Chase Refer a Friend: How Referrals Work

Ad Disclosure: This article contains references to products from our partners. We receive compensation if you apply or shop through links in our content. You help support CreditDonkey by using our links.

Earn Chase points fast by referring your friends and family members. You can earn up to 100,000 extra points with little work. Read on.

|

Chase has long been known for offering some of the best credit card bonuses and rewards.

Plus, their Ultimate Rewards (UR) is one of the best travel programs on the market.

And now, Chase makes it easier to earn points (or cash!) by giving you a bonus for every friend you refer. This can help you rack up the points faster for your next award flight or hotel stay.

Read on to learn how this program works and who's eligible.

What Is Chase Refer a Friend?

When your family members or friends sign up for a new Chase card, you can receive a nice bonus.

Here's how it works:

- Invite a friend to apply for a Chase credit card (it has to be for the card you own).

- If the friend applies and is accepted, you will earn bonus points.

- You can invite as many friends as you want. But there is a limit as to how many referral bonus points you can earn per year for each Chase card you own.

Different cards will pay out different bonus points for the referral. Usually, they range from 5,000 to 20,000 bonus points.

You can get up to 5 referral bonuses per year. That's a total of 25,000 to 100,000 bonus points per year, depending on the card.

What is the Best Chase Credit Card Promotion?

| For | Credit Card |

|---|---|

| Travel | Chase Sapphire Preferred® |

| Small Business | Ink Business Preferred® |

| Cash Back | Chase Freedom Unlimited® |

If you can't decide, check out this comparison between Sapphire Preferred and Freedom Unlimited.

Cards Eligible for Refer a Friend

Not all of Chase's cards are participating in this program. Generally, the ones that participate are:

- Chase Freedom Unlimited®

- Chase Sapphire Preferred®

- Chase Sapphire Reserve®

- Chase Ink Cash

- Chase Ink Preferred

- Chase Southwest Rapid Rewards Plus

- Chase Southwest Rapid Rewards Premier

- Chase Southwest Rapid Rewards Priority

- Chase United MileagePlus Explorer

- Chase Marriott Bonvoy Boundless

- Chase World of Hyatt

- Chase IHG Rewards Club Premier

- Chase Disney Rewards Visa

How to Refer a Friend

Next, we'll show you step-by-step how you can refer a friend and earn bonus points.

Step 1: Go to the Refer a Friend site and enter your details

To check for any promotions and to get your referral code, go to the Chase Refer a Friend website at https://www.chase.com/referafriend/catch-all.

You will need to enter your last name, zip code, and last 4 digits of your card number.

|

You can also find a list of eligible Chase card referrals at https://creditcards.chase.com/refer-a-friend. Locate your card on the page and click the "Refer friends now" button.

Step 2: See what your current promotion is

Right away, you'll see if your card is eligible for this program and what you will get.

For Chase Sapphire Preferred, you can receive 15,000 bonus points for each friend who signs up for the card through your referral link. You can earn up to 75,000 points through referrals per year. That equals to $937.50 in travel on the Ultimate Rewards portal.

For other cards, such as Freedom Unlimited, you can earn up to $500 in cash back per year through referrals.

Be sure to check often, though, because sometimes the bonus promotion changes.

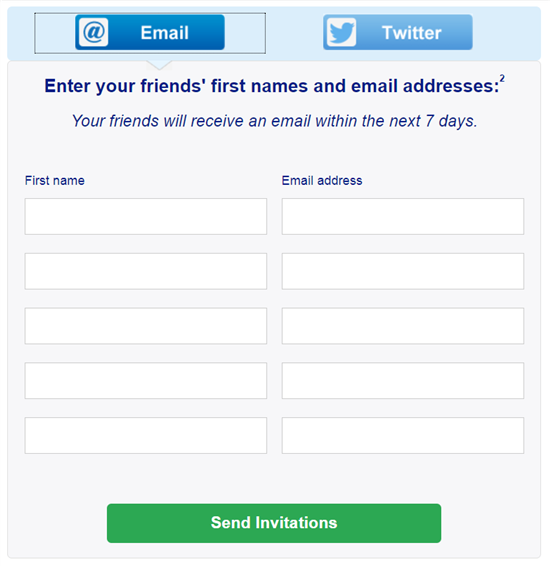

Step 3: Share the referral code

You will see your personalized referral link. You can share it a few different ways:

- Click on "Copy Link" and you can send it to your friends whatever way you like (such as through text or email).

