed as payments.

Pros and Cons of Term Life

While many experts agree that term life insurance is a wise choice for most policy shoppers, it's still important to weigh the pros and cons. We cover these below.

Pros

- Policy is straightforward

- Level premiums

- More affordable

- Renewal is flexible

Cons

- Coverage is temporary

- Renewal results in higher premiums

- No investment portion

What is Whole Life Insurance?

|

| © CreditDonkey |

Whole life provides coverage for your entire life, or as long as you pay premiums. Upon your death, the death benefit is paid to your beneficiary.

In addition to a guaranteed death benefit, whole life policies also have a cash value component, which grows as premiums are paid and allows you to borrow from it if you need money. If you terminate the policy, you get the cash value amount.

Guaranteed Cash Life Insurance

Whole life insurance is also sometimes referred to as "guaranteed cash insurance". Unlike with term life insurance, you can grow the cash value of the policy (as long as you pay the insurance premiums).

The value of your whole life policy will grow at a low fixed rate set by the insurer. After a period of time, you might be able to pay your monthly premiums with the cash value you accumulate.

Term life insurance offers a guaranteed death benefit as long as you pay your premiums. However, it does not offer a cash value component that you can borrow against or withdraw money from.

Pros and Cons of Whole Life

While many insurance experts often advise against whole life insurance, it's important to make the decision for yourself. Read on for the pros and cons below.

Pros

- Lifelong coverage

- Cash value growth

- Level premiums

- Guaranteed death benefit

- Cash out at any time

Cons

- Expensive premiums

- Slow investment return

- More complex policy

- Higher fees

While lifelong coverage and cash value may sound appealing, whole life insurance isn't all it's made out to be. Lifelong coverage comes with a high price tag, and cash value accumulates relatively slowly. Instead, opt for a term life insurance policy and invest the money you save from the lower premiums.

Whole Life Insurance and Retirement Planning

Can your life insurance plan also account for your retirement? Whole life insurance builds cash value, providing you with a savings vehicle that you can use while you're alive.

However, if you're looking into a whole life policy to fund your retirement savings, you may want to reconsider. The returns on a whole life policy could be low compared to other long-term investments.

If you really struggle to contribute to your retirement savings, a whole life policy might be helpful. Just keep in mind that the returns will be modest.

Life Insurance and Estate Planning

If your children or other family members anticipate a significant estate tax after you pass away, you might be tempted to factor that into your life insurance coverage.

However, keep in mind that the value of the life insurance policy will be included when totaling the insured's assets and, ultimately, how much the heirs will pay in estate tax. Plus, the estate tax can change from year to year, making it difficult to estimate accurately.

The point of life insurance is to act as a financial safety net for your loved ones. If you're hoping to use the cash value of a whole life policy as your own safety net, keep in mind that your returns will be modest. Consider having a separate savings vehicle to depend on in the event of a financial emergency.

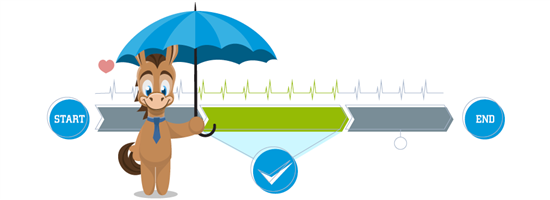

Should I Get Whole or Term Life Insurance?

|

| © CreditDonkey |

The best policy for you is the one that provides the coverage you need at a rate you can afford.

For most people, term life insurance fulfills these requirements. Plus, it's affordable.

Term Life Insurance is best for providing coverage…

- During times of high-cost living

- In the event of a partner's premature death

- Before children finish college or become self-sufficient

- If your mortgage consumes a large portion of the family income

Yes. In fact, it's smart to take out life insurance on the stay-at-home parent to cover the period of time until any children graduate from college. The cost of replacing the activities of a stay-at-home parent can be $100,000 a year.

Whole Life is a good choice for…

- Paying estate taxes after you die

- Covering funeral expenses

- Funding a business succession plan

- Providing lifelong care for a special-needs child

- Providing equal inheritance for multiple heirs

Some whole life plans provide options for both income and asset accumulation on a tax-deferred basis. These types of plans can be complicated. Talk to someone with expertise in creating these arrangements.

Best Term Life Companies

|

| © CreditDonkey |

When shopping for life insurance, it's easy to feel overwhelmed by all of your options. Here are a few term life companies that stand out from the crowd. Remember to get quotes from multiple companies to find the best rates.

Best for No-Exam Coverage - Haven Life

Haven Life only offers term life insurance and their application process takes place online.

Depending on your health info, you may qualify for their InstantTerm product. If so, no medical exam is required, and your coverage can begin immediately.

A.M. Best rating: A++

Best for Seniors - State Farm

Unlike many insurance companies, State Farm provides several term life options for seniors. Their Select Term product provides a 10- or 20-year policy for those between 45 and 65, while those over 75 can get a 10-year term.

