Survey: Shopping Addiction Statistics

Survey finds a significant number of Americans who show signs of a problem

Do you buy things just because they're on sale? Do you sometimes hide purchases from your friends and family? Do you feel anxious when you're not browsing store aisles or retailer websites? If so, you may be a shopping addict – an affliction uncovered by a significant portion of respondents to a recent CreditDonkey.com survey.

Since one key indicator of addiction is denial, we didn’t expect many respondents to raise their hands and announce, Yes! I’m a shopaholic! But the survey results reveal a significant percentage of consumers display some, or all, of the warning signs of shopaholism.

These red flags include feeling guilt or shame after shopping (which 36.7 percent of respondents have experienced), hiding purchases from their families (20.5 percent), and checking available credit at least once a week (26.7 percent). However, just 4.7 percent of respondents said they have been labeled “shopaholics."

Among the survey’s other findings:

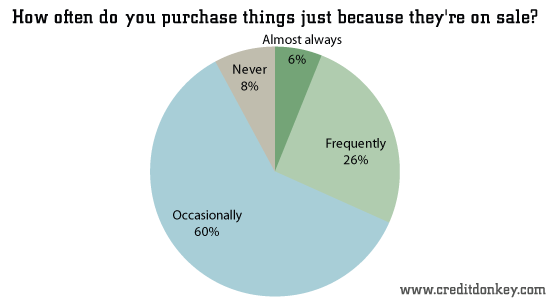

- 31.7 percent of respondents said they “almost always” or “frequently” purchase things just because they’re on sale.

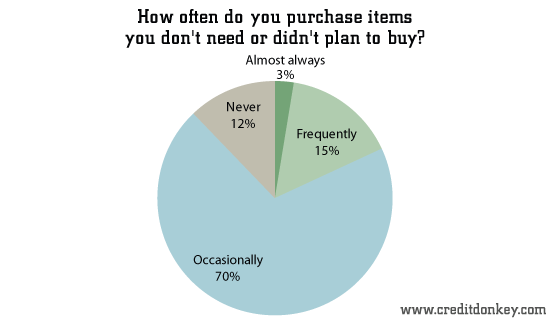

- 18.1 percent said they often purchase items that they don’t need or didn’t plan to buy when they set out to shop.

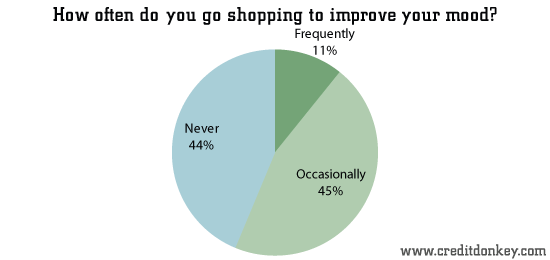

- Nearly 11 percent of those polled said they frequently shop to improve their mood.

- 47.4 percent said they experience a rush of excitement when they go shopping.

- 24.4 percent admitted they have items in their closets that are still in shopping bags or have price tags.

- 18.5 percent said they have frequent arguments over money.

- 19.1 percent said their main reason for using credit cards is to pay for items when they don’t have enough money.

|

|

| How often do you purchase items you don't need or didn't plan to buy? © CreditDonkey |

|

| How often do you go shopping to improve your mood? © CreditDonkey |

We were happy to learn that most consumers use credit cards for the sake of convenience or to save money via rewards programs, but the fact that so many people treat credit cards as extra spending money is disturbing. When people routinely spend so much on their cards that they can’t pay off the monthly balance, we recommend that they temporarily suspend their card use – say, for 30 days. This will help them distinguish between when they’re buying on impulse and when they’re purchasing things they really need.

(From September 3 to September 8, 2013 CreditDonkey surveyed 1,063 Americans about their shopping habits, payment preferences, credit card use, and what makes them happy.)

Charles Tran is the founder of CreditDonkey, a credit card comparison and reviews website. Write to Charles Tran at charles@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.