Infographic: Labor Day Statistics

Celebrate the Worker on Labor Day

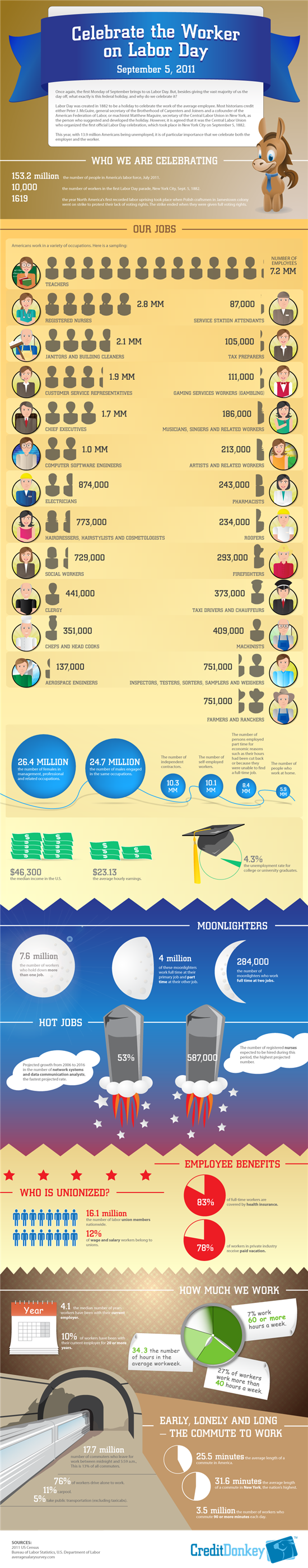

As a tribute to all of the hard working Americans out there, we have compiled some interesting facts and figures about the U.S. work force just in time for Labor Day.

|

| Infographics: Labor Day © CreditDonkey |

Created in 1882 to celebrate the work of the average employee, the first celebration comprised of a parade in New York City in which 10,000 workers took to the streets. These days, Americans tend to celebrate the day with backyard barbeques and end-of-summer camping weekends. But with so many Americans out of work during the past several years (the current figure is 13.9 Americans), it's important that we do more than just roast a weenie this holiday weekend. Instead, take a moment to reflect on the following figures so you can fully appreciate all that the work force does and sacrifices people make to keep the country running.

Keeping the country running

As the country continues to grow and technology advances, our needs become increasingly diverse. This calls for an enormous variety in our careers to help accommodate all of our needs. Here are just a few of the different careers Americans now hold, along with the number of people who are employed in these jobs:

• Teachers: 7.2 million

• Registered Nurses: 2.8 million

• Janitors and Building Cleaners: 2.1 million

• Gaming Services Workers: 111,000

• Tax Preparers: 105,000

• Service Station Attendants: 87,000

There are also many workers who are going less traditional routes, being contractors (10.3 million), self-employed (10.1 million) or working from home (5.9 million). And many others (8.4 million) who are now employed part time due to the rough economy, which has caused their hours to be cut back or made it so they were unable to find full-time work.

Working long and hard

Many would be surprised to learn that 7.6 million Americans currently moonlight, meaning they hold down more than one job. Even more surprising, 284,000 work full time at two jobs. This is the sacrifice they make to ensure their families have the funds they need to cover their expenses.

The moonlighters aren't the only ones working hard; data shows that 27 percent of workers work more than 40 hours a week, with seven percent working 60 or more hours a week.

And when it comes to commuting, there is no rest for the weary. While 25.5 minutes is the average length of commute in America, 3.5 million workers commute 90 minutes or more each day. Add to that the 17.7 million commuters who leave for work between midnight and 5:59 a.m. and it's no wonder that Starbucks stays in business. The vast majority of workers (76 percent) drive alone to work, while 11 percent carpool and only five percent take public transportation.

It all pays off

Data shows that all of the hard work pays off, with the median income for the U.S. currently sitting at $46,300 and the average hourly earnings currently at $23.13. Of course, all of this hard earned money doesn't go directly toward entertainment. It also needs to be used to cover bills like credit cards, mortgages, gas and utilities.

Thankfully, a large percentage of the work force does not have to worry about paying for health insurance, as 83 percent of full-time workers are currently covered by health insurance. Seventy-eight percent of workers in the private industry also receive paid vacation, making it much easier to take time off for much needed rest and relaxation. Also, twelve percent of U.S. wage and salary workers are labor union members, providing them with extra security and protection in the workplace.

Andrew Green is a contributing writer at CreditDonkey, a credit card comparison and reviews website. Write to Andrew Green at andrew@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.