![]()

It will say something like:

"Earn bonus points with Chase Sapphire Preferred. I can be rewarded too if you apply here and are approved for the card. Learn more.

[your referral link will appear here]"

Tip: In our opinion, this is the best way to ensure that your friends will get the link. Because if you send it straight from the Chase website (see next step), it may be blocked or sent to your friends' spam folder and they won't get it. - Send an invitation from the site. You can choose to have Chase contact your friends by email or Twitter.

![]()

or share on Twitter:

![]()

You may also see an option to share on Facebook.

Step 4: Wait for your friends to sign up

When your friends click through your referral link, they'll see a website with the card offers. There will be an "Apply Now" button. As long as your friends click through the link to apply, you'll be awarded the bonus points.

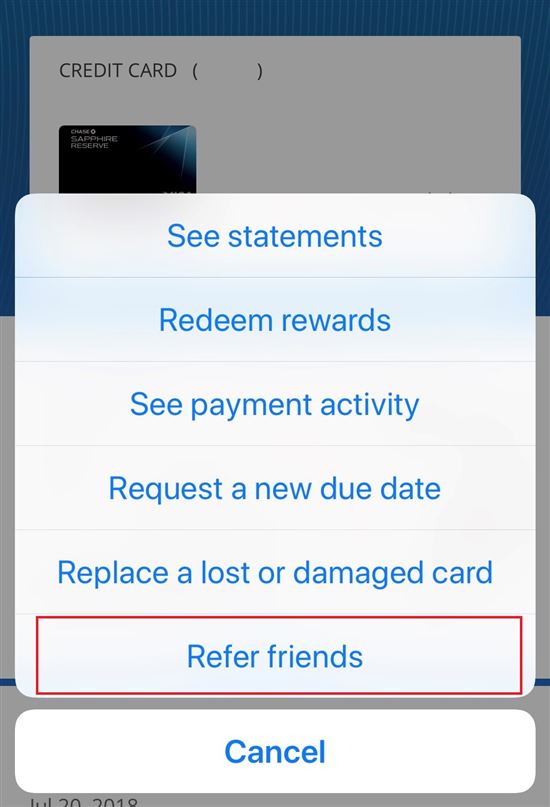

How To Invite Friends On The Mobile App

Chase also allows you to send referrals from your phone. Simply login to the Chase app and you'll see find a list of your active Chase cards.

Click on the 3 dots in the lower right corner next to the card you want to refer. A "Refer friends" option will come up if the card is eligible.

|

Frequently Asked Questions

Can I refer a friend for a Chase card I don't have?

Yes. Generally, you can refer friends to sign up for any of the participating Chase cards even if they are ones you don't hold as long as it's the same "family" of cards. So for example, if you have Chase Freedom Unlimited but your friend wants a Chase Freedom Flex, you can still earn referral points as long as they use your referral link and get approved.

How many referrals can I send per year?

You can send as many as you like, but you only get the bonus for 5 referrals per year. You can get the referral bonus for the first 5 friends who sign up and get accepted.

When do the referral bonuses post to your account?

Unfortunately, there are many complaints that it takes a long time for the referral bonuses to post. Generally, they should post with the 2nd billing cycle after your friend gets approved.

If someone is already my authorized user, can I still refer them?

Yep! You can refer them for their own card, and you will still receive the referral bonus. And they will still receive the card sign-up bonus (provided the minimum spending requirements are met).

Can I see who accepted my referral?

No, you won't be able to see who applied using your referral link due to confidentiality issues.

Bottom Line

If you have friends or family looking for a new credit card, consider referring them to Chase. After all, referrals straight from existing users are often the most trusted. Inviting them only takes a moment and you can earn valuable bonus points.

Visit Chase's Refer a Friend page to see if your card is currently participating.

Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. This site may be compensated through the Advertiser's affiliate programs.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by Chase. This site may be compensated through the Advertiser's affiliate programs.

Read Next: