Survey: Haggling Statistics

Hate to Haggle? You're Missing Out on Deals, According to a New Survey

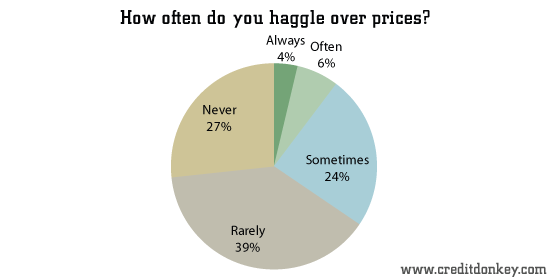

Most consumers rarely haggle, according to a recent CreditDonkey.com survey. When asked how often they try to get retailers to lower their prices, 38.8% of respondents answered that they rarely do it, and 24.2% said they sometimes try to bargain.

Although the practice of challenging a salesperson over the price of an item often elicits groans from both parties, it can save the haggler money. Our survey found that 57.5% were successful at getting a better price when they had haggled.

|

| How often do you haggle over prices? © CreditDonkey |

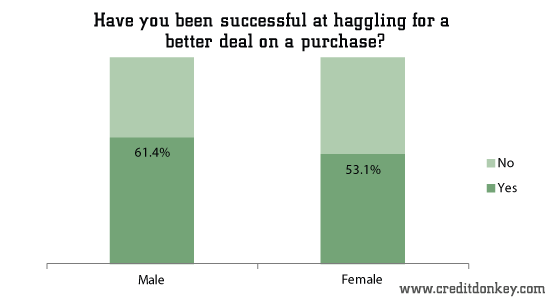

So who's a better haggler: men or women?

Men were overwhelmingly pleased with their haggling. 61.4% of men say they have been successful at getting a better price by haggling versus 53.1% of females.

|

| Have you been successful at haggling for a better deal on a purchase? © CreditDonkey |

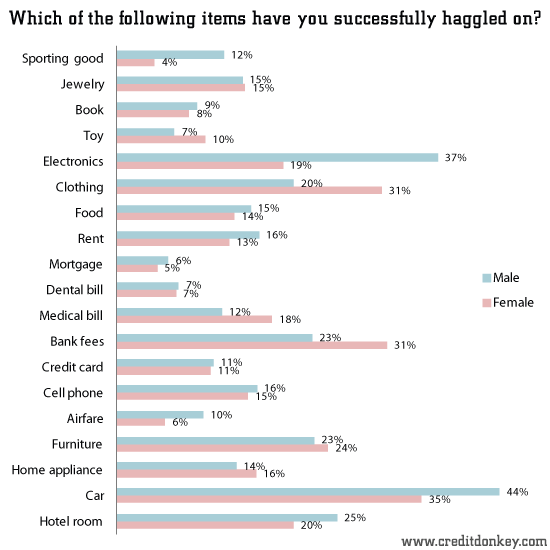

Our survey found that women, however, are slightly more successful when it comes to haggling about bank fees. 31.3% of women say haggling works well on bank fees versus only 22.6% of men who agreed. Could it be that all a woman has to do is ask – with a good reason – to have her bank fee reversed or minimized? There's no reason men shouldn't try it too, especially with the increasing state of bank fees today.

|

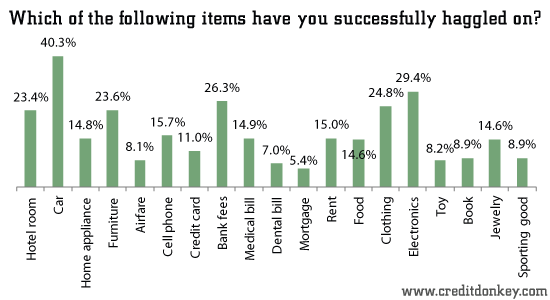

| Which of the following items have you successfully haggled on? © CreditDonkey |

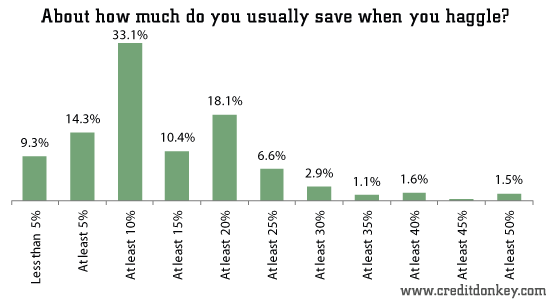

Even though 33.1% of respondents said they were able to shave an average of 10% off the purchase price by haggling, they would still rather pay more than go through the trouble, according to our survey.

|

| About how much do you usually save when you haggle? © CreditDonkey |

Haggling about price is most often associated with buying a car. Even so, car dealerships have successfully publicized no-haggle pricing to appeal to those consumers who don't want to haggle. And some have had success outside of dealerships. While 40.3% of respondents say that haggling works best when buying a car, 29.4% said it also works for electronics, followed by the 26.3% of total respondents who said it can be used to argue down bank fees.

|

| Which of the following items have you successfully haggled on? |

From October 9 to October 23, 2012, CreditDonkey.com polled 1,125 Americans, age 18 and over, about their holiday shopping plans using multiple choice questions and short-answer questionnaires.

Naomi Mannino is a contributing writer at CreditDonkey, a credit card comparison and reviews website. Write to Naomi Mannino at naomi@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.