How to Go Paperless with Chase Bank

Tired of getting paper statements from Chase? Follow this simple guide to go paperless with Chase Bank.

J.P. Morgan Chase Bank offers a variety of personal banking and credit card products, and generous new customer bonuses. Take a look at how to stop receiving paper statements from Chase Bank.

How to enroll in paperless statements on desktop

If you're on desktop or a mobile browser, follow these steps to stop receiving paper statements from Chase:

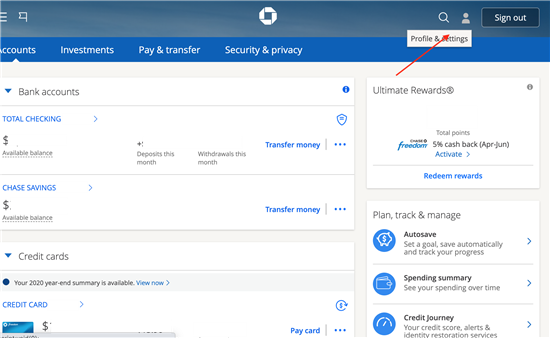

|

| Screenshot of Chase |

- Sign in to Chase.com

- Go to "Profile and settings" (upper right corner)

- Choose "Account management," then "Paperless"

- You'll see a list of your Chase accounts that are eligible for paperless statements

- Select the ones that you want to receive as paperless statements

- Choose "I consent"

Your enrollment is complete! Keep in mind that it may take a month or so to stop receiving paper statements in the mail.

Next, you'll see a paperless enrollment confirmation via email. To view your statements online, login to your account and choose the "Statements'' button in the summary via the summary section for that account.

How to enroll in paperless statements with mobile app

You can turn off paper statements on Chase Mobile App with the steps below:

- Sign into the Chase Mobile app

- Go to "Profile & settings"

- Go to Account Settings

- Go to Settings then select "Paperless"

- You'll see a list of your Chase accounts that are eligible for paperless statements

- Select the ones that you want to receive as paperless statements

- Choose "I consent"

Some banks may charge you a statement copy fee (similar to paper statement fees). The big difference between paper statement fees and statement copy fee is this: paper statement fees are charged monthly while statement copy fees are charged per statement.

Statement copy fees range from $3 - $7. Save time and money by viewing statements online or with the mobile app. It's better for your wallet and the environment.

FAQ

Ready to go paperless? Review these common inquiries before updating your settings.

- Can I look up paperless statements from previous months?

Yes. Depending on the account type, you can browse up to 7 years of statements. To see past statements: choose the "Statements" button in your account summary and then select the See/Save icon next to the year and month. Lastly, choose the dropdown option for what you want to do. You can also save or print previous statements.

- Do paperless statements include information on all of my accounts?

No. Each statement only covers the account selected. To view more statements, select another account and view the document.

- Can I go back to receiving paper statements?

Yes. To change your preferences, use the Chase Mobile App or sign into chase.com. Choose the "Paperless" button within an account summary or select "Account management" in the "Profile & Settings" icon. You can update your settings at any time.

Bottom Line

Paperless statements allow you to view your bank account anywhere and anytime you want. And it's pretty quick and easy to enroll online or with the mobile app. You receive statements with a Chase checking/savings account or credit card. If you don't already have a Chase account, consider applying for one of their popular bank promotions.

Chase Total Checking® - $300 Bonus

- New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking® account with qualifying activities

- Access to more than 15,000 Chase ATMs and more than 4,700 branches

- Chase Mobile® app - Manage your accounts, deposit checks, transfer money and more -- all from your device.

- JPMorgan Chase Bank, N.A. Member FDIC

- Open your account online now

- Available online nationwide except in Alaska, Hawaii and Puerto Rico. For branch locations, visit locator.chase.com.

- Chase Overdraft Assist℠ - no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*

Bank of America Advantage Banking - $200 Bonus Offer

- The $200 bonus offer is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 5/31/2024.

- To qualify, open a Bank of America Advantage Banking account through the promotional page and set up and receive qualifying direct deposits totaling $2,000 or more into that new account within 90 days of opening.

- Bank of America will attempt to pay bonus within 60 days.

- Additional terms and conditions apply. See offer page for more details.

- Bank of America, N.A. Member FDIC.

U.S. Bank Smartly® Checking and Standard Savings - Up to $700 Bonus

Earn up to $500 with a new Bank Smartly Checking account. Complete the following within 90 days of account opening:

- Enroll in online banking or the U.S. Bank Mobile App

- Make two or more direct deposit(s) totaling $3,000 to $4,999.99 to earn $100, $5,000 to $9,999.99 to earn $300 or $10,000 or more to earn $500

Earn up to $200 with a new Standard Savings account.

- Make new money deposit(s) totaling $15,000 or more by July 17, 2024

- Maintain that balance until October 31, 2024

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Personal Checking Account - $200 Bonus

Open an eligible Fifth Third checking account. Make direct deposits totaling $500 or more within 90 days of account opening to qualify for bonus. The cash bonus will be deposited into your new checking account within 10 business days of completing qualifying activity requirements.

Online Savings Account - Earn 4.25% APY

- No fees

- No minimum opening deposit

- No minimum balance required

Amber Kong is a content specialist at CreditDonkey, a bank comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|

Compare: