FedLoan: What You Need to Know

Is FedLoan your student loan servicer? Read on for everything you need to know. Learn how to avoid common (and costly) problems.

|

| © CreditDonkey |

- What Do Loan Servicers Do

- What is FedLoan

- Public Service Loan Forgiveness

- TEACH Grant Program

- Common Problems (and Solutions)

- When Should You Contact FedLoan

- FedLoan Customer Service Numbers

- Disputes: Who Do I Call?

- Repayment Help from FedLoan

- Grace Period

- Making Payments

- FedLoan Servicing App

- How to Get Rid of FedLoan as Your Servicer

What Is Loan Servicing?

Student loan servicers help you manage your loans. The Department of Education (DOE) uses several companies to do this job. They act as the "middleman" between the DOE and you. They handle your repayment and provide customer support.

All your federal student loans will likely be handled by the same servicing company. Unfortunately, you don't get to pick your servicer. It's randomly assigned by the DOE.

One of the largest loan servicers is FedLoan. If you have FedLoan as your servicer, we're here to help you understand your options with them.

Read on.

How FedLoan Works

|

| © CreditDonkey |

FedLoan is supposed to help you stay on top of your loans. It is their job to make sure your loans remain current. Their services are free. A few things they can help with include:

- Keeping track of your balances and assist with billing

- Switching repayment plans if you can't afford payments

- Understanding your bills

- Customer service

- Loan consolidation

- Applying for forgiveness programs

Related: How to Pay Off Student Loans Fast

Is FedLoan Legit?

FedLoan is part of the Pennsylvania Higher Education Assistance Agency (PHEAA). It is a legit servicing company. However, there have been some problems.

Recently, PHEAA came under fire for failing to properly support borrowers during repayment. A Massachusetts attorney even filed a lawsuit against them for overcharging their borrowers. The Consumer Financial Protection Bureau (CFPB) also released a report outlining FedLoan's failure to properly process payments and enroll borrowers in the PSLF process.

Read on to learn more about FedLoan and the issues borrowers have had. If you've been wronged, there are some places to seek further help.

Public Service Loan Forgiveness Program

FedLoan is the ONLY servicer that deals with Public Service Loan Forgiveness (PSLF). If you apply for this program, you will automatically be switched to FedLoan.

Some borrowers encountered problems when they switched to FedLoan after applying for PSLF. Among the problems were:

- Being told that their years of payments didn't count as qualifying payments for PSLF.

- Losing payment history.

- Delaying processing applications for income-based repayment plans.

- Not accepting paperwork to place borrowers into the program.

This neglect has caused borrowers to go even further into debt. When application processing is delayed, FedLoan will often put the borrower into forbearance. This causes even more interest to accrue and delays paying off the debt.

Some borrowers were unable to receive resolution. Unfortunately, if you want to apply for PSLF, you have no choice but to be stuck with FedLoan as well.

What You Can Do

Don't let this discourage you too much from applying. You should be rewarded for public service. To minimize these issues, we suggest you do the following:

- Make sure you understand the rules of the PSLF program and know for sure if you qualify or not. If you don't fully understand it and apply incorrectly for PSLF, then there's not much FedLoan can do either.

- Get on an income-based repayment plan as soon as possible. You must be enrolled in one to qualify for PSLF. Payments made before enrollment don't count as qualifying payments towards PSLF.

- Keep records of every single payment towards PSLF. That way, if FedLoan "loses" the paper trail, you'll have proof.

- Get your annual verification for PSLF, including all paperwork from your employer.

- Keep records of every communication with FedLoan, including who you spoke with.

- If you're having issues with the reps, ask firmly to speak to a manager.

These actions won't guarantee you won't have issues. But hopefully, they'll make issues easier to resolve.

TEACH Grant Program

FedLoan is also the official servicer for the Teacher Education Assistance for College and Higher Education (TEACH) Grant Program. If you enroll in this program, you'll be assigned to FedLoan.

However, there has been problems with how FedLoan has been managing this program. Because of paperwork errors, thousands of teachers' grants were converted to loans instead.

Instead of receiving $4,000 per year in grant money, they now had $16,000 - $20,000 of new loans, with interest.

A lot of this problem occurred because of small reasons such as:

- Students not receiving important emails because their contact changed (or they landed in the junk mail folder)

- Narrowing missing submission deadlines, even by just one day

- Not receiving the annual paperwork from FedLoan

Many teachers said though they fulfilled requirements and submitted the annual forms, their grants were still converted.

- Use an email address that will be available to you even after graduation

- Check your junk mail for FedLoan's emails regarding the annual certification

- Keep your contact information and address updated

- Submit your annual forms ahead of time

For students saddled with new loans, they feel they have no choice but to pay them back. Appeals have been largely unsuccessful. The Massachusetts attorney general is also suing FedLoan for mishandling the TEACH program.

Other Common Problems with FedLoan

Even if you don't apply for PSLF or TEACH, borrowers have had other issues.

- Direct Debit Delay: Have you signed up for direct debit? If so, great job! You can save 0.25% per month on your interest. Those savings will add up. But take note: it may take up to two months for the direct debit to be applied to the account.

How to Fix It: Monitor your account. If the direct debit is taking some time to go into effect, you may have to make one or two manual payments. Don't let your account become past due. Remember that your servicer will report missed payments to the credit bureaus.

- Payments Applied Incorrectly: You may choose to make larger payments on your loans. You can pay extra and have specific amounts applied to certain loans. We recommend it if you're able to. But borrowers have found that when setting this option up, it's not always applied to the right loans.

How to Fix It: Make sure that you have set up the payments properly online. If you need to, call FedLoan and have them assist you in getting them onto the correct loans.

- Failure to Process Payment Plans: Another problem is not processing payment plans in a timely manner. Income-driven repayment plans (IDR) often need extra tax documentation and review. FedLoan has been known to take as long as 6 months to process paperwork.

What You Can Do: As soon as you're eligible for a repayment plan, fill out the necessary forms. Mail or scan in documents. Maintain contact with your servicer until the plan has been applied. Make sure that you are making payments. If you are past due or going to become past due, ask for a forbearance.

- Transferred Loans: Your student loans may be transferred to another servicer at any time (the DOE makes this call). You'll be informed first. If you're switched to FedLoan, this can cause some issues for the borrowers.

A borrower may call to make a payment and told their account is past due. Or that their loans would not qualify for certain forgiveness programs. Or you may see a fee on your account after the transfer.

How to Fix It: After a transfer, contact the new servicer immediately. Talk with them to schedule payments and figure out your best payment options. Keep a paper trail of your previous payments.

No matter what the issue, keep yourself informed by monitoring your loans. Stay in contact with your servicer. Know your rights as a student loan borrower. There are always options.

These problems can create a significant financial impact on you, including:

- Bad marks on your credit score when payment processing is delayed.

- Paying more in payments and interest over the life of the loan.

- Loss of benefits, such as the PSLF and TEACH programs.

When Should You Contact FedLoan?

|

| © CreditDonkey |

You don't have to wait until your loans are in repayment to contact FedLoan. You can contact them while you're in school.

To keep track of your loans while you're in school, just log into your MyFedLoan dashboard. Here, you'll be able to view your loan status, balance, and interest rates. This is also a great way to confirm your school enrollment with FedLoan.

As soon as you receive your Repayment Obligation, you can contact them to go over your options. You can ask about repayment plans and carefully evaluate your choices. Your goal is to pay off the loans as fast as possible within your ability.

There are certain times when contacting FedLoan is crucial:

- You don't understand your bill

- Your address or contact information changes

- You can't afford your payments

- You need to change your due date

- You received a bill while you were still in school

- You have not received a bill

After you have signed in, you can email them through the secure email system.

