Portrait of a Freelancer

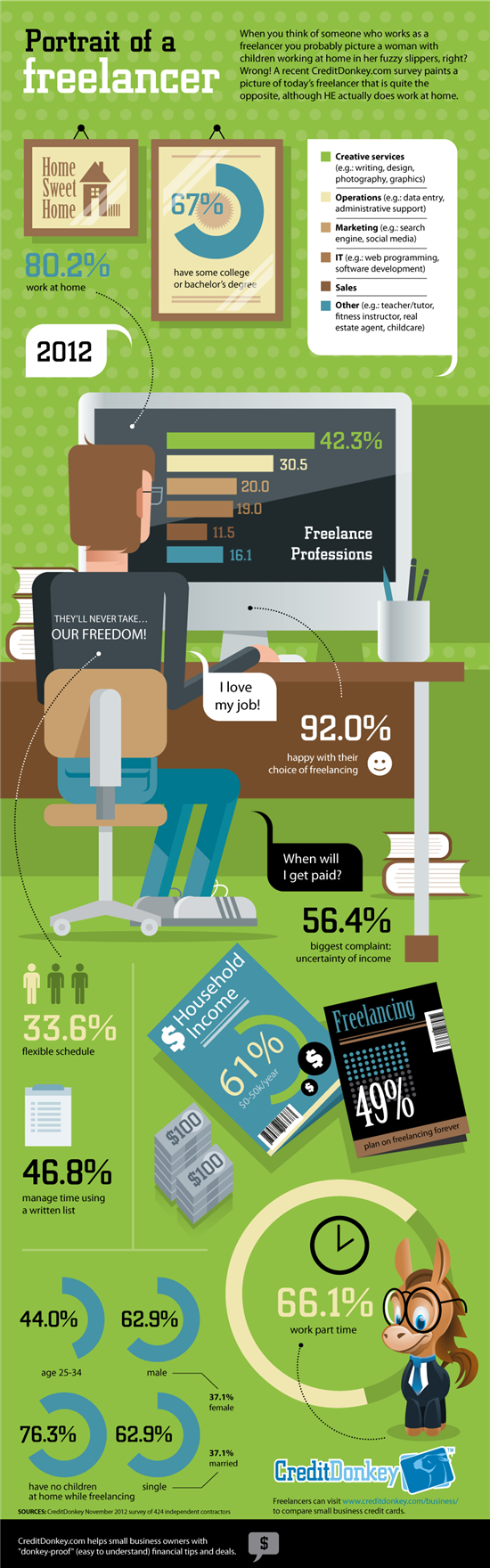

Many people assume that the growing workforce of freelance workers is primarily made up of stay-at-home moms who are either trying to maintain their professional skills or supplement their growing family's income. We think of a young woman working away at the computer while the kids quietly color (or tear apart the playroom).

But a recent CreditDonkey survey of independent contractors has revealed a very different picture. According to the survey respondents, this new segment of the American workforce is not dominated by mothers or even females. Instead, it is largely made up of young, single males. Just over 62 percent of the respondents are men. And more than 76 percent of all the respondents don’t have kids running around their home while they’re hard at work.

|

| Portrait of a Freelancer © CreditDonkey |

The Motivation

There are many American workers who have never tried the freelancing lifestyle. But, it’s easy for many to understand the appeal: no actual boss to answer to, no set schedule, no dress code! It’s no wonder that more than 92 percent of survey respondents stated they are happy with their choice of freelancing.

The Drawbacks

Of course, as with any income source, there are some drawbacks to these gigs – the largest being the uncertainty of steady income. With 61 percent of respondents stating they make less than $50,000 per year, as well as 66 percent stating they work part time, this uncertainty is the largest drawback for the majority of respondents.

Thankfully, CreditDonkey has some tips to help budding freelancers combat this drawback.

How to Get Ahead

Here are some ways to build your growing brand and manage your funds so you can turn your hobby or part-time job into a full-time career:

- Build the brand. The brand, of course, being you. Set up a separate email address, website, and even social media profiles for your freelance business. Also become active with several professional groups so you can start making networking contacts (don’t forget to take business cards to take with you).

- Educate yourself. Read up on the various aspects of starting a small business. Some good resources include the Small Business Administration and SCORE. You may also want to meet with a trusted accountant so that you’ll know how to keep good records of your income and expenses to take some of the headaches out of filing your taxes.

- Separate your finances. If you don’t have time to meet with an accountant immediately, one smart step is to start separating your personal and professional finances. This not only includes your savings and checking accounts but also credit cards. Keeping your two lives separate will help you at tax time.

- Give yourself credit. Speaking of credit cards…it’s a great idea to get a small business credit card to use specifically for your freelance expenses. These may include expenses incurred when meeting with clients, as well as office supplies and resource materials. Having such a card will help you track your expenses as well as provide you the ability to build business credit. While you may be starting out small now, you may need a business loan down the road to grow your business – such as by leasing office space – and you’ll be thankful for your stellar credit score.

(From November 5 to November 27, 2012 CreditDonkey.com surveyed 424 independent contractors in the U.S., age 18 and over using a multiple-choice and short-answer online questionnaire. Research and Writing by Naomi; Graphic Design by Boris; Additional Writing by Meghan; Editing by Maria and Sarah)

Naomi Mannino is a contributing writer at CreditDonkey, a credit card comparison and reviews website. Write to Naomi Mannino at naomi@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Read Next: