I Need a Credit Card?

Just How Much Do We Need Our Credit Cards

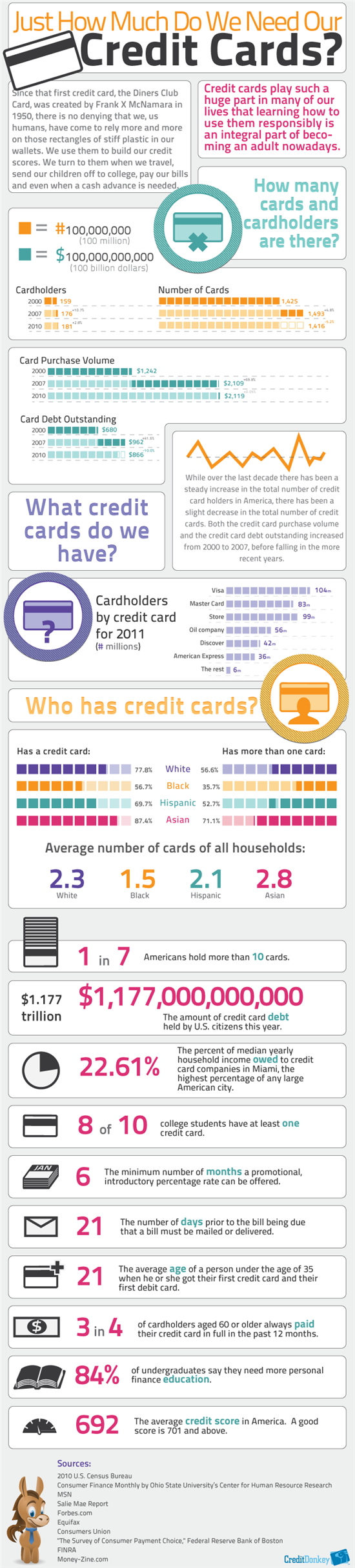

Americans collectively are predicted to hold $1.177 trillion in credit card debt in 2011 and 1 in 7 Americans hold more than 10 cards. This indicates that not only are Americans continuing to spend, but many are reliant upon their credit cards to maintain their lifestyle.

|

| Infographics: How Much Do We Need Our Credit Cards © CreditDonkey |

Couponing has become an exploding trend in the United States. Turn on the TV and you see shows of extreme couponers saving 90% on their grocery purchases. Open your email and it’s full of offers for 55% off meals and salon visits. Check your mailbox and it’s stuffed with circulars and postcards offering 10% or 20% off your next clothing purchase.

With all of these coupons, you’d think that Americans have stopped spending. However, current credit card usage trends indicate otherwise.

Utilizing credit cards doesn’t have to be a bad thing. As long as you practice responsible usage, credit cards can provide a safe and secure way to pay for the items that you need. Here are some tips you can use to make sure that you’re staying practical with your plastic:

- Pay your credit card bills on time and in full each billing cycle.

Data shows that 3 out of 4 cardholders age 60+ always pay their credit card bills in full each month. This is a smart move because it saves them big money by avoiding interest charges. - Keep an eye on promotional rates.

Good things usually must come to an end. If a 0% promotional APR drew you to your credit card, you’ll want to read the fine print to see when the offer expires and what the rate will be after that promotional period. The good news is that the law dictates that introductory rates must be offered for at least 6 months. Plan your purchases and payments wisely during the promotional period. Otherwise, you may start accruing interest. That deal will no longer be a deal if you end up paying interest on purchases that you wouldn’t have otherwise made! - Don’t be tempted to bite off more than you can chew.

On average, Miami residents have $9,797 in credit card debt. This is the equivalent of 22.61% of their median yearly household income. It can be easy to slip into this slippery slope of credit card debt if you don’t keep a close eye on your spending habits. Just because you have the ability to purchase thousands of dollars’ worth of merchandise each month doesn’t mean it’s a wise move to make.

Create a monthly spending budget and stay on top of it. Many credit card companies now offer online banking tools that allow you to monitor your monthly purchases. The tools break down your spending by merchant category – like restaurant, grocery, gas and clothing – so you can identify the areas in which you may want to cut back.

(Initial Research by Andrew Green; Infographics by Tina; Additional Writing by Meghan Clark)

Editor's Note: Some statistics are based on projections.

Andrew Green is a contributing writer at CreditDonkey, a credit card comparison and reviews website. Write to Andrew Green at andrew@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.