FedLoan Customer Service

You can contact FedLoan Customer Service at:

- Toll-Free: (800) 699-2908

Monday - Friday 8 am - 9 pm (ET) - International: (717) 720-1985

Monday - Friday 8 am - 9 pm (ET) - Fax: (717) 720-1628

- Email: Via their website

Disputes

Your servicer is supposed to help with customer service issues. If you feel they have provided you bad information or you have been wronged, here are some steps you can take:

- Department of Education: If FedLoan is not providing you with an appropriate answer, you should call the DOE. The DOE will help with problems that servicers cannot or will not handle. You can speak with them at 1-800-872-5327.

- Ombudsman Group: If the DOE is still not helping you through a dispute with your servicer, there are other options. The Ombudsman Group is a neutral third-party to help through student aid disputes. This is your last resort. You can reach them at 1-877-577-2575.

- File a complaint: You can file a complaint with the Consumer Financial Protection Bureau.

Remember to keep records of all your payments and communication with FedLoan.

FedLoan Repayment Options

|

| © CreditDonkey |

Every student loan borrower begins repayment with the Standard Repayment Plan. This plan evenly divides payments over 10 years. This is the quickest way to repay with the least amount of interest.

If you are unable to afford the Standard Repayment Plan, FedLoan offers several other options.

- Graduated Repayment Plan: This is still a 10-year plan, but the payments start out low and get bigger. Your payments will increase by 20% every two years. Your final 2 years of payments will not be more than 3 times your original payment.

This is a great plan if you know your income will increase every couple of years. If you find payments are becoming unmanageable, you can return to the Standard plan. You may also change to an income-driven repayment plan if needed.

- Income-Driven Repayment Plans: These plans are based on your current income. Under these plans, some borrowers may qualify for a $0 per month payment. Your loans will be divided over a 20-year term.

At the end of the term, whatever leftover balance you have will be forgiven.

The federal government offers borrowers four different repayment plans: Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), Pay as You Earn (PAYE), and Revised Pay as You Earn (REPAYE). Each option provides different benefits. Your payment amount depends on your income and family size.

If you work in a public sector and want to apply for Public Service Loan Forgiveness Program (PSLF), you MUST be on one of these income-driven repayment plans. This allows you to take maximum advantage PSLF, since it means your monthly payments will be less.Get more details on forgiveness programs here.

- Extended repayment plans: These extend the term of the loan (up to 25 years), which helps to reduce the minimum amount due. But you'll pay more in interest over time.

- Forbearance or Deferment: Both temporarily pause payment. If you absolutely cannot make payments, these options prevent your loans from becoming past due or ending up in default.

A forbearance is valid for up to 12 months, with a cumulative maximum of 3 years. You may be granted a forbearance during times of financial hardship. During this period, however, interest continues to accumulate and you are responsible for paying off that interest.

Deferments are harder to get because you need to qualify for one. The difference is that interest will not accrue on most subsidized federal loans or Perkins loans during this time. The most common uses are unemployment, economic hardship, in school, or in the military. Like forbearance, you can have up to three years of deferment time.

FedLoan Grace Period

Most likely, you won't have to make student loan payments right away after graduation.

Federal student loans usually have a grace period of 6 months after graduation. This means you don't owe any payments during that time. After 6 months, your payments become due.

However, it's smart to make payments during the grace period if you are able. The Interest Savings Calculator estimates how much money you could save on interest by doing so. Because there are no minimum payments due during this time, you could make your payments as little or big as you want.

A $10,000 student loan at 4% interest rate could save the following:

- Paying $50/month during the grace period (6 months) saves $73.14 in interest

- Paying $100/month during the grace period (6 months) saves $144.68 in interest

Though the savings might not look like a lot, every little bit will add up to help you reduce your overall repayment period.

FedLoan offers other resources to help you estimate your monthly bill. This will give you an idea of what to expect after the grace period.

