Starting Check Number

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. You help support CreditDonkey by using our links.

Your starting check number has a big impact on recordkeeping. Take a look at how to find this reference number.

|

There are several ways to identify your starting check number.

Keep reading to learn how to make sense of all the numbers on your personal check. Plus, find out the best ways to order checks from your bank quickly.

What is a Check Number?

|

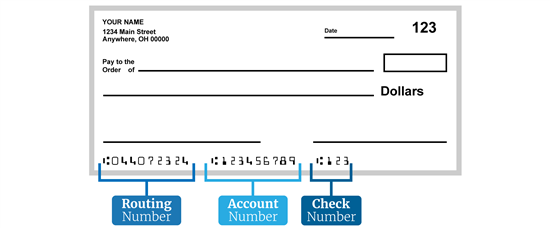

The check number is generally the last set of numbers (usually 3 or 4 digits long) on a personal check. You can also find this number on the top right of your check.

There are three groups of numbers at the bottom of a check.

- The first group is the routing number

- The second group is the account number

- The third group is the check number

Your check number helps your balance your checkbook, and track which checks have been processed by the bank and which checks are still outstanding.

Do Starter Checks Have Check Numbers?

|

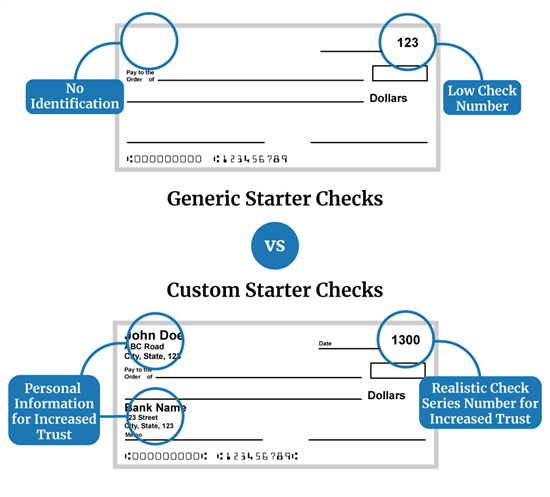

Some starter checks do not have pre-printed check numbers.

There isn't a set rule. Starter checks contain the routing information needed to process the check but they do not include personal information, such as your name or address.

How Do You Find Your Starting Check Number?

Your starting number is the check number that your checking account started with.

Many starting numbers are 1001 because it makes your account look older. You or the bank decide the starting number. But there's no set rule - you can start your first checkbook with whatever number you'd like.

If it's an existing account, you should start your check number where your last check left off.

With a brand-new checkbook, you can find your starting check number on the first check. If that check has been used, contact your bank for this number.

Why Do Checks Start at 101?

You can choose any starting number you'd like. Most people start with 001 but it's up to you.

If you want the starting number to be 101, you would just specify 101 when you order your checks. This number is used to keep track of your own checks and the bank doesn't care what you start with.

You cannot use the same check number twice for one checking account. The bank may void the check and you might be charged a fraud fee.

How Do You Order Your First Check?

When you open a checking account, the bank will give you a few checks to start off. But if you run out, you will need to order more on your own.

There are three ways to order checks for the first time ever.

- Get your checks in-person at the bank - Just head over to your local branch, speak with a representative and order directly. Be sure to verify prices. If you bring your initial set of checks, the process will go much smoother and faster.

- Order online or with the mobile app - Nowadays, most banks, like Chase Bank, let you order via their mobile app. This is a convenient way to order while you're on the go.

- Get checks by phone - You will need to provide your account number and routing number to the representative over the phone.

Compare Checking Account Promotions

U.S. Bank Smartly® Checking and Standard Savings - Up to $700 Bonus

Earn up to $500 with a new Bank Smartly Checking account. Complete the following within 90 days of account opening:

- Enroll in online banking or the U.S. Bank Mobile App

- Make two or more direct deposit(s) totaling $3,000 to $4,999.99 to earn $100, $5,000 to $9,999.99 to earn $300 or $10,000 or more to earn $500

Earn up to $200 with a new Standard Savings account.

- Make new money deposit(s) totaling $15,000 or more by July 17, 2024

- Maintain that balance until October 31, 2024

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

BMO Smart Advantage Checking - $250 Cash Bonus

Open a new BMO Smart Advantage Checking account and get a $250 cash bonus when you have a cumulative total of $4,000 in qualifying direct deposits within 90 days of account opening. Offer is limited to one per customer and is not available for existing BMO personal checking customers (including signers on joint accounts) or those who have closed a BMO personal checking account within the past 12 months. Conditions apply.

Bank of America Advantage Banking - $200 Bonus Offer

- The $200 bonus offer is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 5/31/2024.

- To qualify, open a Bank of America Advantage Banking account through the promotional page and set up and receive qualifying direct deposits totaling $2,000 or more into that new account within 90 days of opening.

- Bank of America will attempt to pay bonus within 60 days.

- Additional terms and conditions apply. See offer page for more details.

- Bank of America, N.A. Member FDIC.

Bottom line

It's pretty simple to find your check number. You can get the info from a physical check or by contacting your bank. Remember, you can choose any starting number you'd like. This number is for your own recordkeeping. Just make sure it's a number that makes sense to you.

Amber Kong is a content specialist at CreditDonkey, a bank comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|