Do Freelancers Make Enough Money?

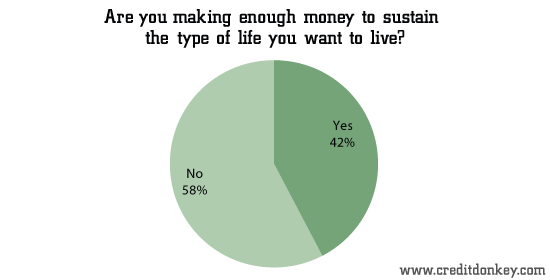

Whether or not one makes enough money depends on how much money is enough. 57.7% of freelancer respondents to a recent CreditDonkey.com survey said they are not making enough money to sustain the type of life they want to live.

|

| Are you making enough money to sustain the type of life you want to live? © CreditDonkey |

But freelancers are able to afford the basics:

- 85.4% are making enough to at least pay the minimum on all their bills

- 50.2% are able to afford health insurance

- 83.9% have never been unable to pay their taxes

|

| Are you always able to pay at least the minimum due on all of your bills? © CreditDonkey |

|

| As a freelancer, have you ever been unable to afford health insurance? © CreditDonkey |

|

| As a freelancer, have you ever been unable to pay your taxes? © CreditDonkey |

In fact, 42.6% of respondents said their personal finances have actually improved since they made the switch.

Sally Herigstad, author of Help! I Can't Pay My Bills says while she made more money in 2012 than she ever did as a salaried employee, "not every year has been as profitable. The first couple of years as a freelancer were slim. Even after I built up my business, sometimes I've had to wait as long as a year to get paid for a project."

Work less, earn less…enjoy more

These seem to be the hallmarks of respondents’ attitudes toward their choice in freelancing. Two-thirds said they work part time versus full time, and they are happy about their work schedule, even though they may not make as much money as they would like.

|

| Are you a full-time or part-time freelancer? © CreditDonkey |

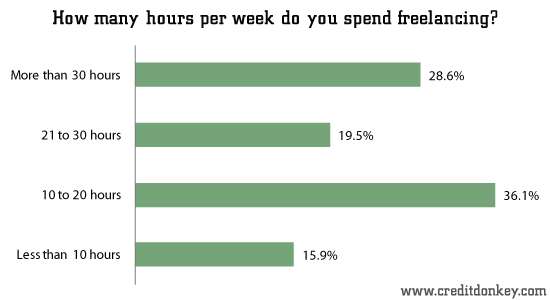

How many hours are part-time? 36.1 % said they work only 10-20 hours per week, 19.5% said they work 21-30 hours per week, and 28.6% said they work more than 30 hours per week.

|

| How many hours per week do you spend freelancing? © CreditDonkey |

The benefits go beyond their flexible work schedule. More than half of respondents said the most notable improvement in their life since becoming a freelancer has been their emotional well-being.

|

| What aspects of your life has improved since you became an independent contractor? © CreditDonkey |

|

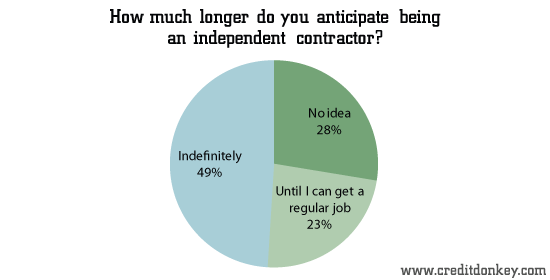

| How much longer do you anticipate being an independent contractor? © CreditDonkey |

For these reasons, 49% of our respondents plan to remain a freelancer indefinitely, while 28% aren’t sure what the future holds. So despite any issues they have in reaching their financial goals, many of them will stick with self-employment for now.

David Radovanovic, creative director at WhatsTheBigIdea.com says "prepare to work long and hard. If you are tenacious you will reap the reward of making money doing what you love."

(From November 5 to November 27, 2012 CreditDonkey.com surveyed 424 independent contractors in the U.S., age 18 and over using a multiple-choice and short-answer online questionnaire.)

Naomi Mannino is a contributing writer at CreditDonkey, a credit card comparison and reviews website. Write to Naomi Mannino at naomi@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.