Understanding Your Payments

|

| © CreditDonkey |

Before your grace period expires, FedLoan will send you a Repayment Obligation. You can view an example by clicking "view example" here.

The document will break down the

- Account number

- Loan types

- Disbursement date

- Starting repayment date

- Payment amount

- Payment due date

It will also show you the

- Amount of unpaid principal balance

- Amount of accrued interest

- Total cost of the loan with interest

FedLoan Making Payments

FedLoan offers some options to help you save money and pay loans faster. There are no fees or penalties for paying your loans off early.

- 0.25% auto-debit deduction: When you set up auto-debit, FedLoan offers a 0.25% break on your interest rate. And plus, automatic payments ensure your payments are made on time.

- Pay ahead: Pay more than the minimum each month. This will lower the total interest you pay over the life of the loan.

- Targeted payments: You can choose which loan to pay down first. If you make more than the minimum payment, you can direct the extra funds. You can put it towards loans with the highest interest rate or the highest balance.

- Extra payments: Whenever you have some extra money, you can manually enter a second monthly payment. This will also reduce interest and lower repayment length.

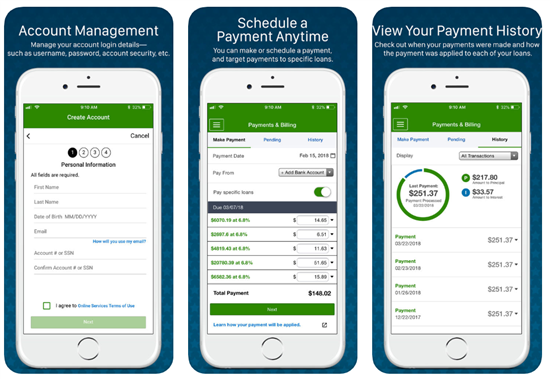

FedLoan Servicing App

|

FedLoan has an app available for both iOS and Android.

On the app, you can:

- Create your account

- Fingerprint sign-in

- View your loan balance and amounts due

- Make and schedule payments

- Set up targeted payments to specific loans

- View your payment history

- Save bank info for easy payments

- See repayment options and estimated monthly payments

- Upload your documents for an income-driven repayment plan

How To Get Rid of Fedloan As Your Servicer

So what if you're not happy with FedLoan and want to leave? If you're not applying for PSLF or TEACH (in which case, you have no choice but to stay with them), you have some options for escape.

- Consolidation: Consolidation is a great option if you only have federal loans. Consolidation will take all your loans and make them one new loan. You'll only have one payment per month. This is great if you have many loan servicers and different payment due dates every month.

You get a new fixed interest rate that is the weighted average of your loans. Note that this does not lower interest.

If you consolidate your loans, you can pick the servicer you want. You can choose from Nelnet, Navient, and Great Lakes. Consolidation is free. When you sign up, you will need to enter a repayment plan. The easiest way is to complete both applications is on their website.

- Private Refinance: If you have a mix of federal and private loans, refinancing may be the best option. Refinancing is through a private lender. They will combine all your loans and give you an interest rate based on your creditworthiness. This will create one monthly payment.

If your credit has improved since graduation, consider refinancing. You can get a better interest rate. This could result in thousands of dollars in interest savings over the years.

| For | Lender |

|---|---|

| Overall | SoFi |

| Flexible Terms | Earnest |

| Advanced Degrees | Laurel Road |

The Bottom Line

The best thing is to remain in contact with your servicer. Their job is to help. If you ever feel like you're struggling, contact them. Know your options. Know what will get you out of debt the fastest. But what will also be a manageable payment.

Keep records of your payments. Track your loans from the date of first disbursement. Be aware of any fees and questionable charges. If you feel like you've been wronged by FedLoan, there are other options too.

Keep yourself educated. Read through our other articles about student loans. Gain confidence when talking with your loan servicer.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next: