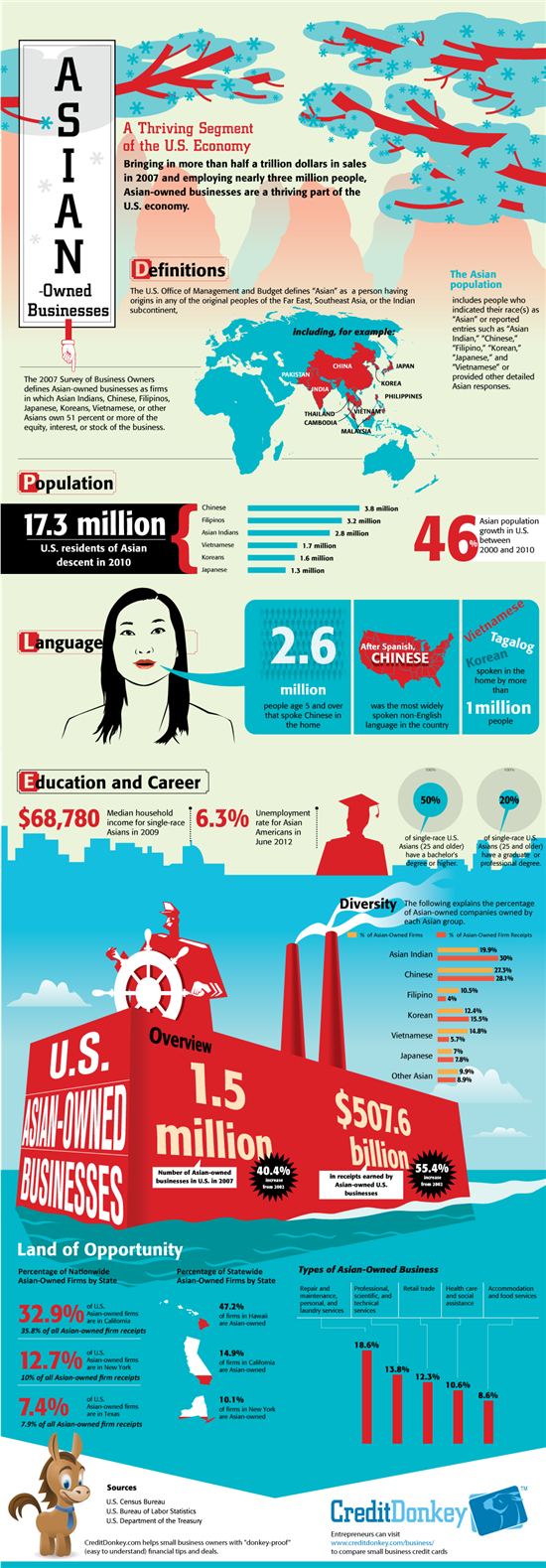

Asian-Owned Businesses: A Thriving Segment of the U.S. Economy

From corner grocery stores to major companies, Asian-American entrepreneurs are helping to make the U.S. thrive. Asian-owned businesses based in the United States employ millions of people and pump billions of dollars into the nation's economy each year.

|

| Infographic: Asian Business © CreditDonkey |

The Many Faces of Asian-America

“Asian” is an umbrella term that encompasses a terrifically diverse group of immigrants to this country, including Chinese, Pakistani, Malaysian, and Korean immigrants, as well as many, many others. Some newcomers bring considerable economic resources and a strong knowledge of English, while others have neither but still succeed in business with their great ideas and plenty of hard work.

Diversity Has Its Advantages

The benefits Asian-owned businesses bring to U.S. communities aren’t just economic. As anyone who loves Thai food or appreciates the bounty of vegetables at Korean groceries knows, immigrant entrepreneurs bring their adopted country new things that enrich all of our lives. There’s nothing new about these kinds of contributions. As this fascinating timeline from the Center for Educational Telecommunications shows, Chinese peddlers were transforming the streets of New York back in 1830, and by the start of the 20th century, Korean immigrants were forming churches and mutual assistance societies in Hawaii and California.

Business VIPs

The vast majority of all U.S. businesses are small, and the proportion breakdown is no different for Asian-owned companies. But Asian-Americans have also led many big and influential businesses. They include, for example:

- An Wang, Chinese-born founder of Wang Laboratories, one of the early leaders of the U.S. computer industry.

- Vicki Sato, biotech pioneer and granddaughter of Japanese immigrants.

- Amar G. Bose, the son of an Indian father and white American mother who revolutionized the sound system business.

International Relations

These days, the business world is turning more and more toward Asia. The growing buying power of countries like China and India are an obvious attraction for all sorts of companies, small and large. That puts Asian-Americans, particularly those who speak Chinese or other Asian languages, in an enviable position. Their businesses may be able to profit from existing connections with their countries of origin or build new networks with those countries.

At the same time, the number of Asian-Americans has grown tremendously in recent years, so businesses that can connect with this demographic are likely to find a strong market.

Help Wanted

Any new business owner will encounter unexpected obstacles. Recent immigrants who don’t have a strong social network in the U.S., or who are still perfecting their English, may face additional barriers. Fortunately, there are a number of resources available for Asian-American entrepreneurs, including the US Pan-Asian Chamber of Commerce and the U.S. Chamber of Commerce’s Minority Business Development Agency.

While Asian-Americans may have some particular challenges and opportunities in the business world, almost all business owners find that cash flow is always a big deal. Check out the CreditDonkey roundup of credit cards that offer deals for all types of businesses and tips on finding the best ways to make business expenses work for you.

(Research by Kelly; Graphic Design by Marcelo; Graphic Editing by Maria; Additional Writing by Livia; Editing by Sarah)

Kelly Teh is a contributing features writer at CreditDonkey, a credit card comparison and reviews website. Write to Kelly Teh at kelly@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|