Rates are level for the entire initial term, and the policy can be renewed annually up until the age of 95. Keep in mind that, if you choose to renew, your rates will increase.

A.M. Best rating: A++

Best for Competitive Rates - Protective

Protective, a subsidiary of Dai-ichi Life Holdings, Inc., insures over 8 million people and has over $862B in financial strength.

They offer a variety of policy options, including the Protective Classic Choice Term policy, with rates up to 49% less expensive than their competitors.

A.M. Best rating: A+

If your health has changed or you've taken up a dangerous hobby, consider converting to whole life policy at the end of your term.

If you are not sure about your health, try to buy replacement coverage before your term insurance expires. If you don't qualify for good rates, then convert your term insurance to whole life.

Keep in mind that whether you renew your term policy or convert to whole life, you'll likely pay higher premiums.

How Much Life Insurance Do I Need

|

| © CreditDonkey |

To calculate your potential coverage amount, follow these steps:

- Consider how many years you want coverage, then multiply your annual income by that number.

- To that, add any other financial obligations your policy will cover, including:

- Funeral costs

- Mortgages

- Student loans

- Credit card debt

- Medical bills

- Funeral costs

- Then, add the cost of any services would need to be replaced. This is particularly important for stay-at-home parents.

- Do you have any savings or life insurance through a current employer? If so, you'll want to subtract those totals from your determined policy amount.

Coverage Amount = (Coverage Years × Annual Income) + (Debt + Expenses) - (Liquid Assets + Savings)

Best Whole Life Companies

If you choose to purchase a whole life policy, you'll want to do plenty of research on the best life insurance company and policy for you. Here are a few of our top whole life insurance companies to get you started.

Best for Dividend Payments - MassMutual

A mutual whole life insurance company will pay regular dividends to their policyholders. Among these, MassMutual is a top choice for consistently high dividend payments.

MassMutual has offered consistent dividends to their policyholders since the 19th century, often 1-2 percentage points higher than other mutual life insurance companies.

A.M. Best rating: A++

Best for Seniors - Foresters

Offering up to $400K in coverage with no medical exam, Foresters is an especially generous option for senior policyholders.

Their PlanRight Whole Life policy even provides lifetime coverage up to age 121, with guaranteed level premiums.

A.M. Best rating: A

Best for Cash Value Options - Guardian Life

In business for nearly 160 years, Guardian Life offers eight different whole life insurance models, giving policyholders the ability to customize a policy that fits their needs and financial goals.

They also offer a wide variety of riders, including accelerated death benefit for long-term care, paid-up additions, waiver of premium and more.

A.M. Best rating: A++

A whole life policy can be worth it if you earn a sizeable income and want to diversify your existing investment portfolio.

Average Term vs. Whole Rates

Below are the average rates for a 20-year term life policy. These rates are based quotes for healthy, non-smoking men and women.

20-Year Term Rates—Male

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 20 | $9.92 | $13.57 | $20.88 | $34.67 |

| 30 | $9.92 | $14.57 | $20.88 | $35.67 |

| 40 | $12.67 | $19.67 | $34.92 | $56.90 |

| 50 | $24.63 | $47.68 | $92.06 | $145.55 |

20-Year Term Rates—Female

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 20 | $9.05 | $12.09 | $18.71 | $30.19 |

| 30 | $9.14 | $13.31 | $19.14 | $32.06 |

| 40 | $12.12 | $17.99 | $27.67 | $46.72 |

| 50 | $20.16 | $34.46 | $63.87 | $109.36 |

Below are average whole life policy rates for healthy, non-smoking men and women.

Whole Life Insurance—Male

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 20 | $50.67 | $109.42 | $223.75 | $437.08 |

| 30 | $75.89 | $165.83 | $299.50 | $662.58 |

| 40 | $120.88 | $229.41 | $449.50 | $996.92 |

| 50 | $177.60 | $357.42 | $911.25 | $2,188.33 |

Whole Life Insurance—Female

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 20 | $43.08 | $96.00 | $197.75 | $385.25 |

| 30 | $72.09 | $134.25 | $293.23 | $576.17 |

| 40 | $101.33 | $232.17 | $438.75 | $877.16 |

| 50 | $157.67 | $335.17 | $685.50 | $1,300.50 |

What the Experts Say

As part of our series on life insurance, CreditDonkey asked an industry expert to answer readers' most pressing questions. Here's what he said:

Bottom Line

Term insurance is the best option for most families. It's affordable and will ensure your family is protected. It works just fine if you only need coverage for a certain period (such as until the kids graduate or until the mortgage is paid off).

Whole life insurance is a lot more expensive. In most cases, it's only for more special circumstances (such as if you have estate taxes, a business, or a special-needs child).

Think carefully about you and your family's needs. The most important thing is to get coverage that you can afford.

Write to Jeanine J at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|